HM Revenue and Customs (HMRC) has issued a stern warning to cryptocurrency users, cautioning that failure to disclose necessary information could result in £300 fines. Starting from January next year, UK crypto holders will be required to share personal details with their crypto service providers or face financial penalties, HMRC officials announced today.

This move is part of HMRC's intensified efforts to clamp down on tax evasion related to cryptocurrency profits. From January 2026, individuals holding cryptocurrencies such as Bitcoin, Ethereum, or Dogecoin will need to provide personal information to all crypto service providers they utilise, ensuring accurate tax payments.

Non-compliance could lead to a£300 fine imposed by HMRC. Once the data is collected from service providers, HMRC will be able to identify those who have not been accurately paying tax on their cryptocurrency earnings - funds which contribute towards essential public services like nursing, policing, and education.

READ MORE: 'I went to Wimbledon and was floored by price of strawberries and cream'

READ MORE: DWP confirms future of Blue Badges and free bus travel after new PIP changes

The initiative is projected to generate up to £315 million in tax revenue by April 2030 - an amount officials say is equivalent to the annual salary of over 10,000 newly-qualified nurses. This forms part of a broader HMRC campaign to address non-compliance, including the small fraction of individuals intentionally evading tax on their cryptocurrency profits.

Crypto service providers will commence data collection on user activities from January 2026. Any provider failing to report this information, or submitting inaccurate or incomplete reports, could also face a penalty of up to £300 per user from HMRC.

The new regulations require crypto service providers to gather and report:"By ensuring everyone pays their fair share, the new crypto reporting rules will make sure tax dodgers have nowhere to hide, helping raise the revenue needed to fund our nurses, police and other vital public services." Jonathan Athow, HMRC's Director General for Customer Strategy and Tax Design, said: "Importantly, this isn't a new tax - if you make a profit when you sell, swap or transfer your crypto, tax may already be due. ""These new reporting requirements will give us the information to help people get their tax affairs right.

"I urge all cryptoasset users to check the details you will need to give your provider. Taking action now and having this information to hand will help you avoid penalties in the future."

The fresh regulations - dubbed the Cryptoasset Reporting Framework - will assist HMRC in pinpointing individuals liable for tax on their cryptocurrency dealings.

They will also align the UK with international standards established by the Organisation for Economic Co-operation and Development (OECD), allowing tax authorities to exchange information between participating nations.

Cryptocurrency holders should already declare any crypto profits or earnings on their Self Assessment tax returns.

HMRC has introduced new specialised sections to the capital gains pages to be filled out from the 2024 to 2025 tax year onwards. Capital Gains Tax may be applicable when selling or exchanging crypto, while Income Tax and National Insurance could apply to crypto received from employment, mining, staking or lending activities.

Those uncertain about their tax obligations can verify if they need to pay tax when they receive or sell crypto on gov.uk. They can also inform HMRC about unpaid tax on crypto using the cryptoasset disclosure service.

For further information, visit theGov website here.

-

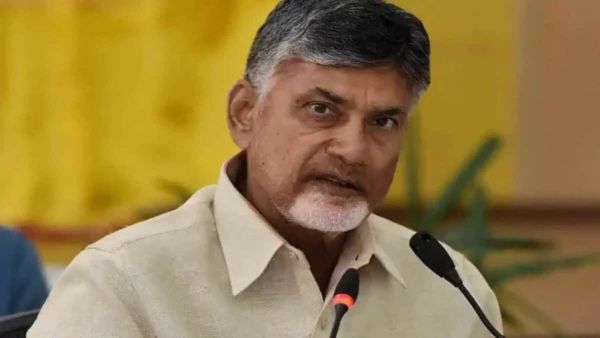

AP: Chandrababu Naidu for zero crime-rate through technology

-

Train withdrawal affects Metro Line 1; stampede-like situation at Ghatkopar stn

-

Waqf Act will be scrapped in one hour if Congress comes to power: MP Imran

-

HYDRAA demolishes wall obstructing commute of 25,000 people in Hyderabad

-

Rachel Reeves scrambling to fill hole in public finances after U-turns