The year 2025 kicked off on a high note for India’s startup ecosystem, with Netradyne becoming the first unicorn just days into the new year. But any hopes of a unicorn revival were quickly tempered, and the pace of new unicorn creation remained subdued, in line withthe funding slump seen over the past two years.

India minted a record 45 unicorns in 2021, but the number fell sharply to 22 in 2022 and just two in 2023. While 2024 saw modest recovery with seven new unicorns, 2025 has so far added six— Netradyne, Porter, Drools, Fireflies.ai, Jumbotail and Dhan.

This slowdown isn’t unexpected. With capital now flowing more selectively, founders and investors are shifting from a “growth-at-all-costs” mindset to a focus on sustainable business models and profitability.

So far, 126 Indian startups have entered the unicorn club. But the pace has shifted. What was once a unicorn frenzy has now become a more measured climb, as the funding winter made investors more selective and forced founders to double down on fundamentals.

Still, the ecosystem continues to evolve. While 14 of the 126 unicorns have since slipped below the $1 Bn valuation mark (some due to broader market volatility), over 20 have gone public and five have been acquired.

As of December 2025, India’s unicorns have collectively raised over $117 Bn and command a combined valuation exceeding $389 Bn.

Notably, among all the unicorns, Mensa Brands took the least time to reach the billion-dollar mark; it achieved unicorn status in just six months. It was followed by GlobalBees, which took seven months to become a unicorn.

Meanwhile, startups like 5ire, Ola Krutrim, and Glance took about a year to achieve unicorn status.

To help track this evolving landscape, Inc42 has launched the Indian Unicorn Tracker. From founding years and sector focus to funding raised, investors, and time taken to reach unicorn status, this tracker is your one-stop resource for decoding India’s most valuable startups. It also offers a snapshot of where each Indian unicorn stands today.

| Organisation Name | Sector | Founded In | Became Unicorn In | Time Taken To Unicorn Club | Valuation ($ Bn) | Unicorn Status | Headquarters | Status | Total Funding ($ Bn) | Notable Investors |

| Jumbotail | Ecommerce | 2015 | 2025 | 10 | 1.0 | Active | Bengaluru | Private Company | 0.17 | Nexus Venture Partners, Kalaari Capital, Arkam Ventures, Alteria Capital, InnoVen Capital |

| Fireflies AI | Artificial Intelligence (AI) | 2016 | 2025 | 9 | 1.0 | Active | San Francisco | Private Company | 0.01 | Khosla Ventures, f7 Ventures, Canaan Partners, Forum Ventures |

| Drools | Ecommerce | 2009 | 2025 | 16 | 1.0 | Active | Bengaluru | Private Company | 0.06 | L Catterton, Nestle |

| Porter | Logistics | 2014 | 2025 | 11 | 1.0 | Active | Bengaluru | Private Company | 0.30 | Tiger Global Management, Lightstone Ventures, Peak XV, Peak XV Partners, Mahindra |

| Netradyne | Logistics | 2015 | 2025 | 10 | 1.3 | Active | Bengaluru | Private Company | 0.35 | Point72 Ventures, Qualcomm Ventures, Pavilion Capital Partners, SVB, SoftBank |

| Dhan | Fintech | 2021 | 2025 | 4 | 1.2 | Active | Mumbai | Private Company | 0.14 | |

| Travel Boutique Online (TBO) | Travel Tech | 2006 | 2024 | 18 | 2.0 | Active | Delhi NCR | Listed | Not Available | Naspers, General Atlantic, Affirma Capital, Lap Travel |

| Ather Energy | Clean Tech | 2013 | 2024 | 11 | 2.9 | Active | Bengaluru | Listed | 0.58 | NIIF, Hero MotoCorp, GIC, InnoVen Capital, Caladium Investments |

| Perfios | Fintech | 2007 | 2024 | 17 | 1.0 | Active | Bengaluru | Private Company | 0.44 | Ontario Teachers’ Pension Plan, Kedaara, Warburg Pincus, Bessemer Venture Partners, Stride Ventures |

| Money View | Fintech | 2014 | 2024 | 10 | 1.2 | Active | Bengaluru | Private Company | 0.22 | Accel, Tiger Global Management, Nexus Venture Partners, Ribbit Capital, Winter Capital |

| Rapido | Travel Tech | 2015 | 2024 | 9 | 1.1 | Active | Bengaluru | Private Company | 0.54 | WestBridge Capital, Nexus Venture Partners, Prosus Ventures, Swiggy, TVS Motor Company |

