Transaction rules: Now, due to digital payment, people transact money through many means. These include net banking, cheque, UPI, and cash transactions. The Income Tax Department keeps an eye on every method of cash transaction (cash transaction rules).

According to the Income Tax Department, if anyone violates the rules during the transaction anywhere, then the department immediately sends a notice (income tax department notice) and seeks an answer. In this notice, the department can ask many types of questions of the concerned person.

1. Those who invest in FD should keep this in mind-

FD is considered a good option for investment (FD investment) nowadays, but many people are not fully aware of the rules and methods of depositing money in it. If any person deposits Rs 10 lakh or more in cash in an FD, then the Income Tax Department will not delay sending a notice (IT notice kab aata h) asking the source of the money. Therefore, you need to know the limit of depositing cash in an FD.

2. How many transactions should be done from the bank account?

If you withdraw or deposit 10 lakh or more rupees from the bank account in a financial year, then you are sure to get a notice from the department. This rule is also applicable for the amount of 10 lakh or more deposited in one or more bank accounts. This provision has been made by the Central Board of Direct Taxes (CBDT) and the Income Tax Department.

3. Be alert while buying property -

A lot of money is transacted in the deal of buying property. If you give an amount of Rs 30 lakh or more in cash to someone while buying a property (property buying rules) or take it while selling a property, then be ready to respond to the notice of the department. Please note that the property registrar sends the information about this transaction to the income tax department. In the notice, you may be asked about the source of this money.

4. How to pay the credit card bill-

If you have taken a credit card, then it will be better to pay the bill online. If you pay a bill of Rs 1 lakh or more in cash, then the income tax department can send a notice in any case.

5. Rules for those investing in the stock market-

Nowadays, many people have started investing in the stock market as well. If you take or give Rs 10 lakh or more in cash to buy a mutual fund or a bond, then it is certain to get a notice from the Income Tax Department (IT notice rules).

6. Transaction limit in a financial year-

For the last few years, the government has promoted digital transactions (cash transaction rules) so that tax evasion can be curbed. If a person makes a transaction of more than Rs 10 lakh in a financial year by any means, then difficulties may arise for them. In such a situation, the income tax department can ask for the source of the money by sending a notice. If you want to avoid an income tax notice, then everyone must keep in mind the cash transaction limit of one day while transacting in cash.

How to reply to the notice -

When you get a notice from the Income Tax Department (IT notice rules), first of all, keep in mind that there is a fixed time limit for replying to every notice. Reply to the notice (how to reply to an income tax notice) within this fixed time limit. Before replying, read the notice thoroughly and understand what has been asked in it. After that, reply within the fixed time as per the question. If you want, you can also take expert advice.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

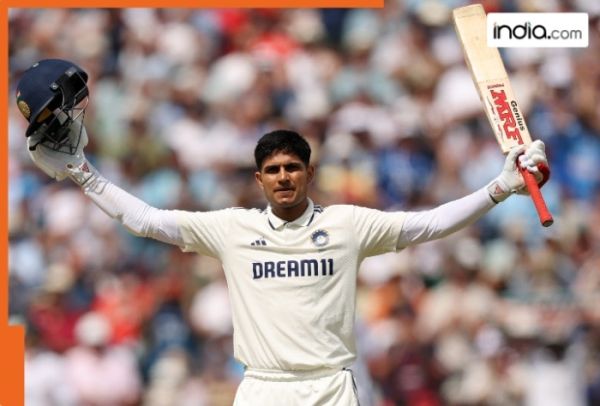

IND vs ENG: Shubman Gill’s maiden double century put India on top in second Test

-

ENG vs IND 2025: Full list of records broken and milestones achieved by Shubman Gill with his 269 at Edgbaston

-

Victims of Gaddafi-backed IRA terror demand to be told what's in 'top secret' report

-

Victims of Gaddafi-backed IRA terror demand to be told what's in 'top secret' report

-

Five-week-old baby girl murdered by drug-taking dad who 'shook her like a ragdoll'