Reliance Retail is transferring its consumer goods business to a new entity New Reliance Consumer Products Ltd (New RCPL) as part of an internal business restructuring. According to the scheme filed with the NCLT Reliance is transferring and vesting the FMCG brands business from Reliance Retail Ltd (RRL) to the newly formed entity New Reliance Consumer Products Ltd (New RCPL). The Mumbai bench of the National Company Law Tribunal (NCLT) on June 25 asked to convene a meeting for approval of the internal restructuring process under which its consumer business is transferred as a going concern on Slump Sale. Why Is Reliance Transferring Its Consumer Goods Business? Explaining the reasons Reliance firms said the Consumer Brands Business is one of building brands managing the entire product lifecycle from research development manufacturing distribution and marketing. This is a large business by itself requiring specialised and focused attention expertise and different skill sets as compared to retail business. This business also entails large capital investments on an ongoing basis and can attract a different set of investors it said. This composite scheme part of the internal restructuring of companies in the RIL group to house the Consumer Brands Business in New RCPL and will have RIL and other investors of RRVL holding the same percentage shareholding as in RRVL they said. The scheme proposes transferring and vesting the FMCG brands business from Reliance Retail Ltd (RRL) to the parent firm RRVL as a going concern on Slump Sale merger of RCPL with RRVL and demerger of consumer goods business from RRVL to New RCPL in the third stage. Both RRL and RCPL are wholly owned arms of RRVL. What Is Current Structure Of Reliance Retail ? Presently Reliances consumer goods business is spread in three verticals - RRL Reliance Retail Ventures Ltd (RRVL) and RCPL. The boards of directors of these companies on April 25 2025 passed a resolution to transfer the FMCG Brands Business Undertaking from RRL to RRVL. Reliance Industries Ltd the parent entity holds 83.56 per cent in RRVL while other investors hold 16.44 per cent. NCLT directed that a meeting of the unsecured creditors of RRL RRVL and RCPL be convened and held within 70 days from the date of the order being uploaded on its website for the purpose of considering and approving the Scheme. RRVL primarily carries on the business of supply chain and logistics management for the retail business of Reliance while RCPL is engaged in manufacturing distribution selling and marketing of multiple products under the FMCG category and investments in subsidiaries and joint ventures engaged in the FMCG category retail business. Reliance Following Path Of Tata Birla Vedanta Reliance is not the first Indian company to list separate businesses as distinct entities to unlock their true value. Earlier companies like Tata Motors Aditya Birla Fashion and Retail Quess Corp Siemens Raymond Vedanta and ITC have also adopted similar strategies. Take Siemens for instance last month Siemens Energy India which was demerged from Siemens was valued at over Rs 1 lakh crore. Post-listing the combined valuation of the two companies surged to Rs 2.14 lakh crore compared to just Rs 1 lakh crore before the separation. (With Inputs From PTI)

-

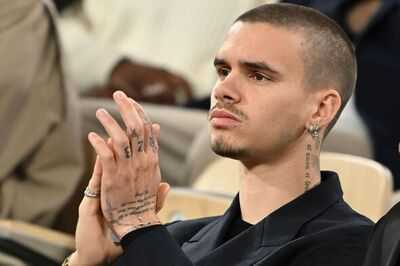

Diogo Jota made phone call hours before tragic crash that killed him and his brother

-

Cleaning expert shares unlikely product that 'will remove almost any stains' from carpets

-

Horror A-52 road Diogo Jota died on branded 'most dangerous highway' with frequent crashes

-

'I kept smelling things that were not real - now I am fighting for my life'

-

Romeo Beckham says 'life's too short' in message to Brooklyn after Diogo Jota death