Nippon India Mutual Fund | I do not have much money to invest. Because of this many people say that I can never be rich. But, there are many such investment options in the market, where you can also do this by applying just 1000 rupees. Yes, you read it right.

You can fulfill this dream by making a monthly investment (SIP) of just Rs 1000 in mutual funds! Can SIP of Rs 1000 really deposit Rs 1 crore? This question is bound to come to your mind. So, the answer is yes, it is possible.

When we studied the oldest and best performing mutual funds, some schemes came out which have proved this. These things have been possible in some plans of HDFC Mutual Fund, Nippon India Mutual Fund and Franklin Templeton. All these schemes have been in the market for 29 to 30 years.

How to become a millionaire from SIP of 1000 rupees?

Nippon india growth fund

Annual Return in 29 years: 22.91%

Monthly SIP: 1,000 rupees

Total investment: 3,48,000 (in 29 years)

SIP value after 29 years: 2,31,88,625 (ie Rs 2.32 crore)

HDFC Flexi Cap Fund

Annual Return in 30 years: 21.22%

Monthly SIP: 1,000 rupees

Total Investment: 3,60,000 (in 30 years)

SIP value after 30 years: 2,01,55,339 (ie 2.01 crore rupees)

HDFC ELSS Tax Saving Fund

Annual Return in 29 years: 22.28%

Monthly SIP: 1,000 rupees

Total investment: 3,48,000 (in 29 years)

Value of SIP after 29 years: 2,04,75,108 (ie 2.04 crores)

Franklin India Flexi Cap Fund

Annual return in 30 years: 20%

Monthly SIP: 1,000 rupees

Total Investment: 3,60,000 (in 30 years)

SIP Value after 30 years: 1,56,20,400 (meaning Rs 1.56 crore)

SIP’s ‘compound’ strength!

It is clear from this figure that you can make big money in a long time by saving a little bit through a cystmatic investment plan. The strength of ‘compound interest’ works behind this. The more time you invest, the more the benefit of compound increases and your money can increase manifold.

-

Chelsea make £55m transfer decision to unleash Cole Palmer

-

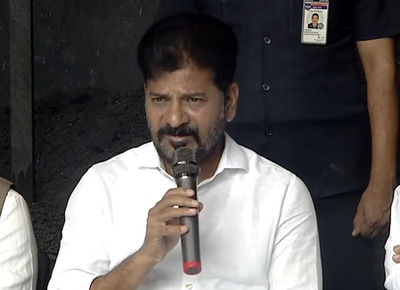

Telangana CM visits pharma unit; reviews rescue, relief operation

-

Free Aquarius monthly horoscope for July 2025

-

Woman left with permanent sunburned red nose after falling asleep on trip - five years ago

-

Disturbing Video: Speeding Car Crashes Into Roadside Hotel On NH-9 In UP's Hapur; 1 Dead, 3 Injured