Once a rising star in India’s non-banking finance company (NBFC) space, Kinara Capital has suffered a blow. For the first time in the last 10 years, the company recorded a loss in the fiscal year 2024-25 (FY25) due to rise in bad loans, increase in credit cost and decline in AUM.

Last month, credit rating agencies India Ratings and Care Ratings downgraded their respective ratings for Kinara Capital, citing concerns over its financial stability.

As per India Ratings, the Bengaluru-based NBFC faced challenges in recovering unsecured loans and also breached some of its financial covenants with its lenders in FY25. This resulted in a rise in its credit cost, which impacted the lender’s bottom line.

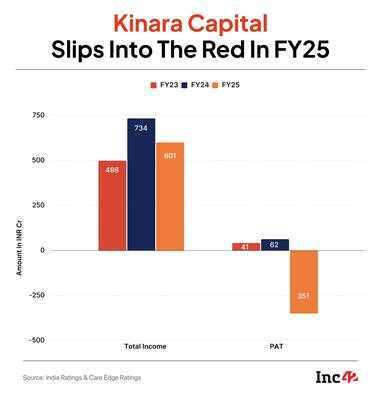

According to the company’s standalone statements, Kinara Capital recorded a net loss of INR 351 Cr in FY25 against a profit of INR 62 Cr in the previous fiscal year. Meanwhile, the rating agencies have advised Kinara Capital to raise more funds through debt or equity and look for alternate revenue channels to boost its top line.

So, how exactly did Kinara Capital reach here? We will come to it, but let’s first take a brief look at the NBFC’s history.

Kinara Capital’s Initial DaysThe struggles of medium and small size enterprises (MSMEs) of the country to raise capital is widely known. Many banking institutions prefer not to extend loans to small businesses due to lack of comprehensive financial records or credit scores, paucity of sufficient collateral, and small scale requirements.

But Hardika Shah had a different idea. She acquired Kinara Capital in 2011 and wanted to change the notion around extending debt to MSMEs. She established Kinara Capital with an eye on disbursing loans to the credit-starved small businesses and disrupting the NBFC ecosystem.

The NBFC, which provides collateral-free loans, uses a mix of online and offline strategy to serve its customers. Almost 90% of its customers come from its 125 offline branches spread across 100+ cities in six states, including Tamil Nadu, Karnataka, Maharashtra, Andhra Pradesh, Telangana and Gujarat.

Kinara Capital’s end-to-end digital platform, which is capable of handling functions like lead generation, customer screening, underwriting, disbursement, and collections, caters to the online-savvy customers. At the heart of its tech stack lies its automated loan decision system to determine loan approval, amount, tenure, and risk-adjusted interest rates.

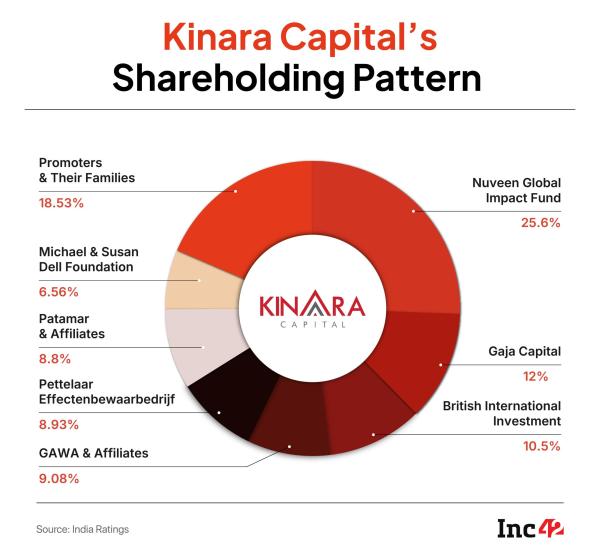

Kinara Capital is backed by the likes of Nuveen Global Impact Fund, Gaja Capital, British International Investment, GAWA and affiliates, Pettelaar Effectenbewaarbedrijf, Patamar and affiliates and Michael & Susan Dell Foundation.

How Kinara Capital FalteredKinara Capital tasted profitability for the first time in FY15. Thereafter, it consistently reported profits for the next nine years. However, the NBFC was hit by a rise in write-offs over the last few years.

In FY25, its write-offs zoomed 177% to INR 341 Cr from INR 123 Cr in the previous fiscal year. The write-offs stood at INR 74 Cr and INR 31 Cr in FY23 and FY22, respectively.

