Luggage and travel accessories company VIP Industries is set to be sold after 54 years of operations. The company which has a presence in 45 countries and a market capitalization nearing Rs 7000 crore holds a commanding 50% share in India’s branded luggage market. The move will also trigger an open offer to acquire 26 per cent share from the open market as per the SEBI Takeover Regulations by Multiples consortium. Dilip Piramal and Family has entered into a “definitive agreement with the Multiples Consortium to sell up to 32 per cent stake in the Company” according to a joint statement issued by both the companies. “Upon completion of the transaction control of the company will be transferred to Multiples Private Equity while Dilip Piramal and Family will continue to be shareholders in the Company” the statement said. Dilip Piramal will be Chairman Emeritus of VIP Industries it added. Open Offer At Rs 388 per Share Later the VIP Industries also updated the exchanges about the open offer from the Multiples consortium to acquire 3.70 crore shares of the company from its public shareholders. “The Open Offer is made at a price of Rs 388/- per Offer Share which has been determined in accordance with Regulations 8(2) of the SEBI (SAST) Regulations” it said. Assuming full acceptance of the Open Offer the total consideration payable by Multiples will be Rs 1437.78 crore. The open offer price is around 15 per cent lower than the closing price of VIP Industries on BSE on Friday which was at Rs 456.40. In the last one year share prices of VIP Industries’ highest trading price was on September 24 2024 at Rs 580.6 and lowest on April 9 2025 at Rs 259.7. As on March 2025 the promoter and promoter entity were holding 51.73 per cent shareholding in VIP Industries. “The transaction including the open offer is subject to approval of the Competition Commission of India and will be in accordance with the SEBI Takeover Regulations” the joint statement added. VIP Chairman Dilip Piramal On Sale Commenting on the development VIP Chairman Dilip Piramal welcomed Multiples consortium as ‘strategic partners’ in the Company. “This marks an important step toward reviving the company’s strong legacy and helping it regain its foothold in the Indian luggage market where it has struggled in recent years” he said. Renuka Ramnath Founder MD and CEO of Multiples Alternate Asset Management said:” Multiples is excited to lead the ownership transition of the very strong legacy business of VIP and further build on its rich heritage and unlock its next phase of growth.” VIP Industries which has a market capitalization of Rs 6481.78 crore competes with Samsonite and Safari Industries in the premium and mass segment. The company which owns brands such as Aristocrat VIP Carlton Skybags and Caprese had over 50 per cent market share in the branded luggage market in FY24. However now the company is facing stiff competition from rivals and its market share is gradually reducing. For the financial year ended on March 31 2025 VIP Industries’ revenue was at Rs 2169.66 crore. It has over 10000 Points of Sale in 45 countries. Multiples is an Alternate Asset Management company backed over 30 enterprises. It focuses on core sectors of financial services pharma & healthcare consumer and technology and more recently the green economy. (With Inputs From PTI)

-

Manisha Koirala Receives Honorary Doctorate by University of Bradford

-

Who is this 23-year-old actor set to make her Bollywood debut opposite Ajay Devgn? She was once a child artist, her name is…

-

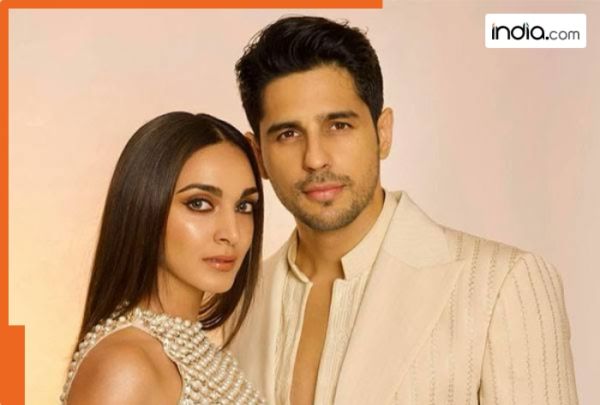

Kiara Advani and Sidharth Malhotra blessed with a baby girl

-

After Rs. 800 Crore salary to Trapit Bansal, now Mark Zuckerberg gives Rs 16000000000 to…, compete in race with Apple, OpenAI and…

-

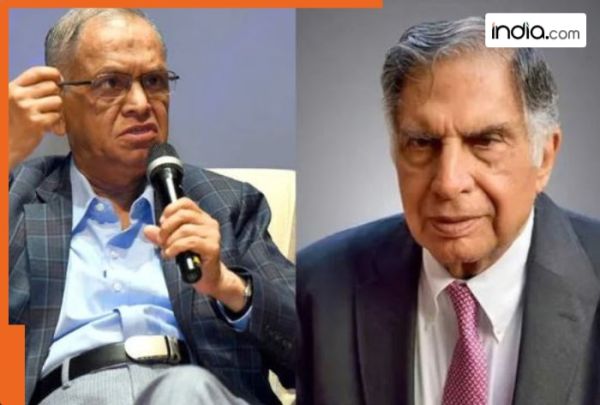

After laying off 500, this tech giant is to sack thousands of employees, not Ratan Tata’s TCS or Narayana Murthy’s Infosys, it is…