Owen Zidar is Professor of Economics and Public Affairs at Princeton University. Speaking to Srijana Mitra Das, he discusses America’s under-the-radar rich — and growing inequality in Donald Trump’s era:

Q. What is the core of your research?

A. I’m interested in tax policy and inequality. One of the things I’ve been working on recently is a group we call ‘the stealthy wealthy’ — these are private business owners with substantial wealth. There are many more than popular narratives suggest. There’s great focus on the richest 50 people in America — but they’re far outnumbered by these ‘stealthy wealthy’ individuals who are often making a lot of money doing mundane things, like auto dealing, floor mat supply or beverage distribution. We study these people and how they influence society.

Q. What do such groups reflect about contemporary capitalism?

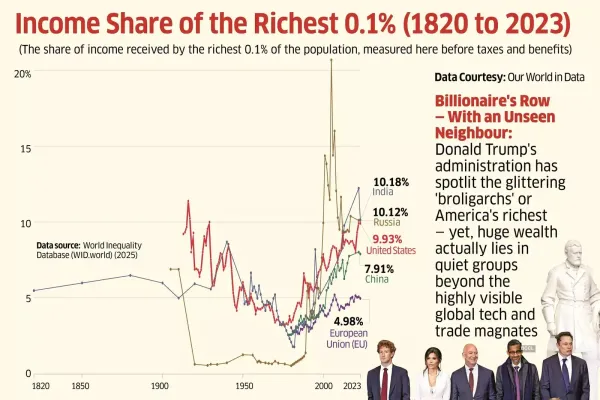

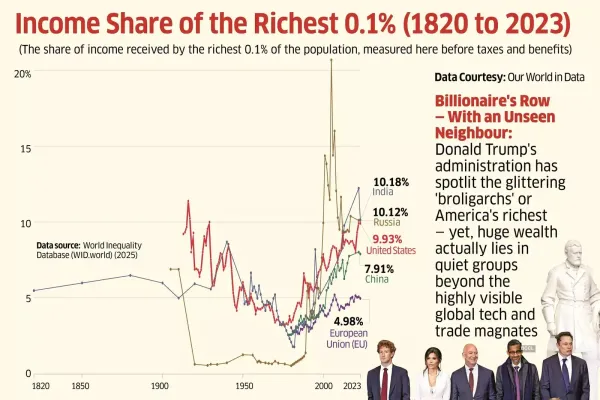

A. Inequality literature outlines an amazing rise in the top 1% share. If you view tax data, like Emmanuel Saez and Thomas Piketty have done, and take, say, all the tax returns and ask what share of income goes to the top 1% of them, that’s been growing quite a bit. An important component of that has been these pass-through businesses.

They don’t face the traditional corporate tax but instead have the profits and losses of their activities passed through to their owners, who pay taxes at the individual level.

Given rising inequality in the 21st century, there are questions about how they generate this income. There’s been a lot of emphasis on capital with Thomas Piketty’s 2013 book. But we think some of this income is better thought of as returns to human capital and labour income because often, it’s the residual payments of a business owner actively participating in their business. They are around the same working age as others and they’re not just passive coupon collectors. They are doctors, auto-dealers or other owner-managers that pay their staffers and then get their residual amount.

Also, the way you value businesses is typically a function of what interest rates are — since the 1980s, we’ve had ‘the great moderation' and lower interest rates following Paul Volcker. That’s increased the value of the stock market and private companies, which have seen a huge jump in wealth.

There are around two million people in the United States with at least 10 million dollars who own a private business — if you ask someone who’s the richest person they knew from high school, the answer often is, ‘It’s the person who cleans air ducts and has 10 local franchises or the person whose family owns a food redistributor.’

There’s a wide range of such businesses with private owners that aren’t in the media’s attention. They’re not necessarily on the coast or in tech or finance. They do routine things but do them well — they get rich slowly and make things, in contrast to Silicon Valley’s ‘Get rich fast and break things’ model.

Q. Will Donald Trump's Big Beautiful Bill now impact them?

A. Yes, these business owners have got huge tax cuts to the order of a trillion dollars over 10 years, just from a special deduction for earning profits through their businesses and increasing the limits for estate tax. This was partially paid for by cutting assistance on food for poor families and health insurance for tens of millions — both these features, the pass-through cuts plus the estate tax, are roughly the same amount as the Medicaid and food stamps or SNAP changes. That’s really unfortunate in a world with rising inequality.

Q. What do you say to a devil’s advocate argument that these tax cuts could enable further investment, jobs and wealth creation?

