The Western India Regional Council of the Institute of Company Secretaries of India (WIRC of ICSI), in collaboration with the Directorate General of Taxpayer Services (DGTS), Mumbai Zonal Unit, organized a pioneering seminar on the theme “GST@8 – Journey So Far, Reflecting on Achievements & Navigating Future Outlook” to mark GST Day. The event was held at Bajaj Bhavan, Mumbai.

The program was inaugurated by Sumit Kumar, Principal Additional Director General, DGTS – Mumbai Zonal Unit, who also delivered the keynote address. Kumar highlighted key milestones in India’s GST journey and underscored the pivotal role of Company Secretaries in ensuring compliance and governance. He encouraged professionals to deepen their understanding of GST and explore it as a promising area of practice.

CS Praveen Soni, Council Member, the ICSI and CS Hrishikesh Wagh, Chairman, WIRC of the ICSI, addressed the participants and emphasized on the increasing relevance of GST in the professional landscape of Company Secretaries. They reaffirmed WIRC’s commitment to supporting members and students in exploring emerging areas of practice, including GST.

A technical session on “GST – Governance, Simplification and Transparency: Role of Company Secretaries” was delivered by CA Payal (Prerana) R. Shah, Director, GSC Intime Services Pvt. Ltd., who elaborated on the recent updates effective from 1st July 2025 and provided practical insights on simplifying GST processes.

The event witnessed the presence of CS Yogesh Choudhary, Secretary, WIRC of The ICSI and CS Sanjay Patare, Treasurer, WIRC of the ICSI. Key Officers from DGTS, Dr. Pradeep Jhajharia, Pawan Agrawal, Praveen Shekhar, Rakesh Santosh, Bhaskar Shetty, and Ms. Aditi Jaiswal, also participated in the program.

The seminar was a meaningful platform for dialogue and collaboration between the professional community and tax administration, focusing on transparency, simplification, and good governance in GST.

-

Vadodara's Gambhira Bridge Was 'Unfit For Use': Did Officials Ignore 2022 Warnings?

-

Wimbledon 2025: Suryakumar Yadav’s Dapper White Suit Steals Spotlight, Poses With Wife Devisha At Centre Court

-

Who Is Sheikha Mahra? Know About 31-Year-Old Dubai Princess Rumoured To Be Dating Rapper French Montana A Year After Divorce

-

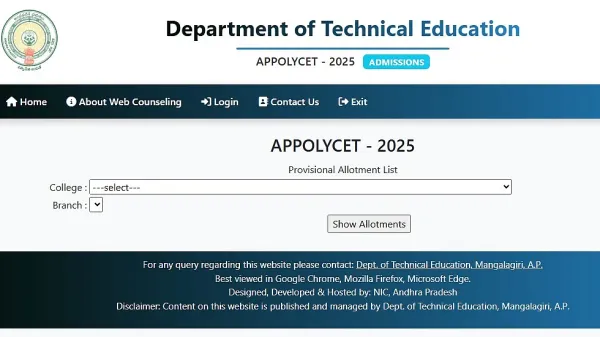

AP POLYCET 2025 Seat Allotment Results OUT At polycet.ap.gov.in; Direct Link Here

-

NEST 2025 Exam Result To Be Out Today At nestexam.in; Here's How To Download