India’s notorious scam call centres, long accused of defrauding pensioners in the West, have now turned their sights on a new, lucrative market: residents of the UAE.

A Khaleej Times investigation reveals that at least three such centres — two in Noida and one in Jaipur — are posing as Dubai-based forex (foreign exchange) firms, using spoofed +971 numbers to deceive unsuspecting investors. Two former employees, speaking anonymously due to fear of retaliation, detailed how the operation works, watch below.

Agents rely on real names and numbers to personalise pitches and sound credible from the first hello.

Stay up to date with the latest news. Follow KT on WhatsApp Channels.

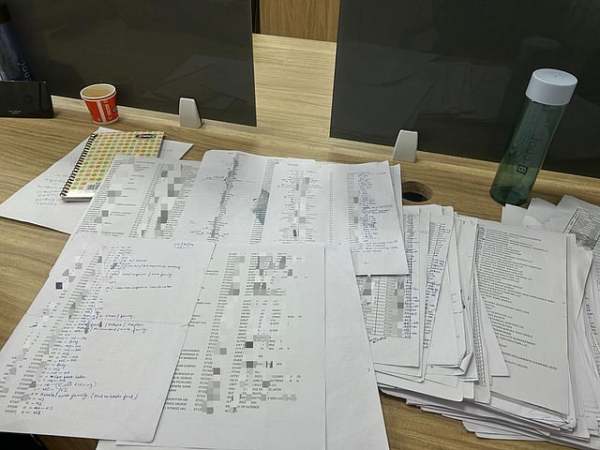

‘I’ve never left India’Khaleej Times was given access to one such leaked contact list by a former employee who said she quit after witnessing too many people fall victim. The spreadsheet contains hundreds of UAE mobile numbers.

“I’ve never left India,” she said. “But I tell people I’m calling from Dubai. That’s the job.”

She explained that fresh data would arrive every few days and be distributed to agents.

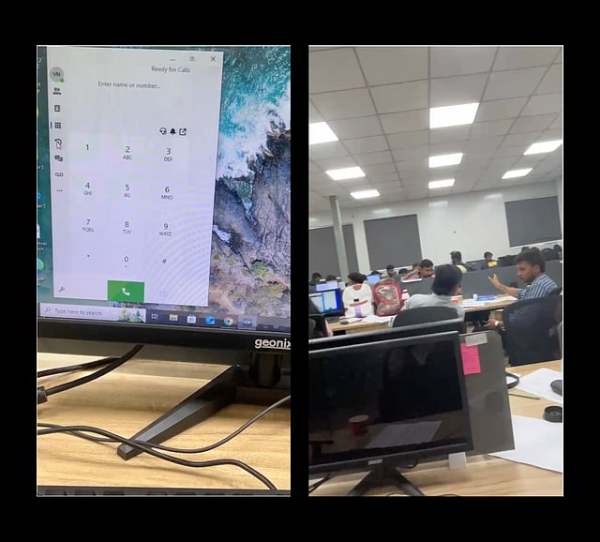

“There are 50 to 100 agents in every centre,” she said, adding: “Each of us made about 150 calls a day, from 8am to 11pm. Every number could mean a payout.”

Inside the call centre. Photos supplied by anonymous employees.

The calls are routed through software that mimics UAE numbers, making them appear to originate from business hubs in Dubai.

“The moment someone sees +971, they pick up. That’s enough to get their attention,” she added.

Agents are trained to claim a Dubai presence and deflect doubts. If a client asks to visit the office before investing, they’re given a fake location. “I had two fake Dubai addresses stuck on a sticky note on my desktop,” she said. “If anyone insisted on meeting, I’d say: ‘Come anytime, brother.’ But no one ever came.”

Picture: Internal sale script combo

Khaleej Times has reviewed internal sales scripts used at the call centres — detailed templates with pre-written rebuttals for nearly every objection.

The scripts cover scenarios like clients asking where their number was sourced, requesting Arabic speakers, citing past bad experiences, or saying they don’t have funds.

Agents are told to praise, press, and pivot, keeping the tone helpful and assured. One script suggests using this analogy when asked about guaranteed returns: “Brother, let’s say you buy a property worth Dh100,000 and the price drops. Do you sell it at a loss? No, right? Same with trading. We wait for the price to rise. Don’t be greedy — clients lose when they stop listening to their relationship managers.”

