Jiraaf, an online bond investment platform, provides critical insights into this evolving asset class, which is now increasingly favored by both institutional and retail investors.

Once largely dominated by government and PSU issuances, India’s bond market is undergoing a significant transformation.

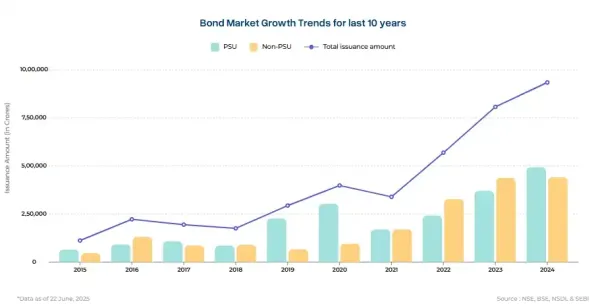

India's bond market is experiencing substantial growth, driven by increased private sector involvement and investor demand for stable returns. Jiraaf Bond Analyser data reveals a decade-long expansion, accelerating post-2020. In 2024, listed bond issuances surpassed ₹9.5 lakh crore. Non-PSU issuances exceeded PSU issuances for the first time, indicating improved private sector credit profiles and investor confidence.

Driven by rising private sector participation and increasing investor appetite for stable, fixed-income products, the market is expanding at an unprecedented pace.

Data from the Jiraaf Bond Analyser—part of the online bond investment platform Jiraaf, founded by Saurav Ghosh and Vineet Agrawal—shows that India’s debt capital market is no longer just an institutional playground, but an evolving opportunity for retail investors as well.

A decade of growth, with acceleration post-2020

Over the last decade, India’s bond market has expanded at a CAGR of around 25%, with growth accelerating over the past four years as both corporate and public sector issuers increasingly turned to debt markets to meet their funding needs.

In 2024 alone, listed bond issuances crossed Rs 9.5 lakh crore (US$110 billion), signaling growing depth and liquidity in India’s debt markets.

A key inflection point was the post-COVID era, particularly after 2021. The global search for yield—combined with abundant liquidity and ultra-low interest rates—encouraged both institutional and high-net-worth investors to seek alternative, stable investment avenues.

Indian corporates, especially in the private sector, capitalized on this shift to diversify their funding sources.

Private players overtake PSUs in bond issuances

What’s particularly noteworthy is the changing market composition. Traditionally seen as a space dominated by Public Sector Undertakings (PSUs), India’s bond market is now seeing a surge in private sector activity.

According to Jiraaf data, non-PSU issuances crossed Rs 4.9 lakh crore (US$56 billion) in 2024, surpassing PSU issuances for the first time.

This shift reflects two important trends:

Improved credit profiles of private corporates post-deleveraging and operational efficiency improvements.

Increased confidence among institutional and retail investors in private sector issuers, driven by regulatory reforms and better corporate governance standards.

The move also underscores a structural shift: as India’s economy diversifies and formalises, more companies outside the public sector are now using debt markets for growth capital, refinancing, and working capital needs.

Lessons from the IL&FS crisis and post-pandemic reforms

The IL&FS crisis of 2018 was a watershed moment, exposing over-reliance on concentrated sources of funding like banks and NBFCs. This led to greater awareness around capital diversification. Regulatory reforms post-crisis and proactive steps by the Reserve Bank of India (RBI) have made bond markets more accessible and transparent.

Bonds 101: Why retail investors should care

For individual investors, bonds present a compelling alternative to traditional instruments like fixed deposits or equities.

Simply put, bonds are fixed-income instruments where governments or corporations borrow money from investors, promising regular interest payments and principal repayment at maturity.

Unlike equities, bonds offer:

Predictable income streams through periodic interest payments.

Capital preservation due to predefined maturity.

Lower risk compared to equities, while delivering competitive returns.

Portfolio diversification, acting as a stabilising force during market volatility.

With platforms like Jiraaf simplifying access to bonds, even retail investors can now participate in what was earlier a domain reserved for large institutions.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)