The Indian stock market ended marginally lower on Thursday, with benchmark indices slipping after recent gains. The BSE Sensex closed at 83,237.74, down 171.95 points or 0.21 per cent, while the NSE Nifty settled at 25,405.30, losing 48.10 points or 0.19 per cent. Profit booking in key sectors and cautious sentiment ahead of upcoming economic data contributed to the subdued performance.

Apollo Hospitals, Hero MotoCorp, Dr. Reddy’s Laboratories, ONGC, and Maruti Suzuki emerged as the top gainers on the Nifty. On the flip side, SBI Life Insurance, Kotak Mahindra Bank, Bajaj Finance, JSW Steel, and Bajaj Finserv were among the major laggards.

The BSE Midcap index ended largely unchanged, while the Smallcap index edged up by 0.5 per cent.

Sectorial Update

Among sectoral indices, metal, realty, and PSU banks declined by around 0.5 per cent each. In contrast, pharma, media, oil & gas, auto, and consumer durables posted gains ranging between 0.3 per cent and 1 per cent.

Sundar Kewat, Technical and Derivatives Analyst, Ashika Institutional Equity, "The Nifty index opened flat at 25,505 on Thursday, slipping to an intraday low of 25,384 before rebounding to touch a high of 25,587. However, the index witnessed renewed selling pressure from the day’s high during the second half of the session, ultimately ending on a subdued note. Sectorally, outperformance was seen in Media, Consumer Durables, Healthcare, and Automobiles, while notable weakness persisted in PSU Banks, Metals, and Realty stocks. The broader market mood remained cautious, as investors stayed on the sidelines ahead of the anticipated US-India trade agreement, keeping overall sentiment subdued.

Previous Trading Session

In the previous trading session on Wednesday, the BSE Sensex closed at 83,384.61, slipping over 300 points, while the NSE Nifty50 settled at 25,444, falling nearly 100 points. The decline wiped out earlier gains driven by positive cues from macroeconomic data and global trade developments. Investor sentiment turned cautious amid uncertainty surrounding the ongoing US-India trade talks, with hopes pinned on a breakthrough by the end of the dialogue. Market anxiety was further heightened as the US tariff deadline, set by President Donald Trump, approached, even as India remained hopeful of negotiating a deal to avoid steep duties from Washington.

-

‘Sham AJL Transaction With Gandhis’ Connivance’: ED Calls National Herald Case ‘Classic Money Laundering’

-

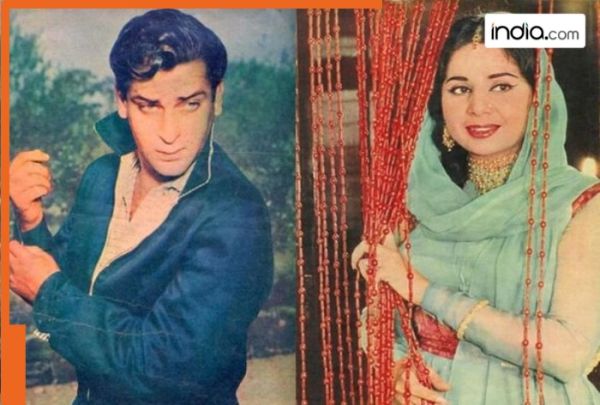

‘It was more than affair…’, This actress made shocking revelations while talking about Shammi Kapoor’s wife, her name is…

-

Meet actress who did 3 films in 6 months, earned Rs 1000 crores, known as ‘golden girl’ of box office, no one could compete with her, she is…

-

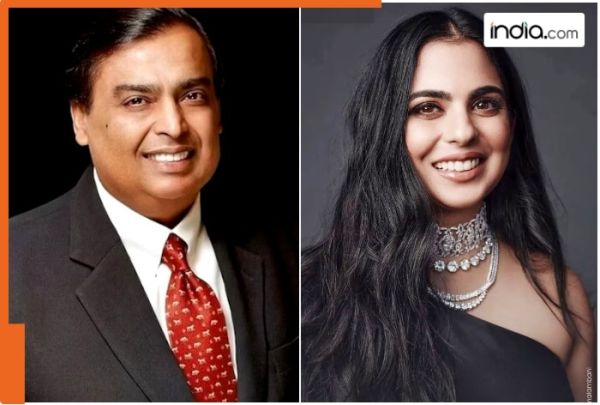

Mukesh Ambani, Isha Ambani make big move, Reliance Retail acquires stake in this foreign company, it is of…, name of…

-

Who Is Andre Silva? Liverpool Star Diogo Jota's Brother, Who Also Passed Away In Car Accident In Spain