And if someone wants to meet in person: “Sir, you’re busy. By the time you come, the opportunity will be gone. I’ve prepared a winning portfolio just for you.”

In one case, a UAE resident was persuaded to transfer $25,000 (approximately Dh91,825) in a single day.

“My colleague told him: ‘Sir, trust me, this window won’t last. If you don’t invest now, you’ll regret it.’ The client wired the money. Two days later, his number was blocked.”

Names and numbers blurred for privacy. Photo supplied by anonymous employee.

When Khaleej Times called the mobile numbers of individuals allegedly coordinating the scam from India, the reaction was swift.

“No, no, no, no… I don’t know what you’re talking about!” said one before abruptly hanging up.

Another demanded, “Who in the team gave you my number?” For legal reasons, Khaleej Times is not naming the Indian company running the call centres.

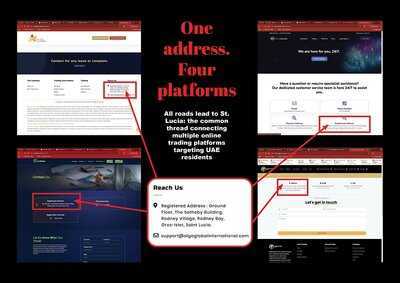

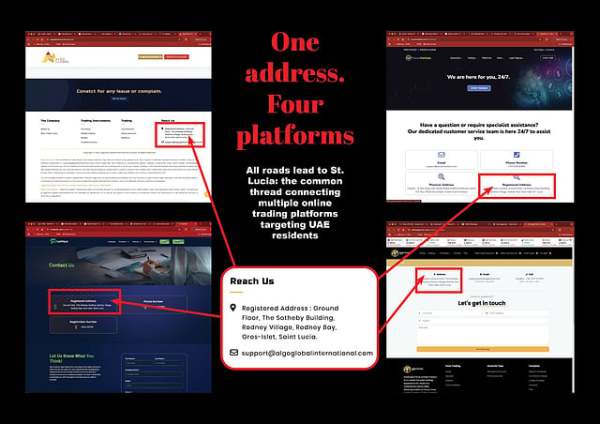

Smokes and mirrorsBut their digital paper trail is far less evasive. The setup mirrors a scam uncovered by Khaleej Times in last month’s exposé, 'Fake platforms, real cash,' which revealed how UAE-based syndicates were promoting unlicensed forex platforms through local call centres. Several operations were found pushing shady platforms with aggressive sales tactics, slick dashboards, and no regulatory oversight. Now, Indian call centres are muscling into the racket, using the same playbooks, targeting the same audience, and eating into the same pie.

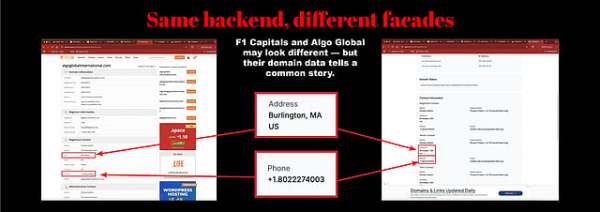

The platform may go by different names, but the underlying infrastructure is identical in many cases.

Algo Global International, aggressively promoted by the Noida and Jaipur centres, lists the same Saint Lucia address as F1Capitals Markets, Oscar Markets, and Arbitrage Prime — all currently being marketed by call centres based in the UAE. Further overlap emerges in domain records. Both f1capitals.com and algoglobalinternational.com are registered under the same proxy identity: “Domain Admin,” linked to a US address and a phone number masked behind @privacyprotect.org.

When contacted, the domain registrar, Holister, emailed saying ownership details could only be shared with law enforcement or a licensed attorney.

Obaidullah Kazmi, founder and CTO of cybersecurity firm CREDO said, “multiple trading platforms using the same offshore address, proxy domain registrations, and shared infrastructure suggest a coordinated operation. This is unlikely to be coincidence. It appears to be a structured cross-border setup using digital anonymity to avoid scrutiny, exploiting cross-border regulatory gaps.”

F1Capitals, which describes itself as a “global leader in investment brokerage,” listed only a UAE mobile number as its contact. The man who answered said he had joined just “three days ago” and couldn’t explain why his personal cellphone was the company’s sole contact or where its Dubai office was. “We’re working on a Bur Dubai location,” he said.