A. There’s some merit to that general sense. We studied the first Trump tax cuts of 2017 which lowered corporate taxes from 35% to 21% and had investment incentives — we saw positive investment effects from that. This time, however, the corporate rate didn’t change. There are some positive investment incentives but those are quite small while the provisions for pass-through owners are around a trillion dollars-plus. There are other ways to get growth. In general, we spend too much on the elderly and not enough on the young. Putting more investments to the future would be a better way to generate prosperity which is also fiscally responsible because those kids will have better trajectories and generate more income tax than some provisions in the Bill.

Q. How do the Trump tariffs now work into this fiscal picture?

A. Tariffs represent a much smaller tax base because the volume of trade is so much smaller than other big bases of tax, like income. The idea that tariffs can be a material part of how the US makes revenue is just not realistic. Trade flows themselves are small, relative to the size of the US economy. It also doesn’t make sense as a policy matter — so, not only is it not feasible to pay for a lot with tariffs, it’s also not advisable.

Views expressed are personal

Q. What is the core of your research?

A. I’m interested in tax policy and inequality. One of the things I’ve been working on recently is a group we call ‘the stealthy wealthy’ — these are private business owners with substantial wealth. There are many more than popular narratives suggest. There’s great focus on the richest 50 people in America — but they’re far outnumbered by these ‘stealthy wealthy’ individuals who are often making a lot of money doing mundane things, like auto dealing, floor mat supply or beverage distribution. We study these people and how they influence society.

Q. What do such groups reflect about contemporary capitalism?

A. Inequality literature outlines an amazing rise in the top 1% share. If you view tax data, like Emmanuel Saez and Thomas Piketty have done, and take, say, all the tax returns and ask what share of income goes to the top 1% of them, that’s been growing quite a bit. An important component of that has been these pass-through businesses.

They don’t face the traditional corporate tax but instead have the profits and losses of their activities passed through to their owners, who pay taxes at the individual level.

Given rising inequality in the 21st century, there are questions about how they generate this income. There’s been a lot of emphasis on capital with Thomas Piketty’s 2013 book. But we think some of this income is better thought of as returns to human capital and labour income because often, it’s the residual payments of a business owner actively participating in their business. They are around the same working age as others and they’re not just passive coupon collectors. They are doctors, auto-dealers or other owner-managers that pay their staffers and then get their residual amount.

Also, the way you value businesses is typically a function of what interest rates are — since the 1980s, we’ve had ‘the great moderation' and lower interest rates following Paul Volcker. That’s increased the value of the stock market and private companies, which have seen a huge jump in wealth.

There are around two million people in the United States with at least 10 million dollars who own a private business — if you ask someone who’s the richest person they knew from high school, the answer often is, ‘It’s the person who cleans air ducts and has 10 local franchises or the person whose family owns a food redistributor.’

There’s a wide range of such businesses with private owners that aren’t in the media’s attention. They’re not necessarily on the coast or in tech or finance. They do routine things but do them well — they get rich slowly and make things, in contrast to Silicon Valley’s ‘Get rich fast and break things’ model.

Q. Will Donald Trump's Big Beautiful Bill now impact them?

A. Yes, these business owners have got huge tax cuts to the order of a trillion dollars over 10 years, just from a special deduction for earning profits through their businesses and increasing the limits for estate tax. This was partially paid for by cutting assistance on food for poor families and health insurance for tens of millions — both these features, the pass-through cuts plus the estate tax, are roughly the same amount as the Medicaid and food stamps or SNAP changes. That’s really unfortunate in a world with rising inequality.

Q. What do you say to a devil’s advocate argument that these tax cuts could enable further investment, jobs and wealth creation?

A. There’s some merit to that general sense. We studied the first Trump tax cuts of 2017 which lowered corporate taxes from 35% to 21% and had investment incentives — we saw positive investment effects from that. This time, however, the corporate rate didn’t change. There are some positive investment incentives but those are quite small while the provisions for pass-through owners are around a trillion dollars-plus. There are other ways to get growth. In general, we spend too much on the elderly and not enough on the young. Putting more investments to the future would be a better way to generate prosperity which is also fiscally responsible because those kids will have better trajectories and generate more income tax than some provisions in the Bill.

Q. How do the Trump tariffs now work into this fiscal picture?

A. Tariffs represent a much smaller tax base because the volume of trade is so much smaller than other big bases of tax, like income. The idea that tariffs can be a material part of how the US makes revenue is just not realistic. Trade flows themselves are small, relative to the size of the US economy. It also doesn’t make sense as a policy matter — so, not only is it not feasible to pay for a lot with tariffs, it’s also not advisable.

Views expressed are personal