| Ola Krutrim | Artificial Intelligence (AI) | 2023 | 2024 | 1 | 1.0 | Active | Bengaluru | Private Company | 0.30 | Z47 |

| Rategain | Enterprise Tech | 2004 | 2024 | 20 | 0.8 | Under Valued | Delhi NCR | Listed | 0.24 | TA, Avataar Ventures, Plutus Wealth Management, Founder Collective, ICICI Prudential Mutual Fund |

| InCred | Fintech | 2016 | 2023 | 7 | 1.0 | Active | Mumbai | Private Company | 0.35 | Paragon Partners, India, Bhupinder Singh, FMO, Ranjan Pai, Neo Asset Management |

| Zepto | Consumer Services | 2021 | 2023 | 2 | 5.0 | Active | Bengaluru | Private Company | 2.10 | Glade Brook Capital Partners, Nexus Venture Partners, Lightspeed Venture Partners, Y Combinator, Contrary Capital |

| 1mg | Health Tech | 2015 | 2022 | 7 | 1.3 | Active | Delhi NCR | Acquired | 0.23 | KWE, HBM Healthcare Investments, Tata Digital, IFC, Peak XV |

| Physics Wallah | Edtech | 2014 | 2022 | 8 | 4.3 | Active | Delhi NCR | Listed | 0.31 | Hornbill Capital, WestBridge Capital, GSV Ventures, Lightspeed Venture Partners |

| Fractal | Enterprise Tech | 2000 | 2022 | 22 | 1.0 | Active | Mumbai | Private Company | 0.69 | TPG, Apax, Khazanah Nasional Berhad, Aimia, TA Associates |

| Games24x7 | Media & Entertainment | 2006 | 2022 | 16 | 2.5 | Active | Mumbai | Private Company | 0.08 | Tiger Global Management, The Raine Group, Malabar Investment Advisors, Bain Capital |

| Uniphore | Enterprise Tech | 2008 | 2022 | 14 | 2.5 | Active | Chennai | Private Company | 0.62 | New Enterprise Associates, Chiratae Ventures, March Capital, SoftBank, SAP |

| Amagi | Enterprise Tech | 2008 | 2022 | 14 | 1.4 | Active | Bengaluru | Private Company | 0.36 | General Atlantic, Nadathur, Premji Invest, Accel, Norwest Venture Partners |

| LeadSquared | Enterprise Tech | 2011 | 2022 | 11 | 1.0 | Active | Bengaluru | Private Company | 0.20 | WestBridge Capital, International Finance Corporation, Gaja Capital, Jyoti Bansal, Stakeboat Capital |

| Purplle | Ecommerce | 2012 | 2022 | 10 | 1.3 | Active | Mumbai | Private Company | 0.56 | Blume Ventures, Peak XV, ADIA, Premji Invest, Sharrp Ventures |

| Lead | Edtech | 2012 | 2022 | 10 | 1.1 | Active | Mumbai | Private Company | 0.19 | WestBridge Capital Ltd., Alteria Capital, Stride Ventures, Standard Chartered Bank, HDFC Bank |

| Xpressbees | Logistics | 2012 | 2022 | 10 | 1.5 | Active | Pune | Private Company | 0.64 | Teachers’ Venture Growth, Khazanah Nasional, Alibaba Group, Blackstone Group, Chrys Capital |

| Livspace | Ecommerce | 2014 | 2022 | 8 | 1.2 | Active | Bengaluru | Private Company | 0.53 | KKR, EDBI, Reno Asia Holdings, Venturi Partners, Jungle Ventures |

| Darwinbox | Enterprise Tech | 2015 | 2022 | 7 | 1.0 | Active | Hyderabad | Private Company | 0.28 | Partners Group, KKR, Lightspeed India Partners, Peak XV Partners, Salesforce Ventures |

| boAt | Ecommerce | 2016 | 2022 | 6 | 1.5 | Active | Delhi NCR | Private Company | 0.18 | Fireside Ventures, Qualcomm Ventures, Warburg Pincus, InnoVen Capital, Malabar Investment Advisors |

| ElasticRun | Ecommerce | 2016 | 2022 | 6 | 1.5 | Active | Pune | Private Company | 0.46 | SoftBank, SoftBank Group, Goldman Sachs Investment Partners, Prosus, Avataar Ventures |