Oscar Markets claims to be based in Abu Dhabi but lists a Dubai landline — a red flag, since Abu Dhabi numbers start with 02. The number doesn’t work.

On Monday, I visited a marketing firm inside Exchange Tower, Business Bay, which had been cold-calling UAE residents, including this journalist to pitch a trading platform called Arbitrage Prime.

Initially unwilling to meet, the staff eventually agreed. From the reception, a glass partition revealed a first-floor office filled with young men and women on headsets, calling prospects.

Soon after, I was led into a side room, where the telesales agent and a 'senior relationship manager' pushed a “can’t-miss opportunity” in Netflix stocks.

Asked why the platform they were promoting had no SCA licence and shared a Saint Lucia address with three other shady platforms, the manager shrugged. “Must be a technical issue. I don’t know.”

He said he’d just joined. His colleague had been there less than a week.

When this journalist revealed his identity and asked how many people on the floor were on the company’s trade licence, both looked at each other and said nothing.

Across many of these firms, vague details are the norm. They appear to be built to keep clients engaged just long enough to take their money.

Once funds are deposited, clients are shown fake profits on sleek dashboards. Encouraged by early gains — and coaxed by smooth-talking telesales agents — many take out bank loans or max out credit cards to invest more.

As deposits grow, so does the manipulation. Victims are steered into high-risk trades to “protect profits.” Then the trap shuts. Withdrawals are blocked, trades frozen, and brokers stop responding. The money’s gone, and there’s no one to chase, because there was never anyone there.

“They think it’s a licensed Dubai broker on the line,” said another former staffer. “What they don’t know is, it’s all coming from India.”

At the core of the fraud is the B-book model where platforms bet against their own clients. Unlike A-book brokers, which route trades to the real market, B-book platforms take the opposite side and profit only when clients lose.

To tilt the odds, trades are manipulated: executions are delayed, spreads widened, stop-losses triggered early, and data falsified.

Sometimes, the entire call centre vanishes overnight. One such case is Gulf First Commercial Brokers, which promoted multiple shady platforms before vanishing from its Business Bay office in May this year.

When investors went looking, all they found was a garbage bag and a mop in a bucket.

The financial toll is steep.

AK from Dubai lost Dh150,000 across three platforms. SJ was defrauded of $232,000 by Sigma-One Capital. A Keralite expat transferred Dh500,000 — money saved for his child’s education — into Core Financial Markets. Imran Moghul, based in Abu Dhabi, lost Dh140,000 to DuttFx. Mohammad Bilal Saeed, also in Abu Dhabi, lost $50,000 to Sigma-One and has filed a police complaint.

All these platforms were fake.

India is already a global hotspot for tele-fraud. In 2022 alone, Americans lost more than $10 billion to scams — many traced back to Indian call centres. Some busted operations were raking in over $600,000 a month. With UAE residents now in their crosshairs, Indian scam syndicates are widening their net.

On Sunday, the UAE Ministry of Interior issued an alert on X, urging residents to verify the licensing status of trading platforms through the Securities and Commodities Authority (SCA) before investing.

“It’s easy money,” said a cybersecurity expert. “The lure of quick profits in forex, paired with slick websites and fake dashboards, makes it hard for many to resist. These call centres used to focus on US and Europe. Now, they’ve realised there’s just as much to exploit in the Gulf."

UAE: Investors warned against illegal firm, unlicensed practices to avoid fraud New Dubai rental scam: Expats frustrated after 'agents' collect deposits, then vanish-

Australian Teen Dies Doing Backflip While Celebrating New House With GirlFriend In Queensland

-

Girls Will Be Girls Fame Kesav Binoy Kiron On Facing Social Media Hatred: 'If Someone Criticises Me For My Looks...' (EXCLUSIVE)

-

Ramayana Is Story Of Our Culture & Our Truth, Says Producer Namit Malhotra As He Unveils First Glimpse Of Ranbir Kapoor's Film

-

Skydiving plane careers off runway and crashes into woods leaving 15 people injured

-

CSG vs DD Dream11 Prediction: TNPL 2025 Match Qualifier 2, Fantasy Cricket Tips, Dream11 team, Playing XI, Pitch Report, Injury Updates - 4th July 202