Personal Loan Rules

Emergencies in life never come unannounced. If your savings suddenly fall short due to illness, treatment or any other important expense, then a personal loan becomes an easy solution. The good thing is that there is no need to give any guarantee or mortgage of property to avail a personal loan. But one important question often comes in people's mind. If the person taking the personal loan dies, who will repay the remaining loan?

Personal loan is called unsecured loan. This means that in return the bank does not have any mortgage like house, land or car. This is the reason that after the death of the borrower, the bank does not directly confiscate any property, but takes further action as per the prescribed rules.

If you have loan insurance, you get relief.

Nowadays many banks and finance companies offer the option of loan protection insurance along with personal loans. If the borrower who has taken this insurance dies, then the bank makes a claim from the insurance company. As per the terms of the policy, the insurance company repays the outstanding loan amount and the loan account is closed. In such a situation, there is no financial burden on the family. However, it is worth noting that this insurance is not mandatory but optional.

What does the bank do if there is no insurance?

If the deceased has not taken any insurance on the personal loan, the bank can recover the outstanding amount from the property left by him. This may include savings account balance, FD, shares, mutual funds, gold or real estate. That means the bank can take only that much amount of property left by the deceased.

The family does not incur debt directly

It is important to know that the family of the deceased or the nominee cannot be forced to repay the personal loan unless they are a co-borrower or guarantor. If the full amount is not recovered from the property and there is no guarantor, then in many cases the bank has to write-off the loan considering it as a loss.

What steps should the family take

In case of death of the loan borrower, the family should first inform the bank and submit the death certificate. After this the bank starts the process of insurance claim or recovery as per its rules. By giving information at the right time, the family can be saved from unnecessary mental stress.

-

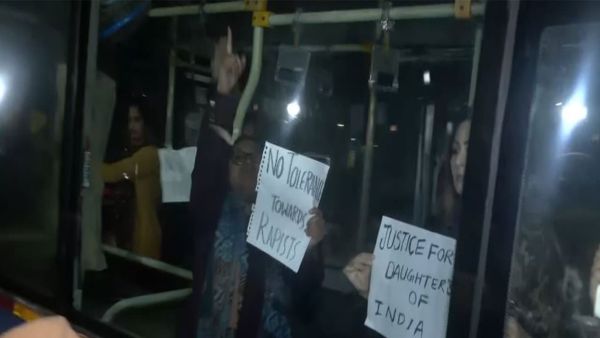

Kuldeep Sengar’s bail sparks protests in Delhi; activists detained

-

Made to remove clothes on the pretext of treatment, did bad touch. 56 year old doctor did dirty work with 22 year old girl.. – News Himachali News Himachali

-

When gold reached ₹1.42 lakh, people came up with a new solution! Now customers are crazy about this jewellery.

-

No physical relationship since 2 years, husband maintains silence in bed, how will marriage survive? , Marriage Conflict Without Intimacy Emotional Distance After Baby

-

Earthquake: Earth trembled due to earthquake in Taiwan, intensity measured 7 on Richter scale. An Earthquake Shook Taiwan Measuring 7 On The Richter Scale