| Oxyzo | Fintech | 2016 | 2022 | 6 | 1.0 | Active | Delhi NCR | Private Company | 0.27 | Alpha Wave Global, Creation Investments Capital Management, LLC, Z47, Norwest Venture Partners, Tiger Global Management |

| Shiprocket | Logistics | 2016 | 2022 | 6 | 1.3 | Active | Delhi NCR | Private Company | 0.42 | Zomato, KdT Ventures, MUFG, Tribe Capital, Saiglobal |

| Hasura | Enterprise Tech | 2017 | 2022 | 5 | 1.0 | Active | Bengaluru | Private Company | 0.24 | Nexus Venture Partners, Lightspeed Venture Partners, Vertex Ventures, Greenoaks |

| Open | Fintech | 2017 | 2022 | 5 | 1.0 | Active | Bengaluru | Private Company | 0.19 | IIFL Finance, Temasek Holdings, Tiger Global Management, 3one4 Capital, BEENEXT |

| DealShare | Ecommerce | 2018 | 2022 | 4 | 1.7 | Active | Bengaluru | Private Company | 0.40 | Tiger Global Management, Alpha Wave Global, Kora, Dragoneer Investment Group, Unilever Ventures |

| OneCard | Fintech | 2019 | 2022 | 3 | 1.4 | Active | Pune | Private Company | 0.26 | Better Tomorrow Ventures, Z47, Peak XV Partners, Alteria Capital, Hummingbird Ventures |

| Yubi | Fintech | 2020 | 2022 | 2 | 1.3 | Active | Chennai | Private Company | 0.23 | Peak XV Partners, B Capital, Dragoneer Investment Group, Insight Partners, Lightrock |

| 5ire | Web3 | 2021 | 2022 | 1 | Less than $1 Bn | Under Valued | Dubai | Private Company | 0.12 | Global Emerging Markets, SRAM & MRAM, Gotbit, Magnus Capital, Extra Watts |

| Blinkit | Consumer Services | 2013 | 2021 | 8 | 13.0 | Active | Delhi NCR | Acquired | 1.30 | Zomato (now Eternal), SoftBank, Tiger Global Management, Peak XV India, Trifecta Capital |

| Meesho | Ecommerce | 2015 | 2021 | 6 | 9.4 | Active | Bengaluru | Listed | 1.70 | Meta (Facebook), Peak XV Partners, SoftBank, Tiger Global Management, Fidelity |

| Digit Insurance | Fintech | 2016 | 2021 | 5 | 3.5 | Active | Bengaluru | Listed | 0.59 | Fairfax Financial Holdings, A91 Partners, Faering Capital, TVS Capital Funds, Peak XV Partners |

| Groww | Fintech | 2016 | 2021 | 5 | 11.0 | Active | Bengaluru | Listed | 0.39 | Peak XV Partners, Ribbit Capital, Y Combinator Continuity Fund, Tiger Global Management, ICONIQ Growth |

| Urban Company | Consumer Services | 2014 | 2021 | 7 | 2.0 | Active | Delhi NCR | Listed | 0.51 | Steadview Capital, Tiger Global Management, Prosus Ventures, Dragoneer Investment Group, Wellington Management |

| MapmyIndia | Enterprise Tech | 1995 | 2021 | 26 | 1.0 | Active | Delhi NCR | Listed | 0.05 | Flipkart, Nexus Venture Partners, Qualcomm Ventures, Zenrin, Sherpalo Ventures |

| Blackbuck | Logistics | 2015 | 2021 | 6 | 1.2 | Active | Bengaluru | Listed | 0.36 | Tribe Capital, VEF, Accel, Sands Capital Ventures, InnoVen Capital |

| Mamaearth | Ecommerce | 2016 | 2021 | 5 | 0.9 | Under Valued | Delhi NCR | Listed | 0.14 | Fireside Ventures, Stellaris Venture Partners, Peak XV Partners, Sofina, Evolvence |

| CarDekho | Ecommerce | 2008 | 2021 | 13 | 1.2 | Active | Delhi NCR | Private Company | 1.30 | Navis Capital Partners, Dragon Funds, Peak XV Partners, CapitalG, Hillhouse Investment |

| Upstox | Fintech | 2009 | 2021 | 12 | 3.5 | Active | Mumbai | Private Company | 0.20 | Tiger Global Management, Kalaari Capital, InnoVen Capital, BlackSoil, GVK Davix Technologies |

| Eruditus | Edtech | 2010 | 2021 | 11 | 3.1 | Active | Mumbai | Private Company | 1.30 | Accel, SoftBank, Accel, Peak XV Partners, Bertelsmann India Investments |

