The shares that flooded the market were lapped up by BNP Paribas Financial Markets for a total consideration of INR 18.19 Cr

As per the BSE data, Morgan Stanley sold the shares at INR 1,819 apiece

The block deal comes a week after PB Fintech cofounders Yashish Dahiya and Alok Bansal dumped a big chunk of their shareholding in the company for a cumulative INR 920 Cr

Financial services firm Morgan Stanley Asia (Singapore) Pte offloaded 99,994 shares of fintech company PB Fintech in a block deal worth INR 18.19 Cr.

As per BSE data, Morgan Stanley sold the shares at INR 1,819 apiece yesterday, a discount of 0.2% from the stock’s last closing price of INR 1,823.7 on the BSE on Friday (June 27).

The shares that flooded the market were lapped up by BNP Paribas Financial Markets at the same price for a total consideration of INR 18.19 Cr.

The block deal comes a week after PB Fintech cofounders Yashish Dahiya and Alok Bansal dumped a big chunk of their shareholding in the company via bulk and block deals for INR 619.6 Cr and INR 300.6 Cr, respectively.

The development comes at a time when the fintech major’s share prices have been witnessing heavy volatility amid broader market churn and questions raised by investment research firm Trudence Capital. The stock has grown 14.65% in the past three months but is down more than 13% on a year-to-date (YTD) basis.

The report by Trudence Capital, in March, raised questions about PB Fintech’s revenue recognition practices, transparency with investors and the role of its lending arm, Paisabazaar. It claimed that the fintech company has not been fully transparent about the commissions earned from insurance distribution and the role of Paisabazaar in the company’s financial statements.

However, the company continues to post healthy top and bottom line numbers. Its net profit soared 448% to INR 353.2 Cr in FY25 from INR 64 Cr in the previous fiscal year. Operating revenue, too, jumped 45% to INR 4,977.2 Cr during the fiscal under review from INR 3,437.7 Cr in FY24.

Recently, it also received RBI’s in-principle nod for its subsidiary PB Pay to operate as a payment aggregator. On top of this, its healthcare arm, PB Healthcare, raised $218 Mn in seed funding in May this year.

Shares of PB Fintech closed yesterday’s trading session 0.11% lower at INR 1,821.75 on the BSE.

-

Islamabad Takeover Confirmed! Maulana Fazlur Rehman’s Threat Shakes Sharif Government – Jihad in One Week or Total Ruin!

-

Akhilesh Yadav’s ‘under the table’ dig at Dhirendra Shastri amid kathavachak row

-

Thar desert, empty jerry can: How ‘thirst’ ended Pakistani couple’s India dream in Rajasthan

-

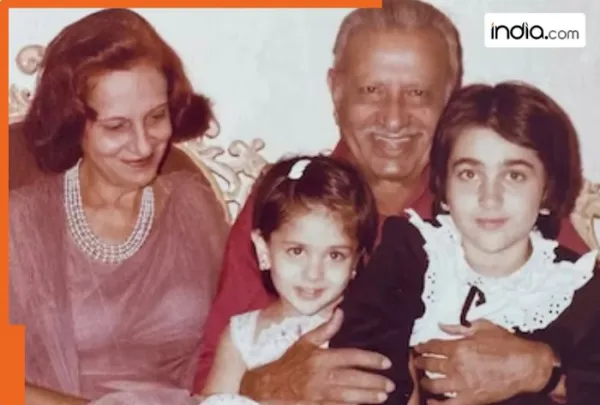

Meet Karisma Kapoor’s flop brother, who is 4 years younger than her, acting since 14 months old, still couldn’t become a star, he is.

-

Jailer 2 Box Office Day 1: Can Rajinikanth Starrer Earn 51% More Than Leo & Create History For Kollywood?