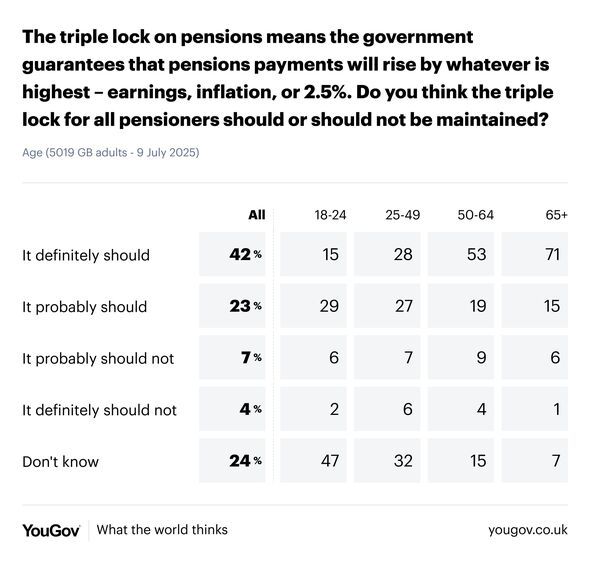

A new poll by YouGov has found that a supermajority of the British public support keeping the pensions triple lock, a day after the Office for Budget Responsibility warned it is set to become unaffordable. A whopping 65% of Britons polled said the mechanism for uprating the state pension should be maintained, compared to just 11% who said it should be scrapped.

Each person polled was informed that the triple lock sees pension payments rise by earnings, inflation, or 2.5% each year, whichever is highest. 42% said it "definitely" should be maintained, with 23% saying it "probably" should. Support for the triple lock remained solid across the ages, with 44% of 18-24 year olds saying it should be kept, compared to just 8% opposed. 47% of young voters said they didn't know.

By contrast 71% of those aged 65+ said the support "definitely should" be maintained, compared to just 7% opposed.

The survey comes just one day after the Office for Budget Responsibility warned that the policy is on course to cost three times the amount predicted when first introduced 13 years ago by the Tories.

A report by the OBR looking at the UK economy's level of risk found that the triple lock will cost £15.5 billion by the end of the decade.

This is in contrast to a forecast £5.2 billion when created by George Osborne.

It further reported that the cost of the state pension as a whole has shot up since the 1950s, when it cost around 2% of GDP. It is set to rise to 7.7% of GDP by the 2070s.

It concludes that due to an ageing population and the rising cost of healthcare, Britain's debt-to-GDP ratio is set to hit 270% by the early 2070s, up from around 94% today.

Of 36 advanced economies measured in the report, the OBR says the UK already has the sixth-highest debt, the fifth-highest deficit, and the third-highest borrowing costs.

The report was criticised by pensioners' group Silver Voices, who said: "The OBR attack on the state pension and the Triple Lock is unjustified and is picking out older people as the scapegoats of the current financial mess."

Director Dennis Reed told the Express: "It is inducing panic amongst older people that their vital safeguards against rising prices will be swept away in the near future. It is using a projection up to the early 2070s, to mount an attack on the state pension today.

"Even at that stage, with no changes to the Triple Lock, the cost of the state pension will be at 7.7% of the national economy, much less than the investment in seniors made by France (12%) and Germany (9.8%) today!

"I suspect that the Government has encouraged this unsustainability fallacy from the OBR to try to soften up the public for forthcoming attacks on our state pension system.

"This cost is large but there are over 12 million older people who need support to retire in dignity

-

'Wannabe American': Priyanka Chopra TROLLED For Choosing Hot Dog Over Vada Pav; Indian Fans Call Her 'Pardesi Girl'

-

Pune Crime: Chilling Video Shows Female Journalist Crying For Help As Mob Attacks Her While Reporting

-

US visa fees to increase with new charges from 2026

-

The Most Important Person Behind Indian-American Billionaire Jay Chaudhry: Meet Jyoti, The Wife Of Zscaler's CEO

-

The Most Important Person Behind Indian-American Billionaire Jay Chaudhry: Meet Jyoti, The Wife Of Zscaler's CEO