Post Office Senior Citizen Savings Scheme: The biggest concern with retirement is that a fixed salary stops coming every month. In such a situation, what if you get such a means of investment, where you keep getting a fixed income every month after retirement? In such a situation, the Senior Citizen Savings Scheme (SCSS) of the Post Office is a great option for you. Along with a safe investment in this government scheme, you can also get a guaranteed interest of ₹ 20,500 every month. Let's know how?

The name of this scheme is Senior Citizen Savings Scheme (SCSS). It is specially made for the elderly, in which not only you get more interest than bank FD, but your money is also 100% safe.

SCSS is a small savings scheme backed by the Government of India, specially designed for citizens above the age of 60 years. This is a deposit scheme in which you deposit a lump sum amount for 5 years and the government gives you guaranteed interest on it every three months.

Among most of the safe investment options available for senior citizens, SCSS is one of the highest interest paying schemes. Its interest rate of 8.2% is usually much higher than the 5-year fixed deposit (FD) of the big banks of the country. Once you invest money in it, the interest rate at that time is locked for the entire 5 years. Even if the interest rates are reduced in the future, you will continue to get interest at the same high rate for 5 years.

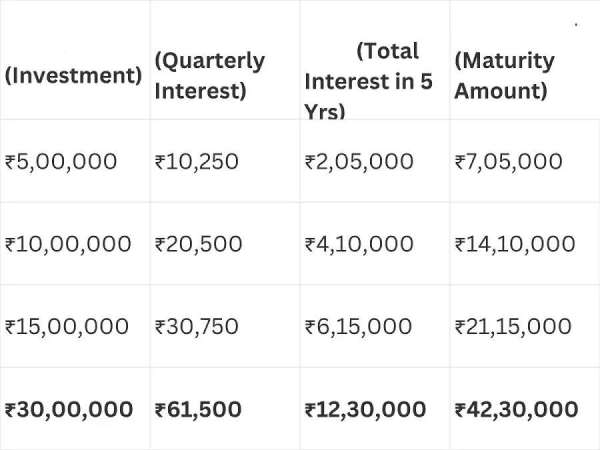

An investment of Rs 1 thousand to Rs 3 lakh can be made in this scheme, let us understand it with a simple calculation. If a senior citizen invests the maximum limit i.e. ₹30,00,000 in this scheme, then he will get a total of ₹2,46,000 (20,500 per month) at an annual interest rate of 8.2%. In this case, the total interest for 5 years will be ₹2,46,000 x 5 = ₹12,30,000. In this way, on maturity after 5 years, you will get back ₹42,30,000 by combining your investment (₹30 lakhs) and total interest (₹12.30 lakhs).

Understand how much return on how much investment

Any person who is 60 years of age or above can invest in it. On the other hand, civil sector government employees taking VRS and people retiring from defense are given relaxation in age limit with some conditions. Investing in SCSS provides tax exemption of up to ₹1.5 lakh under Section 80C of the Income Tax Act. Keep in mind that the interest earned from this scheme is taxable. TDS is deducted if the interest amount in a financial year exceeds ₹1,00,000. It can be extended within 1 year of maturity. The extended account receives interest at the rate applicable on the date of maturity.

-

Like father, like son: Thiago Messi is preparing to step into his father’s boots

-

India always stood by its regional partners as first responder during crisis: MEA

-

Uttarakhand govt to introduce Gita, Ramayana in school curriculum

-

Hindus stage protest over conversion of minor girls in Pakistan’s Sindh

-

Telangana, AP to form expert panel to resolve irrigation disputes