“As of March 31, 2025, the company’s gross non-performing assets (GNPA) and net NPA (NNPA) remain elevated at 7.4% and 4.8%, respectively, compared to 9.4% and 2.3% as of December 31, 2024,” Care Ratings said.

However, it said that the improvement in GNPA was because of sale of stressed assets worth INR 478 Cr to an asset reconstruction company. Of these, INR 276 Cr pertained to NPA accounts.

The reason for the decline in Kinara Capital’s asset quality was sector-specific stress, increased customer overleveraging, and an industry-wide shift towards higher ticket sizes and longer-tenure loans.

In a statement, Kinara Capital also told Inc42 that it was impacted by the industry headwinds due to changes to the regulatory framework of unsecured lending and macroeconomic conditions impacting collections.

Due to the mounting technical write-offs, Kinara’s cost on credit shot up to 14.5% in FY25 from 7.1% in the previous year. The rise in bad loans also led to the company taking a cautious approach in disbursing loans, which resulted in its AUM contracting 9.6% to INR 2,841 Cr at the end of FY25 from INR 3,142 Cr a year ago.

As a result, Kinara Capital’s total income dwindled by 18% to INR 601 Cr in FY25 from INR 734 Cr in the previous fiscal year. This fall in revenue, along with write-offs, losses on sale of distressed assets to ARC, and rising cost of capital, resulted in the NBFC slipping into the red in FY25.

In its note, India Ratings opined that profitability would remain under pressure in the near term for Kinara Capital. On similar lines, Care Ratings said that the lender’s profitability will remain moderate unless it explores alternate channels for revenue generation in the ongoing financial year.

But difficulties for Kinara Capital do not end here. Apart from the losses, the company might also face pressure from its lenders.

Kinara Capital’s Debt ObligationsAccording to India Ratings, Kinara Capital was in “continued breach” of 91.07% of financial covenants in respect of the borrowings totalling INR 1,850 Cr as a result of the fall in profitability and asset quality.

This means that the company would have to repay this amount whenever lenders demand. “Despite the management’s efforts, waivers have been secured for only 4% of the affected debt, leaving a substantial 87% of the borrowings in breach without lender forbearance,” the ratings agency said.

It added that while Kinara Capital’s liquidity position remains adequate, its sustainability is contingent upon timely resolution of covenant breaches and successful negotiation of further waivers. Failure to do so could exert significant pressure on the liquidity profile and overall financial stability.

However, Kinara Capital, in its statement, said that it has met all of its payment obligations in relation to the borrowed debt and continues to do so.

Nevertheless, the NBFC will need to raise fresh funds to get out of this precarious situation.

Kinara Capital To Raise Fresh FundingThe company managed to raise an equity funding of about INR 51 Cr (around $6 Mn) in Q3 FY25. It said that it raised additional capital from its existing investors in December 2024.

Its spokesperson said that the lender has engaged an investment banker to raise fresh funds.

“Currently, we have engaged an investment banker to support us in raising equity in the range of INR 200-300 Cr,” the spokesperson said.

The company said it aims to raise new funds to expand its disbursement capacity through a balanced mix of secured and unsecured loans, which would be delivered via on-ground field sales teams and strategic partnerships.

Going ahead, it also plans to partner with other banking institutions to expand its reach.

“While fundraising efforts are in progress, we are also actively exploring business correspondent (BC) partnerships to enable other institutions to drive MSME financial inclusion by leveraging Kinara’s robust branch network and last-mile distribution capabilities,” the spokesperson added.

However, the company declined to name the investment banker engaged by it or the investors it is in discussions with for the fundraise.

While Kinara Capital is facing the same situation which a number of other MSME-focussed lenders have faced in the past, the company’s liquidity position remains adequate. As of March 31, 2025, its cash and bank balance stood at INR 493 Cr. As such, fresh funding can provide much needed ammunition to the NBFC to march ahead on its mission to empower MSMEs.

The post From Profits To Peril: How Kinara Capital Lost Its Mojo appeared first on Inc42 Media.

-

Brits urged to stock up on medicine, bottled water and tinned food

-

Yorkshire water announces hosepipe ban after hot weather - full list of banned activities

-

Gogglebox star dies after heartbreaking dementia battle

-

Grigor Dimitrov's exact injury diagnosis emerges as Wimbledon hero gets silver lining

-

Wimbledon star gets 'revenge' on her coach after causing a scene at match