| Vedantu | Edtech | 2011 | 2021 | 10 | 1.0 | Active | Bengaluru | Private Company | 0.33 | Stride Ventures, Alteria Capital, Accel, Orios Venture Partners, ImpactAssets |

| Browserstack | Enterprise Tech | 2011 | 2021 | 10 | 4.0 | Active | Mumbai | Private Company | 0.25 | No specific investor data was found in the provided material. |

| Mindtickle | Enterprise Tech | 2011 | 2021 | 10 | 1.2 | Active | Pune | Private Company | 0.28 | Canaan Partners, Accel Partners, New Enterprise Associates, Qualcomm Ventures, Norwest Venture Partners |

| Chargebee | Fintech | 2011 | 2021 | 10 | 3.5 | Active | Chennai | Private Company | 0.47 | Insight Partners, Tiger Global Management, Accel, Steadview Capital, Sapphire Ventures |

| Rebel Foods | Foodtech | 2011 | 2021 | 10 | 1.4 | Active | Mumbai | Private Company | 0.81 | Qatar Investment Authority, Evolvence India Fund, Temasek Holdings, Alteria Capital, InnoVen Capital |

| Innovaccer | Healthtech | 2014 | 2021 | 7 | 3.2 | Active | Delhi NCR | Private Company | 0.68 | B Capital, M12 – Microsoft’s Venture Fund, Tiger Global Management, Dragoneer Investment Group, Steadview Capital |

| Nobroker | Real Estate Tech | 2014 | 2021 | 7 | 1.0 | Active | Bengaluru | Private Company | 0.43 | General Atlantic, Tiger Global Management, Moore Strategic Ventures, Google, Beenext |

| Moglix | Ecommerce | 2015 | 2021 | 6 | 2.5 | Active | Delhi NCR | Private Company | 0.48 | Accel, IFC (International Finance Corporation), Jungle Ventures, Alpha Wave Global, Tiger Global Management |

| Spinny | Ecommerce | 2015 | 2021 | 6 | 1.8 | Active | Delhi NCR | Private Company | 0.64 | Tiger Global Management, Abu Dhabi Growth Fund, Avenir, Accel, Elevation Capital |

| Licious | Ecommerce | 2015 | 2021 | 6 | 1.5 | Active | Bengaluru | Private Company | 0.55 | Multiples Alternate Asset Management, Kotak Investment Advisors, Axis Growth Avenues AIF–I, Amansa Capital, Temasek |

| Upgrad | Edtech | 2015 | 2021 | 6 | 2.3 | Active | Mumbai | Private Company | 0.78 | Temasek Holdings, International Finance Corporation, 360 ONE Asset, IIFL Finance, Kaizenvest |

| Ofbusiness | Ecommerce | 2015 | 2021 | 6 | 2.8 | Active | Delhi NCR | Private Company | 0.99 | Alpha Wave Global, Tiger Global Management, Creation Investments, Cornerstone Venture Partners Fund, SoftBank Group |

| ShareChat | Media & Entertainment | 2015 | 2021 | 6 | 2.0 | Active | Bengaluru | Private Company | 1.80 | Moore Strategic Ventures, Tencent, Twitter Ventures, EDBI, Alkeon Capital |

| Infra.Market | Ecommerce | 2016 | 2021 | 5 | 2.8 | Active | Mumbai | Private Company | 0.85 | Tiger Global Management, Accel, Nexus Venture Partners, Trifecta Capital Advisors, Evolvence India Fund |

| Zeta | FIntech | 2016 | 2021 | 5 | 2.0 | Active | Bengaluru | Private Company | 0.39 | Mastercard, Optum, Sodexo, SoftBank |

| Acko Insurance | FIntech | 2016 | 2021 | 5 | 1.4 | Active | Bengaluru | Private Company | 0.60 | General Atlantic, CPP Investments, Intact Ventures, Lightspeed Venture Partners, Multiples |

| Slice | Fintech | 2016 | 2021 | 5 | 1.3 | Active | Bengaluru | Private Company | 0.39 | Tiger Global, Insight Partners, Advent International, Blume Ventures, Notable Capital |

| Cult.Fit | Health Tech | 2016 | 2021 | 5 | 1.5 | Active | Bengaluru | Private Company | 0.69 | Accel, Temasek, Chiratae Ventures, Zomato, Tata Digital |

