Mumbai : The Reserve Bank of India i.e. RBI has given a big statement on the growth of bank loan on Monday. The RBI has said that till the evening of 30 May, the bank loan has softened. During this period, the industry had gained 4.9 percent in bank loan, while this rate was 8.9 percent in the same period last year.

RBI has released data on bank loans for May 2025 based on information received from 41 selected schedule commercial banks i.e. SCB. This debt is about 95 percent of the total non -food loans given by all commercial banks. On an annual basis, the non -food bank loans gained 9.8 percent by the fortnight on May 30, 2025, while it had gained 16.2 percent during the same period 1 year ago i.e. 31 May 2024.

RBI has said that the loan rate given to the industry increased by 4.9 percent while in last year’s 31 May 2024 this rate was 8.9 percent. In the main industry, the remaining loans of engineering, construction and rubber, plastics and their products recorded fast growth on an annual basis.

The RBI said that the loan for the service sector rose by 9.4 percent, which was 20.7 percent in the same period last year. The main reason for this is that non -banking finance companies, ie NBFCs, are slow in loans. On the other hand, loan growth was good in the computer software segment. According to the data, the loans recorded a 7.5 percent increase in the review period for agriculture and its associated activities, which was 21.6 percent on 30 May, 2024.

Mahendra Singh Dhoni’s brand will get a new identity, make this name a trademark

In addition, the loan in the personal loan segment has upgraded at a rate of 13.7 percent, which was 19.3 percent in the same period a year ago. The main reason for this is other personal loans, vehicle loan and credit card arrears to be low.

(With agency input)

-

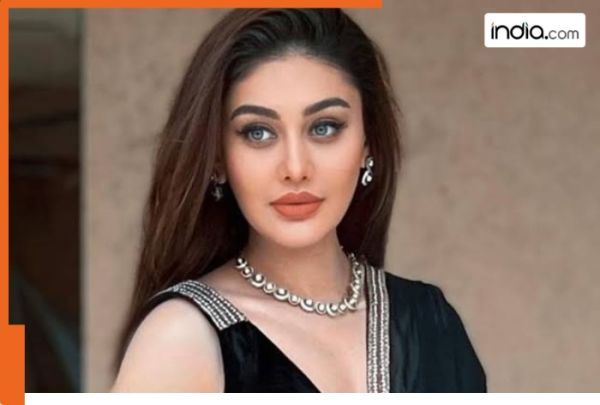

Shefali Jariwala Death: Shefali’s WhatsApp chat goes viral, had special plans with…, was about to…

-

Jurassic World Rebirth cast and their salaries: Scarlett Johansson reportedly takes home Rs 167 crore, Mahershala Ali, Jonathan Bailey and others are paid just Rs…

-

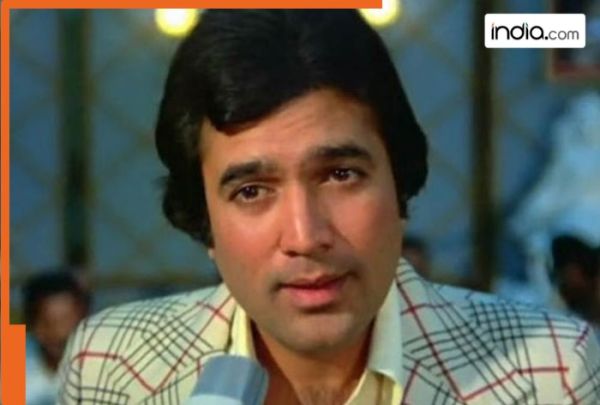

This actress called superstar Rajesh Khanna ‘moody and arrogant’ on the sets of Red Rose, she is…

-

Meet Indian, who migrated from Pakistan to India, built world’s one of biggest business of…, he is…

-

Thane News: MNS Advocacy Leads To Marathi Classes In Kendriya Vidyalaya; School Paid More Attention On Hindi, English Earlier