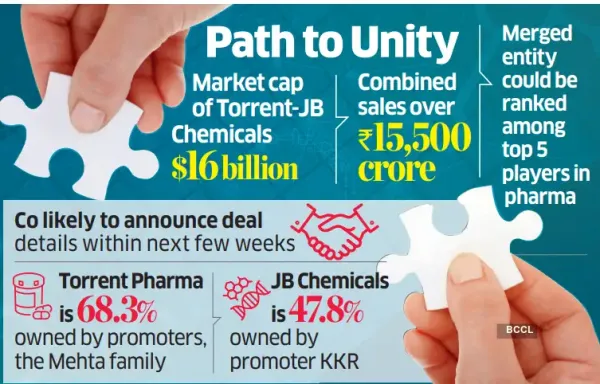

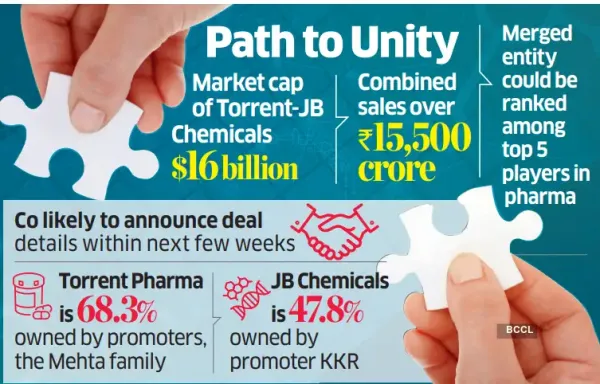

Torrent Pharmaceuticals and JB Chemicals & Pharmaceuticals are working with advisers to firm up the terms for their merger as part of a two-stage transaction, involving the former first buying out US-based private equity firm KKR’s stake in JB in a cash deal, said people familiar with the development. Details of both stages of the proposed transaction could be disclosed within weeks, with the cash payout to KKR and swap ratio for the merger being conveyed to shareholders, they said.

Controlling shareholder KKR has a 47.84% stake in the Mumbai-based JB Chemicals, while the rest is with the public.

In the first stage, Ahmedabad-based Torrent will buy out KKR’s stake, worth about `13,433 crore, for which financing has been arranged from global banks, ET reported on Saturday. The stake purchase could potentially trigger an open offer.

The second stage, involving the merger, will provide a path for the two companies to explore potential synergies faster.

Torrent Pharmaceuticals aims to figure among the top five Indian players through this deal. The combined value of Torrent and JB is `1.41 lakh crore (around $16.5 billion), as per their current market capitalisation.

Both Torrent and JB Chemicals did not respond to ET’s queries, sent on Friday afternoon.

KKR declined to comment.

KKR had five years ago acquired around 54% stake in JB Chemicals from its promoters, the Modi family, for about `3,100 crore. The US private equity firm launched a formal process last year to sell its stake in JB.

Torrent Pharma, Alkem Laboratories and EQT Corporation had held separate discussions at the time to purchase the stake but a deal did not materialise.

KKR also explored selling its stake in JB Chemicals through open market transactions.

More Local Brands

However, KKR decided against pursuing that strategy.

For 2024-25, JB reported revenue of `3,918 crore, an increase of 12% from `3,484 crore in the previous year. Torrent Pharma recorded revenue of `11,516 crore in 2024-25, up 7% year-onyear from `10,728 crore.

The merger with JB Chemicals could add several domestic pharma brands to Torrent’s portfolio, along with a contract manufacturing business.

Controlling shareholder KKR has a 47.84% stake in the Mumbai-based JB Chemicals, while the rest is with the public.

In the first stage, Ahmedabad-based Torrent will buy out KKR’s stake, worth about `13,433 crore, for which financing has been arranged from global banks, ET reported on Saturday. The stake purchase could potentially trigger an open offer.

The second stage, involving the merger, will provide a path for the two companies to explore potential synergies faster.

Torrent Pharmaceuticals aims to figure among the top five Indian players through this deal. The combined value of Torrent and JB is `1.41 lakh crore (around $16.5 billion), as per their current market capitalisation.

Both Torrent and JB Chemicals did not respond to ET’s queries, sent on Friday afternoon.

KKR declined to comment.

KKR had five years ago acquired around 54% stake in JB Chemicals from its promoters, the Modi family, for about `3,100 crore. The US private equity firm launched a formal process last year to sell its stake in JB.

Torrent Pharma, Alkem Laboratories and EQT Corporation had held separate discussions at the time to purchase the stake but a deal did not materialise.

KKR also explored selling its stake in JB Chemicals through open market transactions.

More Local Brands

However, KKR decided against pursuing that strategy.

For 2024-25, JB reported revenue of `3,918 crore, an increase of 12% from `3,484 crore in the previous year. Torrent Pharma recorded revenue of `11,516 crore in 2024-25, up 7% year-onyear from `10,728 crore.

The merger with JB Chemicals could add several domestic pharma brands to Torrent’s portfolio, along with a contract manufacturing business.