Reliance Share Price The domestic equity index BSE Sensex and NSE Nifty-50 made a positive start on Friday, 27 June 2025 amid mixed signals from the global market. On the day of Friday, 27 June 2025, the BSE Sensex jumped 303.03 points or 0.36 percent to 84058.90 and NSE Nifty jumped 88.80 points or 0.35 percent to close at 25637.80 points.

On Friday, 27 June 2025, the Nifty Bank index rose by 237.20 points or 0.41 per cent to close at 57443.90 points by around 3.30 pm. While the Nifty IT index -173.30 points or -0.45 per cent closed at 38822.95 points. However, the S&P BSE Smallcap index rose by 288.83 points or 0.53 per cent to close at 54249.40 points.

Sunday, 29 June 2025, Reliance Industries Limited share condition

By around 3.30 pm on Friday, the stock of Reliance Industries Limited Company rose by 1.24 per cent and the stock closed at Rs 1514. According to the data available on the National Stock Exchange website, Reliance Industries Company shares opened at Rs 1499.4 as soon as the trading started on the opening bail on Friday, June 27, 2025. By Friday, 27 June 2025 AD, Reliance Industries Company shares had reached the high level of the day of Rs 1522. At the same time, the low level of this stock on Friday was Rs 1496.9.

Reliance Industries Share Range

According to BSE data, on Friday, 27 June 2025, Reliance Industries Limited Company share had a 52 -week highest level of Rs 1608.8. Whereas, the 52 -week low of the stock was Rs 1114.85. On Friday, 27 June 2025, the total market cap of Reliance Industries Limited Company increased to 20,50,710 Cr. The rupee has become. On Friday, Reliance Industries Company shares were trading in the range of Rs 1,496.90 – 1,522.00.

What did CLSA broking firm say?

The shares of Reliance Industries Limited Company, which remained stable last year, can gain speed with the results of Q1Fy26 as per CLSA. Brokerage hopes that the clipping parathas will see a good increase and it has repeated the ‘outperform’ rating with a gain of 14% and a target price of Rs 1,650. This is a sign of the beginning of the ‘exciting period’ for India’s most valuable company.

Vikas Kumar Jain, analyst of the CLSA broking firm, said in a note, ‘Reliance Industries is entering a fun time, which is starting with its 1QFY26 earnings, where we are expecting to see notable improvements in KPIS in its main business.

What did CITI broking firm say?

The city broking firm has given a ‘bye’ rating on this stock and has increased the target of its price from Rs 1,585 to Rs 1,690 per share. City said that focusing on the market’s next tariff hike is ignoring the long growth opportunities for the Indian telecom sector and especially for Jio.

Brokerage has estimated the annual growth rate (CAGR) of a three -year consolidated Ebitda for Jio platforms, making the company a total value of $ 135 billion. He said that apart from the increase in tariff in this growth, the contribution of other reasons is 6-7% CAGR.

What did the Bernstein Broking firm say?

The Bernstein Broking Firm has given a ‘outperform’ rating on Reliance Industries stock and has kept the target price of Rs 1,640 per share. This means that the share price can lead to a jump of more than 13% later. Brokerage hopes that “the growth growth momentum near the completion of the store rationalization” will be seen.

The Bernstine Broking firm further stated that the calculation shows that RIL is currently trading on a one -year forward EV/ebitda and it is at 15% discount from an average EV/Ebitda of 3 years. He believes that “the attitude of rising growth and a 3 -year -lower assessment makes it attractive according to the risk reward.

What did Jeffaris broking firm say?

Jefferies broking firm has also given a strong ‘by’ rating on Reliance Industries, with a target price per share is Rs 1,650. This means that the current levels can lead to an increase of about 14%. For example, the rest of the major brokerage, jeffists are also expecting to improve retail growth. Positive tariffs for Jio and strong performance in O2C have also promoted a positive attitude.

Sunday, 29 June 2025 – Reliance Industries Company share target price

According to the update from Dalal Street at 3.46 pm on Sunday, June 29, 2025, the CITI BROKEREGE FIMM has given BUY tag on Reliance Industries Company shares. Citi Brokerage Firm has kept a target price of Rs 1690 on Reliance Industries Stock. In this way, Reliance Industries Stock can later give an upside return of 11.62% to investors. Reliance Industries shares are currently trading at the price of Rs 1514.

How much return did Reliance Industries Stock give till Sunday, 29 June 2025?

In the last 1 year since Sunday, 29 June 2025, Reliance Industries Company Stock has seen a decline of -0.65%. And on the basis of year-two-year (YTD) basis, this stock has seen a rise of 24.68%. At the same time, in the last 3 years, Reliance Industries Company Stock has seen a jump of 32.61%. And in the last 5 years, this stock has seen a jump of 90.46%.

-

South Korean Auto Parts Delegation Visits Us to Explore Investment Opportunities | World News

-

Arjun Kapoor turns 40; Kareena Kapoor, Karan Johar, and others send heartfelt birthday wishes

-

Meet Ajay Devgn’s co-star, a villain, who quit acting to become maulana, he looks unrecognisable now

-

How Hindi cinema rewrites the KM Nanavati case for contemporary India

-

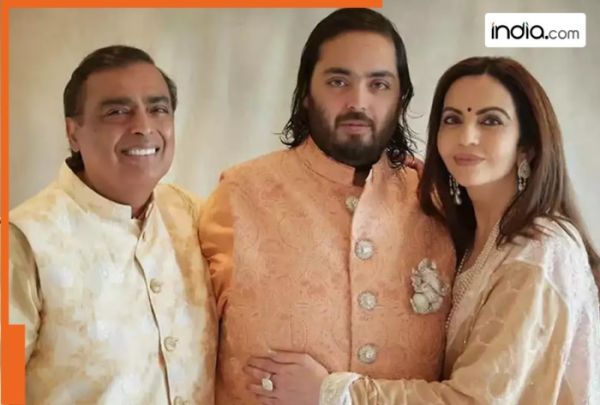

You won’t believe how much salary Mukesh Ambani and Nita Ambani’s son Anant Ambani Isha Ambani, Akash Ambani to be…