| CoinSwitch | Web3 | 2017 | 2021 | 4 | 1.9 | Active | Bengaluru | Private Company | 0.30 | Pantera Capital, Andreessen Horowitz, Coinbase Ventures, Tiger Global Management, Paradigm |

| Zetwerk | Enterprise Services | 2018 | 2021 | 3 | 3.1 | Active | Bengaluru | Private Company | 0.87 | Khosla Ventures, Rakesh Gangwal, Greenoaks, Accel, Lightspeed India |

| CRED | Fintech | 2018 | 2021 | 3 | 3.5 | Active | Bengaluru | Private Company | 0.92 | Alpha Wave Global, Tiger Global Management, GIC, Sofina, Ribbit Capital |

| Bharatpe | Fintech | 2018 | 2021 | 3 | 2.8 | Active | Delhi NCR | Private Company | 0.85 | Tiger Global Management, Coatue, Ribbit Capital, Insight Partners, Steadview Capital |

| Pristyn Care | Health Tech | 2018 | 2021 | 3 | 1.4 | Active | Delhi NCR | Private Company | 0.18 | Peak XV Partners, Hummingbird Ventures, Epiq Capital, Tiger Global Management, Peak XV |

| Mobile Premier League | Media & Entertainment | 2018 | 2021 | 3 | 2.2 | Active | Bengaluru | Private Company | 0.40 | Legatum, MDI Ventures, Pegasus Tech Ventures, RTP Global, SIG Global India Fund |

| CoinDCX | Web3 | 2018 | 2021 | 3 | 2.2 | Active | Mumbai | Private Company | 0.25 | Pantera Capital, Steadview Capital, B Capital, Block.one, Polychain |

| Apna | Enterprise Tech | 2019 | 2021 | 2 | 1.1 | Active | Bengaluru | Private Company | 0.19 | Peak XV Partners, Lightspeed India Partners, Insight Partners, Tiger Global Management, GSV Ventures |

| GlobalBees | Ecommerce | 2021 | 2021 | Less than 1 Year | 1.1 | Active | Delhi NCR | Private Company | 0.31 | FirstCry, Premji Invest, Chiratae Ventures, SoftBank Group, Lightspeed Venture Partners |

| Mensa Brands | Ecommerce | 2021 | 2021 | Less than 1 Year | 1.0 | Active | Bengaluru | Private Company | 0.29 | Accel Partners, Prosus, Tiger Global, Alteria Capital, InnoVen Capital |

| Easemytrip | Travel Tech | 2008 | 2021 | 13 | 0.3 | Under Valued | Delhi NCR | Listed | 0.17 | Nomura Holdings |

| MobiKwik | Fintech | 2009 | 2021 | 12 | 0.2 | Under Valued | Delhi NCR | Listed | 0.28 | No external investor data was found in the provided material. |

| Gupshup | Enterprise Tech | 2004 | 2021 | 17 | 0.5 | Under Valued | Mumbai | Private Company | 0.48 | Tiger Global Management, CRV, Fidelity, White Oak Global Advisors, Helion Venture Partners |

| Droom | Ecommerce | 2014 | 2021 | 7 | 0.4 | Under Valued | Delhi NCR | Private Company | 0.34 | Finvolve, India Accelerator, 57 Stars, SeventTrain Ventures, Digital Garage |

| Good Glamm Group | Ecommerce | 2015 | 2021 | 6 | Less than $1 Bn | Under Valued | Pune | Private Company | 0.35 | Warburg Pincus, Prosus, Bessemer India, Accel Partners |

| Pharmeasy | Health Tech | 2015 | 2021 | 6 | 0.5 | Under Valued | Mumbai | Private Company | 1.77 | B Capital, Temasek Holdings, ADQ, Bessemer Venture Partners |

| Nykaa | Ecommerce | 2012 | 2020 | 8 | 8.1 | Active | Delhi NCR | Listed | 1.50 | Lighthouse Funds, TVS Capital Funds, Axis Mutual Fund, Aditya Birla Sunlife Mutual Fund, Steadview Capital |

| Firstcry | Ecommerce | 2010 | 2020 | 10 | 1.7 | Active | Pune | Listed | 1.13 | SoftBank, TPG Capital Asia, Chrys Capital, Premji Invest, Vertex Ventures |

| IndiaMart | Ecommerce | 1996 | 2020 | 24 | 1.5 | Active | Delhi NCR | Listed | 0.04 | Intel Capital, Elevation Capital, Hornbill Capital Advisers, Kuwait Investment Authority, Malabar Investment Advisors |

