SBI Card, one of India’s largest credit card issuers, is introducing several key changes starting July 15, 2025, which will significantly affect cardholders’ benefits, billing structure, and payment rules. Understanding these updates is essential to avoid unpleasant surprises on future statements.

SBI Card Removes Air Insurance, Hikes Minimum Payment to Promote Financial Discipline

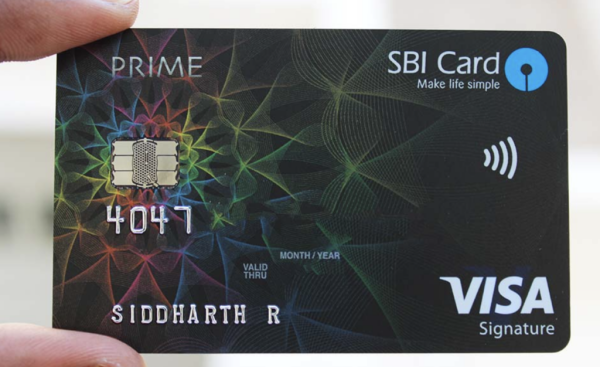

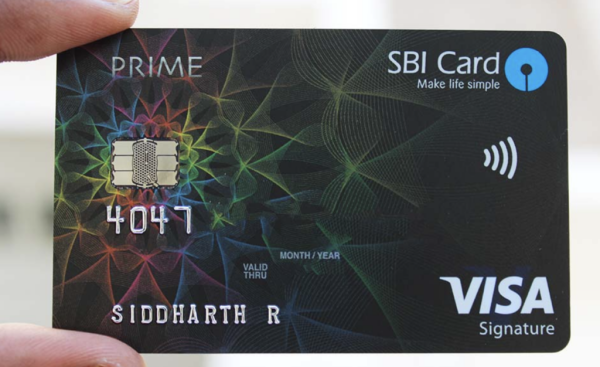

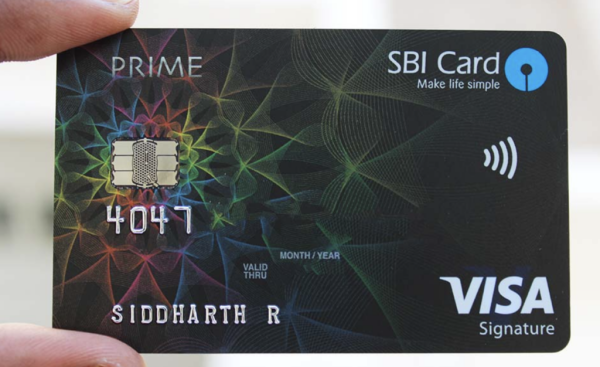

One of the most impactful changes is the removal of complimentary air accident insurance. Previously, premium and co-branded SBI Cards like ELITE, PRIME, and Miles Elite offered insurance coverage ranging from ₹50 lakhs to ₹1 crore for air travel accidents. Effective August 11, 2025 (with notifications beginning July 15), this benefit will no longer be available. Frequent travellers who relied on this protection will now need to purchase separate travel insurance plans.

SBI Card is also modifying the calculation of the Minimum Amount Due (MAD) on monthly bills. Going forward, MAD will include 100% of EMIs, interest charges, GST, over-limit fees, and 2% of any remaining outstanding retail and cash spending. Previously, the MAD was calculated on a smaller base, often allowing users to pay less each month. This new method aims to promote financial discipline and faster debt repayment. However, users who typically pay only the MAD should brace for higher monthly outflows.

SBI Card Restructures Payment Allocation to Minimize Interest Burden

Another critical update is the revised hierarchy for payment reallocation. Payments will now be applied in this order: GST, EMI dues, fees and penalties, finance charges, balance transfers, retail spends, and lastly, cash advances. This ensures that high-interest components like fees and finance charges are cleared first, reducing the accumulation of rolling debt.

Cardholders should take proactive steps to adjust. First, try to pay the full amount due to avoid unnecessary interest. Second, consider third-party travel insurance for frequent flyers. Third, closely review your statements post-July 15 to understand the new billing structure.

SBI Card Overhaul Aims to Boost Transparency and Responsible Credit Usage

Though these updates may seem minor individually, together they represent a significant shift in how SBI Cards will operate—aimed at increasing transparency, encouraging full payments, and fostering responsible credit behaviour.

Summary:

Starting July 15, 2025, SBI Card will remove complimentary air accident insurance and revise billing rules. Changes include a higher Minimum Amount Due and a new payment allocation order prioritizing high-interest dues. These updates aim to improve financial discipline, increase transparency, and encourage responsible credit usage among cardholders.

-

Chelsea agree fifth summer transfer immediately after Jamie Gittens deal

-

Indore: Lord Jagannath's Rath Yatra Held Amid Spiritual Fervour; Foreign Saints And Devotees Mark Grand Procession

-

Air India flight investigated over 'persistent warm temperature' in cabin

-

Indore: DGP Launches System To Improve Police Functioning; QR Code System For People's Feedback On Police

-

The UK city with the highest falling birth rate as locals blame 2 things