IT Notice Rules: Taxpayers have to take care of many things while filing income tax. A slight mistake in the ITR (Income Tax Return) can cost him heavily. On this, the Income Tax Department sends a notice and seeks your reply. Not responding to it or not being satisfied with the department's reply (how to reply to an IT notice) can prove to be even more troublesome for the taxpayer. If you want to stay away from such tension, then know when the income tax notice comes and how to reply.

Notice also comes for filing a wrong return -

Most taxpayers (taxpayers update) do not know in which situations the income tax notice comes. This can come from filing the wrong return, i.e., a faulty return. The department can send a notice and demand tax, along with a reply. Most notices come in matters related to ITR.

Notice comes on the wrong selection of the ITR form-

The main reason for getting an income tax notice (Income tax notice kab aata h) is making a mistake while filing the income tax return or selecting the wrong form. There are four forms for people to fill out ITR (ITR forms): ITR 1, 2, 3, and ITR 4. Many taxpayers make mistakes in choosing these forms. Due to this, there is a mistake in the income tax return, and the department sends a notice.

Notice on mismatch of income and tax -

Most of the taxpayers who filed income tax returns (ITR filing rules) in June last year are now getting notices. The reason for this is a mismatch in the income details. Last year, most of the taxpayers failed to check the actual income in Form 26AS. After this, a situation of demand notice arose.

Notices were also received on non-taxable gifts -

According to the old rules, income tax was not levied on gifts taken from relatives. Now, as per income tax rules, there is no provision to declare non-taxable gifts. In such a situation, a dual situation has arisen, and people have received demand notices for not paying tax on such gifts.

Notice if the revised return is not processed-

If a mistake is found after filing ITR (ITR filing rules), the department sends a notice and asks to correct it and resubmit it. Many have also received notices based on the original return. These notices come even when the revised return is not processed.

Keep this in mind while replying to the notice-

- First of all, it is necessary to check thoroughly what is the reason for receiving the notice from the Income Tax Department. After this, the reply should be given accordingly. You can also check the authenticity of the notice in the 'Pending Action' tab on the e-filing portal. It is also necessary to do such a check to avoid fraud cases of tax refund.

- When you receive a notice, it is important to see under which section of the Income Tax Act it has been sent. Different sections have been prescribed for different reasons for sending notices (IT notice reasons). Notice for wrong returns is sent under section 139(9), while section 143(1) deals with processing errors. By knowing the type of notice (IT notice types) and the reason, you can easily prepare its response and action.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

When Shefali Jariwala Recalled Death Hoax After Kaanta Laga In Old Interview

-

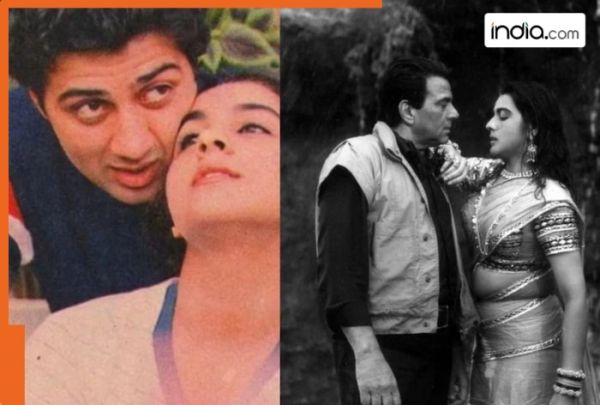

These 6 heroines romanced not only the hero but also their fathers, their chemistry with both father and son was spot on, they are…

-

Maalik Trailer: From ‘Sasta Raees’ To ‘Maza Aayaga’, Rajkummar Rao Starrer Gets Mixed Response From Netizens

-

Chelsea route to Club World Cup final takes a twist in huge £53m boost

-

Chelsea route to Club World Cup final takes a twist in huge £53m boost