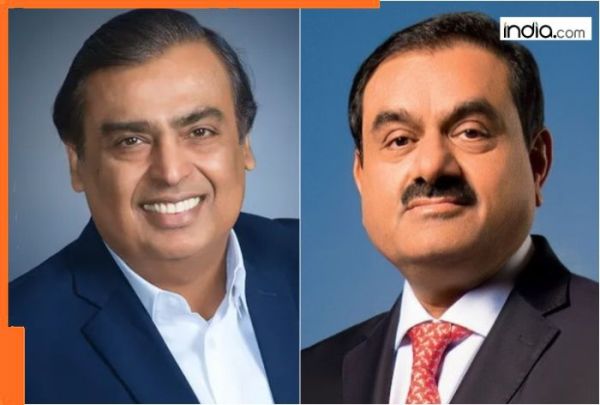

Rosneft a big player in the Russian energy sector is looking to dispose its investment in Indias Nayara Energy. News sources have indicated that Rosneft entered discussions with Reliance Industries (RIL) after previously failing to inspire interest from numerous other Indian firms as well as a lack of interest from government-owned firms. Rosneft had put a $20 billion valuation on the stake previously which was simply too high and had scared off would-be buyers. Reliance and Rosneft negotiations are currently at a very early stage. Russias Rosneft in early talks with Reliance to sell stake in Indian unit Russian oil company PJSC Rosneft Oil Company is discussing selling its 49.13 percent stake in Nayara Energy with Reliance Industries sources told news agency PTI. Nayara owns a 20-million-tonnes-per-year oil refinery and 6750 petrol pumps across India. Reliance is holding preliminary discussions for the purchase of Nayara Energy which might allow it to become larger than state-owned Indian Oil Corporation (IOC) and would also expand its advantage in fuel retail. However these negotiations are in the preliminary stages and theres no guarantee a deal will go through as valuation is still a key issue according to three people with direct knowledge of the matter PTI reported. In the last year Rosnefts senior officials have traveled to India three times including visits to Ahmedabad and Mumbai for talks with potential investors. Due to Western sanctions limiting Rosnefts ability to repatriate earnings from its Indian operations the Russian oil company is looking to exit its investment in Nayara Energy. As a result the ideal buyer would likely be a company with significant overseas revenues or an international presence enabling them to make swift payments abroad for the acquisition. Sources informed PTI that Reliance earns a lot of income from international markets as a major fuel exporter. This makes them a likely candidate to buy Rosnefts stake in Nayara. Emails sent to Rosneft for comment were not returned and a Reliance spokesperson told PTI As a policy we do not comment on media speculation and rumours. Our company evaluates various opportunities on an ongoing basis the spokesperson told PTI. We have made and will continue to make necessary disclosures in compliance with our obligations under Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 and our agreements with the stock exchanges the spokesperson added. Rosneft which purchased Essar Oil in 2017 for $12.9 billion has run into challenges in fully benefiting from its India business because of international sanctions that hinder the repatriation of earnings. After the acquisition Essar Oil was renamed Nayara Energy. In 2024 the Russian energy company decided to exit Nayara and has been looking for buyers. Rosneft is not alone in this. UCP Investment Group a major Russian financial company is also seeking to sell its 24.5 percent stake in Nayara Energy. The remaining ownership in Nayara Energy includes Trafigura Group which has a 24.5 percent interest in Nayara as well as a number of retail investors. According to sources if a transaction were completed Trafigura might also exit the business potentially within months and probably on similar terms. The stakes held by Rosneft and UCP were offered to a number of major players including Reliance Industries the Adani Group Saudi Aramco and a state-owned consortium of ONGC and IOC. However Rosnefts $20 billion valuation for Nayara was seen to be too high by almost every potential investor and this has held up any deal for the time being. Adani Group turned down the investment proposal for Nayara Energy The Adani Group turned down the investment proposal for Nayara Energy given that oil refining is perceived as a sunset industry while the world is transitioning quickly to clean energy and decarbonization. In addition to the high price ask sources said Adanis strategic partnership with French energy giant TotalEnergies contributed to the decision. The two companies have multi-billion-dollar agreements in the city gas and renewable energy spaces. As part of their strategic partnership agreement Adani agreed to limit future investments in fossil fuels to only natural gas meaning Adani could not be part of the Nayara deal. Reliance to become the largest oil refiner if... Nayara makes the most strategic sense for Reliance according to sources. Reliance operates twin refineries in Jamnagar Gujarat with a combined capacity of 68.2 million tonnes per year in very close proximity to Nayaras 20-million-tonnes-a-year refinery in Vadinar also in Gujarat. If Reliance buys Nayara it would exceed IOCs capacity of 80.8 million tonnes per year to become Indias largest oil refiner. Most importantly Nayaras network with a total of 6750 petrol pumps would give Reliance a good grip on the fuel retail side where it currently only runs 1972 out of Indias 97366 fuel stations. Mukesh Ambani eyes major deal! Even Gautam Adani steps back from the race Sources indicate that Rosneft reduced its valuation to USD 17 billion since the talks began; nonetheless companies like Reliance still find this valuation too high. But there has been no formal deal and Rosneft has made no official statement.

-

Gig workers welcome insurance in new rules, slam surge pricing, fare gaps

-

Infosys worker held for ‘filming’ woman in office washroom

-

Window frame of Spicejet flight dislodges mid-air, passengers safe

-

Cyberabad police roll out Op Muskan XI to trace and rescue children

-

Iranian President issues order to suspend cooperation with IAEA