New Income Tax Act 2025: This is big news for taxpayers. A new simplified Income Tax Act 2025 is set to be implemented from April 1st, replacing the old Income Tax Act of 1961. This also includes a focus on GST rate reductions, increased income tax exemptions, and customs duty reforms. The government aims to make the tax system simpler, more transparent, and compliance-friendly, thereby boosting consumption and supporting economic growth.

New Income Tax Act 2025: A major change is coming for taxpayers in India. The central government is set to implement a new simplified Income Tax Act, 2025, from the beginning of the next financial year, replacing the more than six-decade-old Income Tax Act of 1961. This move aims to make the tax system simpler, more transparent, and more compliance-friendly.

What will be special about the new Income Tax Act?

The new income tax law will be effective from April 1st. It emphasises reducing complex provisions, ambiguous definitions, and lengthy legal processes. The government believes that a simpler law will increase voluntary tax compliance and provide taxpayers with relief from unnecessary disputes.

The government is to implement two new laws.

Along with this, the government is also preparing to implement two new laws. The first is that an additional excise duty will be levied on cigarettes, and the second is that an additional charge will be applied to GST rates on pan masala. Both these laws will be implemented from a date decided by the government.

The government's focus on boosting demand

The government has stated that the tax reforms implemented in 2025 aim to stimulate domestic demand amidst a challenging global economic environment. Uncertainties regarding duties and tax rates affect investment and consumption. Therefore, India's tax reforms have focused on increasing consumption, supporting demand, and accelerating economic growth.

Significant reduction in GST rates

One major decision this year was the reduction in GST rates on approximately 375 goods and services from September 22nd. This reduced the tax burden on everyday items and helped address the long-standing problem of the inverted duty structure.

GST Framework: From Four Rates to Two

The government moved towards consolidating the four-tiered GST framework (5%, 12%, 18%, and 28%) into two main rates of 5% and 18%. This is considered a significant reform towards simplifying and rationalizing the indirect tax system. The objective is to reduce the number of tax slabs and minimize litigation.

Impact on GST Collections

In April 2025, GST collections touched a record high of ₹2.37 lakh crore. The average collection in the current financial year 2025-26 has been around ₹1.9 lakh crore. However, due to the extensive rate cuts, there was some pressure on revenue, and the growth rate appeared to slow down. In November, GST collections fell to ₹1.70 lakh crore, the lowest level of the year. This represents a marginal increase of only 0.7% on a year-on-year basis. November was the first month where the full impact of the GST rate cuts implemented in September was felt.

Increased Income Tax Exemption

On the direct tax front, the government increased the income tax exemption limit, providing direct relief to the middle-income group. This has put more disposable income in the hands of taxpayers, which is considered a measure to boost consumption. This relief is considered particularly important for urban households and has strengthened voluntary compliance under the simplified tax regime.

Customs Reforms

Finance Minister Nirmala Sitharaman has indicated that the simplification of customs duties will be the government's next major reform target. This will focus on features like faceless assessment, similar to income tax, rationalization of duty rates, and increased transparency.

Experts' Opinion

According to Mahesh Jaising, Partner and Head of Indirect Tax at Deloitte India, changing trade patterns, increasing compliance costs, and procedural hurdles necessitate the next phase of customs reforms. Meanwhile, Rahul Shekhar, Indirect Tax Partner at Nangia Global, believes that complete digitization of customs procedures, uniformity in documentation, predictable classification, and risk-based expedited clearance will enhance ease of doing business and boost investor confidence. He also emphasized the possibility of a one-time settlement of old customs disputes.

Disclaimer: India Employment News does not provide any recommendations for buying or selling in the stock market. We publish market-related analyses based on information from market experts and broking firms. However, please make market-related decisions only after consulting with certified experts.

-

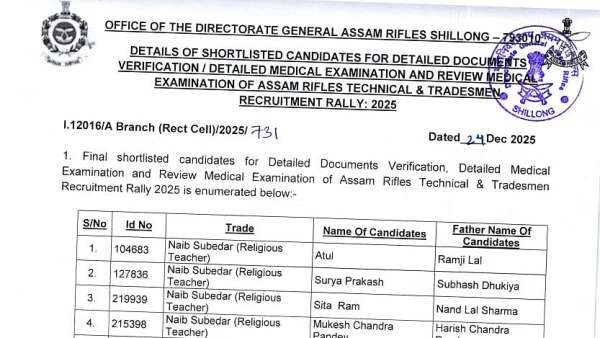

Assam Rifles Technical And Tradesmen Result 2025 Released At assamrifles.gov.in; Direct Link Here

-

Uttar Pradesh: 24-Year-Old BTech Student From Bihar Student Found Hanging In Greater Noida Hostel

-

Tu Meri Main Tera Main Tera Tu Meri Ending Explained: Kartik Aaryan & Ananya Panday's Film Questions Traditional Marriage Norms, Here's What Happens In Last Scene

-

After Rohit Sharma’s super knock of 155 runs, opponent team’s captain makes surprising statement, says…, his name is…

-

Akshay Kumar’s Welcome to the Jungle appearance hints at surprise twist, fans say, ‘This is going…’