Everyone worries about their future. In such a situation, we want to make some arrangements for the time of emergency. Whenever we get a lump sum or more money and want to save it, the first thought that comes to our mind is FD. Investing in Fixed Deposit (FD) is still the safest and most reliable way for Indians. At the same time, to manage emergencies or sudden expenses, a person wants to use his savings instead of asking for money from someone. Some people even break the FD, but is it right to do so? Why not take a small loan on the same FD?

Disadvantages of breaking FD?

If you break the FD when you need money, then you will get cash immediately. But in the future, you will have to suffer a loss. You have to pay a penalty of about 1%. Some banks also deduct separate charges. If you break your FD before maturity or make a partial withdrawal, then you do not get the benefit of interest. You get much less interest than the fixed rate. In such a situation, your financial target for the future is bound to be affected.

The benefit of taking a loan on FD?

If you take a loan on FD, then it will be cheaper than a personal loan. Suppose you are getting up to 7% interest on FD. If you take a loan based on FD, then you will get a loan at 1.5-2% more interest. This means you will be able to take a loan at an 8.5-9% interest rate. Whereas the interest rate for personal loans starts from 11 percent.

FD will also be safe by taking a loan.

If you take a loan on your fixed deposit, then your FD will be safe and will continue till maturity. This means that even though you will be burdened with a loan,, savings will also continue and returns will also keep coming.

How much loan can you take?

You can also take a loan on your FD. You get a loan of up to 90% of the value of the FD. That is, if you have made an FD of Rs 1.5 lakh, then you will get Rs 1 lakh 35 thousand as a loan. In such a situation, you will have to pay 1-2% more interest than the interest you get on a fixed deposit. That is, if you are getting 4% interest on FD, then you can get a loan at a 5 to 6% interest rate.

For how many years will you get the benefit of making FD?

You should make a fixed deposit for at least 5 years. You will get a good return with a lock-in period of 5 years. At the same time, you also get income tax exemption on investing in FD for 5 years. You do not have to pay any tax on your deposit and interest.

-

When Shefali Jariwala Recalled Death Hoax After Kaanta Laga In Old Interview

-

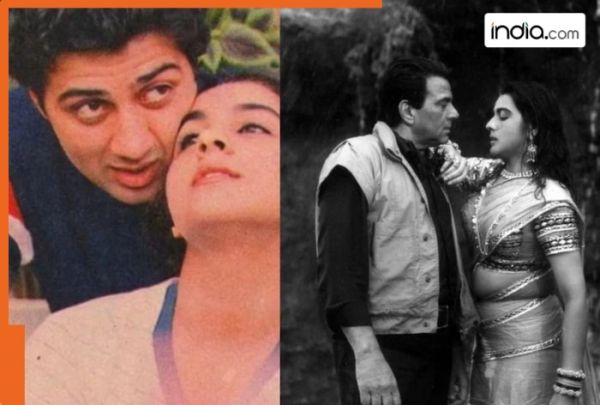

These 6 heroines romanced not only the hero but also their fathers, their chemistry with both father and son was spot on, they are…

-

Maalik Trailer: From ‘Sasta Raees’ To ‘Maza Aayaga’, Rajkummar Rao Starrer Gets Mixed Response From Netizens

-

Chelsea route to Club World Cup final takes a twist in huge £53m boost

-

Chelsea route to Club World Cup final takes a twist in huge £53m boost