| Pine Labs | Fintech | 1998 | 2020 | 22 | 5.8 | Active | Delhi NCR | Private Company | 1.59 | Warburg Pincus, Alpha Wave Global, State Bank of India, BlackRock, Fidelity |

| Verse Innovation | Media & Entertainment | 2007 | 2020 | 13 | 2.9 | Active | Bengaluru | Private Company | 1.70 | Alpha Wave Global, Google, Microsoft, CPP Investments, Meta |

| Zenoti | Enterprise Tech | 2010 | 2020 | 10 | 1.5 | Active | Hyderabad | Private Company | 0.33 | TPG, Advent International, Steadview, Tiger Global Management, Accel |

| Zerodha | Fintech | 2010 | 2020 | 10 | 3.6 | Active | Bengaluru | Private Company | Bootstrapped | Nikhil Kamath, Nithin Kamath, Kailash N. Gupta, Seema Patil, Venu Madhav |

| Postman | Enterprise Tech | 2014 | 2020 | 6 | 5.6 | Active | Bengaluru | Private Company | 0.43 | Insight Partners, CRV (Charles River Ventures), Nexus Venture Partners, Coatue, Battery Ventures |

| Razorpay | Fintech | 2014 | 2020 | 6 | 7.5 | Active | Bengaluru | Private Company | 0.82 | Peak XV Partners, Tiger Global Management, GIC, Lightspeed Venture Partners, Alkeon Capital |

| Cars24 | Ecommerce | 2015 | 2020 | 5 | 3.3 | Active | Delhi NCR | Private Company | 1.30 | Peak XV, DST Global, SoftBank, Alpha Wave Global, Exor Seeds |

| Unacademy | Edtech | 2015 | 2020 | 5 | 3.4 | Active | Bengaluru | Private Company | 0.88 | SoftBank, General Atlantic, Tiger Global Management, Temasek Holdings, Meta (Facebook) |

| Glance | Media & Entertainment | 2019 | 2020 | 1 | 1.7 | Active | Bengaluru | Private Company | 0.39 | Google, Mithril Capital Management, Reliance Jio, Unilever Ventures, Vy Capital |

| BigBasket | Consumer Services | 2011 | 2019 | 8 | 3.2 | Active | Bengaluru | Acquired | 1.50 | Alibaba Group, Tata Digital, Mirae Asset Global Investments, CDC Group, Bessemer Venture Partners |

| Lenskart | Ecommerce | 2011 | 2019 | 8 | 5.6 | Active | Delhi NCR | Listed | 1.08 | Fidelity, Temasek Holdings, Chrys Capital, Abu Dhabi Investment Authority (ADIA), Ravi Modi Family Trust |

| Delhivery | Logistics | 2011 | 2019 | 8 | 3.4 | Active | Delhi NCR | Listed | 1.60 | SoftBank, Tiger Global, CPP Investments, Fidelity, FedEx |

| Ola Electric | Clean Tech | 2017 | 2019 | 2 | 1.7 | Active | Bengaluru | Listed | 1.70 | Temasek Holdings, SoftBank, Alpha Wave Global, State Bank of India, Tiger Global Management |

| Druva | Enterprise Tech | 2008 | 2019 | 11 | 2.0 | Active | Pune | Private Company | 0.48 | Caisse de dépôt et placement du Québec (CDPQ), Neuberger Berman, Atreides Management, Viking Global Investors, Riverwood Capital |

| Dream Sports | Media & Entertainment | 2008 | 2019 | 11 | 8.0 | Active | Mumbai | Private Company | 1.60 | TCV, D1 Capital Partners, Falcon Edge Capital, Tiger Global, ChrysCapital |

| Icertis | Enterprise Tech | 2009 | 2019 | 10 | 5.0 | Active | Pune | Private Company | 0.57 | B Capital, Meritech Capital Partners, Greycroft, Premji Invest, SoftBank |

| Citius Tech | Health Tech | 2005 | 2019 | 14 | 2.2 | Active | Mumbai | Private Company | 1.07 | |

| PhonePe | Fintech | 2015 | 2018 | 3 | 13.0 | Active | Bengaluru | Acquired | 2.60 | Walmart, General Atlantic, Tiger Global Management, Ribbit Capital, TVS Capital Funds |

| Policybazaar | Fintech | 2008 | 2018 | 10 | 9.8 | Active | Delhi NCR | Listed | 1.10 | SoftBank, Tencent, Alpha Wave Global, True North, Info Edge |

