South Korean authorities will implement a one-strike-out rule targeting illegal stock trading and establish a joint inspection team that will enable not only real-time monitoring but also the swift investigation of suspected cases when necessary, officials said on Wednesday.

They are part of comprehensive measures announced jointly by the Financial Services Commission (FSC), the Financial Supervisory Service (FSS) and the Korea Exchange (KRX) to tackle illegal stock transactions, which, in turn, will boost the appeal of the local stock market to offshore investors.

We will enforce a one-strike-out policy against unfair trading practices, such as stock price manipulation, by effectively recovering illegal profits and permanently removing perpetrators from the capital market," the FSS said in a release, reports Yonhap news agency.

Under the new enforcement scheme, the financial authorities will promptly initiate payment suspension procedures when accounts used for illegal activities are identified during the investigation stage, in order to prevent suspects from transferring illicit profits.

Those caught for illegal activities will face fines of up to twice the amount of their unjust gains.

The bold moves come after President Lee Jae Myung called for market reform measures.

Since Lee's election victory last month, the benchmark Korea Composite Stock Price Index (KOSPI) has rallied amid hopes for political stability and market-friendly policies.

On June 20, the index surpassed the 3,000-point mark for the first time in more than three years and has since hovered around the 3,100 level. On Tuesday, it closed at 3,114.95.

The new president has vowed efforts to usher in a KOSPI 5,000 era.

To this end, the three agencies will establish a joint task force at the KRX to enhance the initial response capabilities of the Market Surveillance Committee.

Currently, responsibilities for responding to unfair trading are fragmented across several institutions, leading to delays in effective enforcement. The new task force is expected to respond more swiftly to cases involving large shareholders, corporate executives, false disclosures and other suspicious trading activities, officials said.

The government also plans to revise relevant regulations to enable authorities to conduct market surveillance based on individuals rather than accounts.

The current account-based system results in excessive monitoring and makes it difficult to detect links between accounts held by the same individual. The new approach is expected to reduce the number of subjects under analysis by approximately 39 percent, significantly improving efficiency, according to the officials.

The authorities also decided to strengthen listing maintenance requirements and streamline the delisting process for underperforming companies.

Last week, the National Assembly passed a revision to the Commercial Act, which calls for expanding corporate directors' fiduciary duty to shareholders to better protect the rights of minority shareholders.

(This report has been published as part of auto generated syndicate wire feed.Apart from the headline,no editing has been done in the copy by ABP Live.)

-

Sardaar Ji 3 Box Office Collection: Diljit Dosanjh-Hania Aamir Starrer Becomes The Highest-Grossing Punjabi Film Of 2025, Despite Not Releasing In India

-

Toddler Dies After Mother Leaves Him Inside Car To Get Lip Filler At Spa In US's California

-

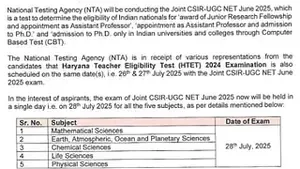

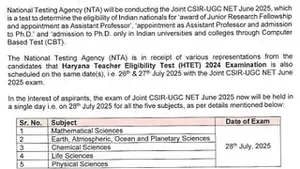

CSIR UGC NET June 2025 Exam Rescheduled Due To HTET 2024 Date Clash; Check New Dates Here

-

CSIR UGC NET June 2025 Exam Rescheduled Due To HTET 2024 Date Clash; Check New Dates Here

-

RRB NTPC UG: Application status of Railway NTPC UG recruitment released, check this way whether the form is accepted or rejected..