India’s Unified Payments Interface (UPI) is gearing up for major enhancements starting June 16, 2025with the National Payments Corporation of India (NPCI) announcing a series of changes to improve transaction speed and system efficiency. These adjustments come as UPI usage continues to surge, and the focus shifts to reducing delays and improving reliability for both users and payment platforms.

Faster Transaction Response Times

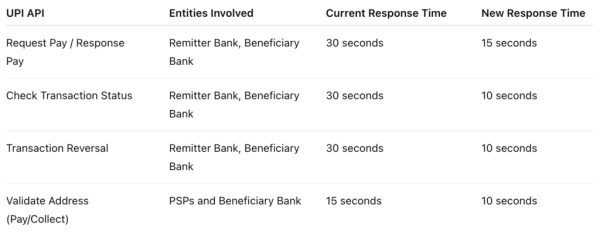

In a circular dated April 26, 2025NPCI revealed plans to halve the response time for multiple UPI- APIs, which govern everything from payment execution to status checks. The reduced response time is expected to benefit remitter banks, beneficiary banksand Payment Service Providers (PSPs) like Google Pay, PhonePe, and Paytm.

Here’s a breakdown of the key API upgrades:

These revisions aim to enhance customer experience by improving reliability and reducing failed or delayed payments. NPCI has asked all stakeholders to ensure system-level changes are in place before rollout.

Additional Reforms Coming From August

In a separate circular dated May 21, 2025NPCI laid out new guidelines on platform usage and API limitswhich will be enforced from August 1, 2025. These changes are designed to ensure responsible usage of system resources and prevent transaction overloads, particularly during peak hours.

Here are the highlights:

1. Balance Enquiry Limit

- Users can now make a maximum of 50 balance enquiries per day through UPI apps.

2. List Account Requests

- This function, which allows users to see accounts linked to their mobile number, will be limited to 25 requests per app per day.

3. Autopay Mandate Execution

- Autopay mandates will be processed with 1 primary attempt and up to 3 retries.

- These retries must occur outside peak hours (defined as 10:00 am–1:00 pm and 5:00 pm – 9: 30 pm).

NPCI has directed all PSP and acquiring banks to monitor transaction volume and TPS (transactions per second) and align with the new thresholds.

Why These Changes Matter

UPI has revolutionized digital payments in India by enabling instant money transfers, low transaction costsand seamless interoperability across platforms. However, as transaction volumes continue to climb—especially during festivals, sale events, and salary days—the system infrastructure needs optimization to handle the load.

The reduced response times and usage limits aim to:

- Minimize failures during peak traffic

- Improve consistency of user experience

- Support faster processing for banks and PSPs

- Prevent system overloads from automated requests

These changes are part of NPCI’s broader efforts to ensure scalability, stability, and fairness across the UPI ecosystem.

In Summary:

From June 16UPI users can expect faster transactions, and by August 1new usage caps and system monitoring will be in place. These upgrades reflect a proactive approach by NPCI to maintain UPI’s performance as it evolves into the backbone of India’s digital payments landscape.

-

Kartik Purnima 2025 Daan: Donate these four sacred items to receive Goddess Lakshmi’s blessings

-

The secrets of health are hidden in the sweetness of jaggery, definitely consume it in winter, you will get immense benefits.

-

5 love languages that will make your relationship stronger

-

Now your corn roti will never break, know the secret of making soft and fluffy roti:

-

Take bath in Ganga and donate lamp on Kartik Purnima… Know what is the method of worship and auspicious time of worship.