| Swiggy | Consumer Services | 2014 | 2018 | 4 | 12.0 | Active | Bengaluru | Listed | 3.58 | SoftBank, Prosus Ventures, Naspers, Accel Partners, Goldman Sachs |

| Freshworks | Enterprise Tech | 2010 | 2018 | 8 | 3.7 | Active | Chennai | Listed | 0.48 | Accel, Tiger Global Management, Peak XV Partners, CapitalG, Steadview Capital |

| Billdesk | Fintech | 2000 | 2018 | 18 | 2.0 | Active | Mumbai | Private Company | 0.24 | Clearstone Venture Partners, General Atlantic, TA Associates, Temasek Holdings, Visa |

| OYO | Travel Tech | 2012 | 2018 | 6 | 2.5 | Active | Delhi NCR | Private Company | 4.00 | RedSpring Innovation Partners, Patient Capital, SoftBank, Microsoft, JP Morgan Chase |

| Udaan | Ecommerce | 2016 | 2018 | 2 | 1.8 | Active | Bengaluru | Private Company | 2.10 | Octahedron Capital, Moonstone Capital, Lightspeed Venture Partners, DST Global, M&G Plc |

| Byju’s | Edtech | 2011 | 2018 | 7 | Less than $1 Bn | Under Valued | Bengaluru | Private Company | 6.30 | B Capital, General Atlantic, BlackRock, Lightspeed Venture Partners, International Finance Corporation |

| Rivigo | Logistics | 2014 | 2018 | 4 | Less than $1 Bn | Under Valued | Delhi NCR | Private Company | 0.31 | Elevation Capital, Warburg Pincus, InnoVen Capital, Trifecta Capital |

| Paytm Mall | Ecommerce | 2016 | 2018 | 2 | Less than $1 Bn | Under Valued | Delhi NCR | Private Company | 0.80 | eBay, Alibaba Group, SoftBank, Elevation Capital |

| Renew Power | Clean Tech | 2011 | 2017 | 6 | 2.5 | Active | Delhi NCR | Private Company | 2.04 | CPP Investments, ADIA (Abu Dhabi Investment Authority), JERA, Norway’s Climate Investment Fund, Goldman Sachs |

| Shopclues | Ecommerce | 2011 | 2016 | 5 | 0.1 | Under Valued | Delhi NCR | Private Company | 0.26 | Nexus Venture Partners, Helion Venture Partners, Unilazer Ventures, GIC, Tiger Global Management |

| Hike | Media & Entertainment | 2011 | 2016 | 5 | Shutdown | Under Valued | Delhi NCR | Private Company | 0.26 | 39A Ventures, Jump Crypto, Republic Crypto, Tribe Capital, JAM Fund |

| Eternal (Zomato) | Consumer Services | 2008 | 2015 | 7 | 30.0 | Active | Delhi NCR | Listed | 4.40 | Info Edge, Peak XV, Temasek, Vy Capital, Ant Group |

| Paytm | Fintech | 2010 | 2015 | 5 | 9.5 | Active | Delhi NCR | Listed | 4.50 | BlackRock, Ant Financial, Alibaba, Berkshire Hathaway, GIC |

| Quikr | Ecommerce | 2008 | 2015 | 7 | 0.6 | Under Valued | Bengaluru | Private Company | 0.42 | Steadview, Alpha Wave Global, Coatue, Tiger Global Management, Kinnevik |

| Info Edge | Consumer Services | 1995 | 2014 | 19 | 9.8 | Active | Delhi NCR | Listed | 0.05 | Intel Capital, Elevation Capital, Hornbill Capital Advisers, Kuwait Investment Authority, Malabar Investment Advisors |

| Ola | Travel Tech | 2010 | 2014 | 4 | 1.3 | Active | Bengaluru | Private Company | 5.00 | Arrow Capital, Axis Mutual Fund, Segantii Capital Management, Hero Corp, IIFL Finance |

| Snapdeal | Ecommerce | 2010 | 2014 | 4 | 0.8 | Under Valued | Delhi NCR | Private Company | 1.80 | Intel Capital, Bessemer Venture Partners, SoftBank, BlackRock |

| Mu Sigma | Enterprise Tech | 2004 | 2013 | 9 | 1.5 | Active | Bengaluru | Private Company | 0.21 | FTV Capital, Peak XV Partners, General Atlantic, Mastercard |

