Gold selling rules: Gold is becoming a special means of investment nowadays. In the last few years, gold has given tremendous returns to people. Many people, after purchasing gold, keep it with them for some time and then sell it. Tax (Tax Rules on Gold) also has to be paid on the sale of gold done in this way. Most people are unaware of this. Let us know what the rules of the Income Tax Department are for paying tax on selling gold.

Tax is levied on this type of gold-

If you sell gold jewelry, coins, biscuits, etc., then you will have to pay tax on it (tax on gold selling). On selling it, the seller of gold has to pay tax according to short-term capital gain and long-term capital gain. Short and long term means keeping the gold with you for a fixed time.

Rules on selling gold according to the time limit-

When you buy gold, the date is also written on its bill. After this, if you sell the gold before 2 years, then tax is levied on it as per short-term capital gain, which is added to the total income and is decided as per the tax slab. If you sell gold after 2 years, then tax will have to be paid as per long-term capital gain. If the profit is less than Rs 1.25 lakh, then no tax is levied, but if the profit is more than this, then 12.5 percent tax (Tax On Gold) has to be paid. The rule of 4 percent cess is also applicable to this.

Tax is levied on the profit made from the sale of gold-

Tax on gold (tax rules on gold selling) does not mean that tax will be levied on the price of gold, but tax is levied on the profit made from selling gold. This profit is added to the annual income. After this, the rule of tax (Income Tax rules for Gold) applies. To pay tax, you can choose any of the new or old tax regimes.

Limit of keeping gold at home -

According to the rules of the Central Board of Direct Taxes and the Income Tax Department, the limit of keeping gold at home has also been fixed. A man can keep 100 grams, a married woman can keep 500 grams, and an unmarried girl can keep 250 grams of gold (gold limit at home) at home. If more gold is found than this, the income tax department can confiscate it. Only if the documents, proof, and source of income are known you can avoid action.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Another Military Coup In Pakistan? Army Chief Asim Munir Likely To Become New President Replacing Asif Ali Zardari: Reports

-

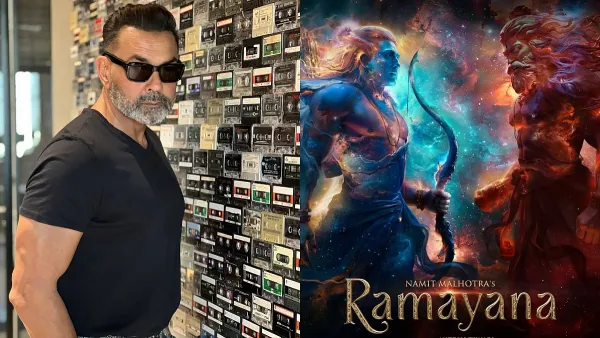

Is Bobby Deol Playing The Role Of Kumbhakarna In Ranbir Kapoor Starrer Ramayana? Here's The Truth

-

AP: Chandrababu Naidu for zero crime-rate through technology

-

Train withdrawal affects Metro Line 1; stampede-like situation at Ghatkopar stn

-

Waqf Act will be scrapped in one hour if Congress comes to power: MP Imran