Income Tax: It is mandatory for every citizen in India to pay income tax on their income, which is paid every year. This year, the last date for filing the Income Tax Return (ITR) is 15 September 2025. If you are also filing ITR this year, then it is important to know that some types of income are not taxed. Today, in this news, we are telling you about some such income on which you do not have to pay tax.

Income from farming-

There is no income tax on income from farming in India. Under the Income Tax Act, 1961, income derived from agriculture is excluded from the tax purview. Its main objective is to provide assistance to farmers and promote the agricultural sector. This exemption applies only to income directly derived from agricultural activities, not to income from trading or processing of agricultural products.

Income from savings account-

In a savings account, income is earned through interest. If you are earning less than Rs 10,000 from interest on your savings account, then you will not have to pay any tax. On the other hand, if you have two accounts and you are earning Rs 10,000 from one and Rs 5000 from the other, then your earnings of Rs 5000 will be taxable.

Senior Citizen Saving Scheme-

There is no tax on the principal amount invested from the Senior Citizen Saving Scheme. On the other hand, you will have to pay tax on the interest earned.

PF Account Balance-

The amount deposited in the PF account is exempted under Section 80C of the Income Tax Act. The only condition is that this amount should not exceed 12 percent of the basic salary.

Gratuity-

Government employees do not have to pay any kind of income tax on gratuity. There is no tax on gratuity amount up to Rs 20 lakh. For private employees, this limit is Rs 10 lakh.

Scholarship and awards-

Whenever a student gets a scholarship or an award, there is no income tax on it.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Mukesh Ambani big gift for middle class Indians! Bring old clothes and…, know details here

-

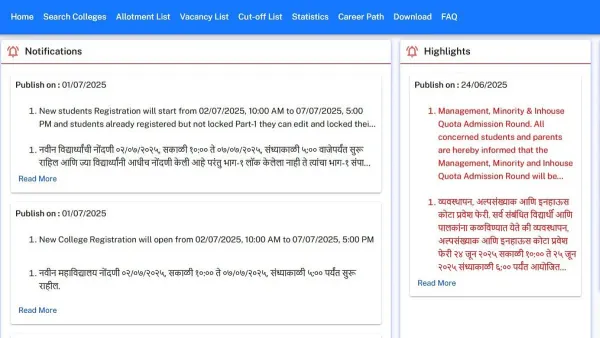

Maharashtra FYJC Admission 2025: Round 1 Admission Deadline Ends Today

-

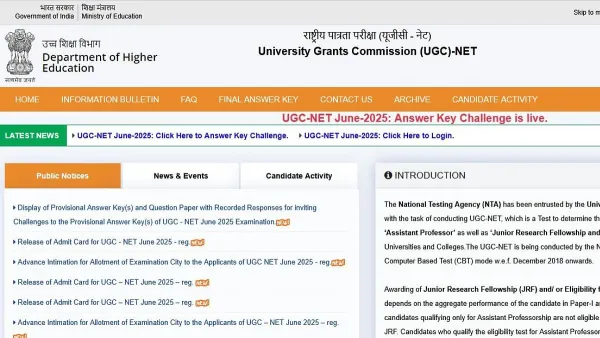

UGC NET 2025: Answer Key Objection Window Closes Tomorrow, Results Expected Soon

-

AIIMS Paramedical Admit Card 2025 Expected To Be Released Today At aiimsexams.ac.in; Here's How To Download

-

Ranbir Kapoor Becomes Highest Paid In Ramayana Cast With ₹150 Crore Deal For Parts 1 & 2, Sai Pallavi To Earn ₹12 Crore As Sita