| Flipkart | Ecommerce | 2007 | 2012 | 5 | 36.0 | Active | Bengaluru | Acquired | 15.00 | Walmart, Tiger Global Management, SoftBank, Accel, GIC |

| InMobi | Enterprise Tech | 2007 | 2011 | 4 | 1.5 | Active | Bengaluru | Private Company | 0.42 | Mars Growth Capital, SoftBank Capital, Kleiner Perkins, Sherpalo Ventures, Lightbox |

| MakeMyTrip | Travel Tech | 2000 | 2010 | 10 | 8.2 | Active | Delhi NCR | Listed | 0.75 | Ctrip, Naspers, Tiger Global Management, Helion Venture Partners, Sierra Ventures |

| Zoho | Enterprise Tech | 1996 | Not Available | Not Available | 1.0 | Active | Chennai | Private Company | Bootstrapped |

Read our methodology here.

India’s Top Unicorn HotspotsBengaluru remains India’s undisputed unicorn capital, with 51 startups headquartered in the city. The city’s position is backed by a mix of engineering talent, established investor networks, and consistent startup activity.

Even as overall funding dipped in 2024, Bengaluru still pulled in over $3.5 Bn in capital, with companies like Razorpay, Meesho, Udaan, Ather Energy, and Rapido raising substantial rounds.

What’s notable is the continued concentration of new unicorns in the city. According to Inc42 analysis, 9 out of the 13 startups that joined the unicorn club in 2024 and 2025 so far are headquartered in Bengaluru.

Close behind, Delhi NCR and Mumbai take the second and third spots, with 39 and 18 unicorns, respectively.

Meanwhile, other hubs are slowly coming into their own. Pune now boasts 8 unicorns, benefitting from its product-first culture and talent pool. Chennai has produced 5 unicorns, anchored by strong manufacturing and SaaS roots. Hyderabad, though smaller in count with 3 unicorns, continues to build quietly in deeptech and healthtech.

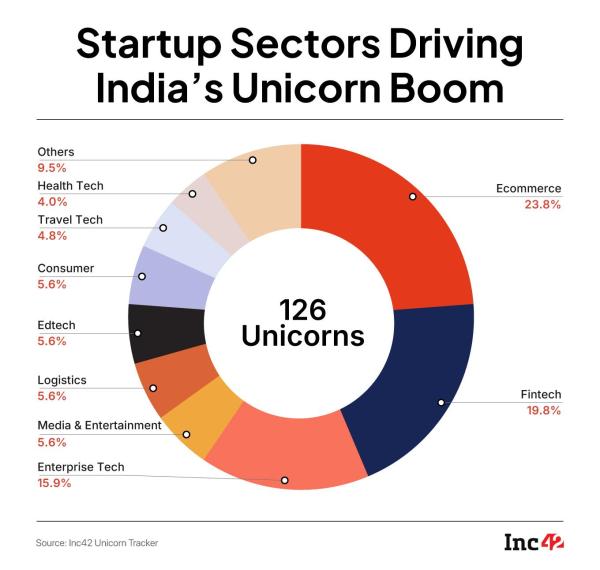

Sectors Driving India’s Unicorn BoomEcommerce, fintech, and enterprise tech continue to anchor India’s unicorn story. Of the 126 startups that have entered the unicorn club so far, 29 operate in ecommerce, 26 in fintech, and 20 in enterprise tech.

But beyond the headline sectors, other categories are also seeing steady momentum.

Media & entertainment, logistics, edtech, and consumer services each account for seven unicorns, reflecting rising demand for digital content, last-mile delivery, affordable education, and everyday convenience.

Travel tech and healthtech follow closely, with six unicorns each, indicating that Indian startups are also making strides in sectors driven by post-pandemic recovery, wellness, and global mobility.

The Indian Unicorn Tracker will be updated periodically with fresh data, funding rounds, and exits. Stay tuned.

Last Updated | December 24, 2025

[Edited By Vinaykumar Rai]

The post Indian Unicorn Tracker: Funding, Investors, Revenue And More appeared first on Inc42 Media.

-

Christmas weekend in Bengaluru 2025: Amazing parties, festive events and staycations

-

Why Skin Healing Isn't the Same for Everyone

-

Cabinet approves 13 new stations for Delhi Metro under Phase-IV A

-

Visure Investment Affairs Hosts 'VisionX - Evolve Beyond Capital', Launches Founder-First Capital Vertical Visioneryy in Navi Mumbai

-

Carrying over 1 million customers every 3 days, fully prepared for holiday season: IndiGo Airlines