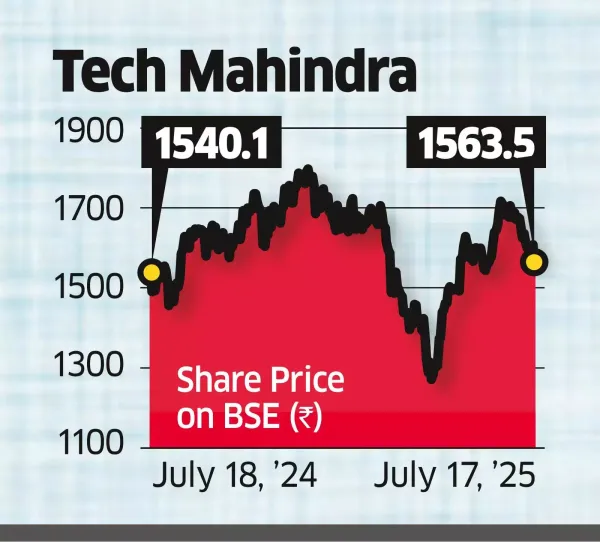

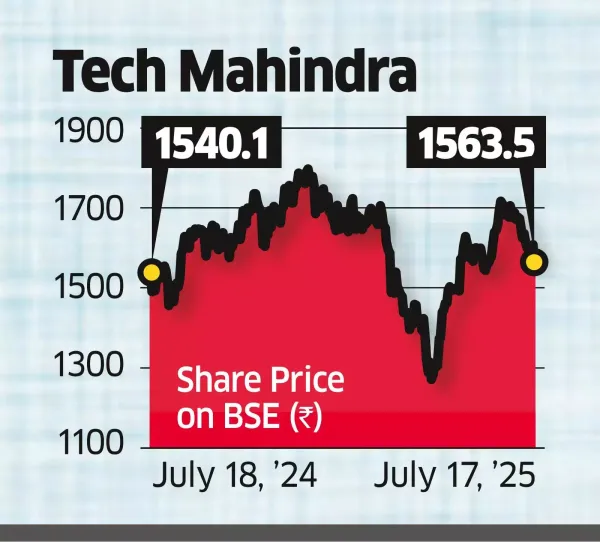

Mumbai: Tech Mahindra dropped 2.7% on Thursday, emerging as the biggest Nifty loser, after the company's first-quarter results fell short of expectations. The stock closed at ₹1,564.2.

Analysts said management expects FY27 revenue growth above peers and a pickup from next quarter, but remain divided over the stock's prospects citing rich valuations. JP Morgan said the stock is at 25 times estimated price to earnings (PE) ratio, which is at a premium to peers and 'bakes in' the margin improvement. The brokerage has a 'neutral' rating on the stock and a target price of ₹1,550, implying a downside potential of 0.9% from Thursday's close.

The Nifty IT Index declined 1.4% on Thursday, while the benchmark Nifty Index moved 0.4% lower on Thursday.

Among the 10 stocks on the Nifty IT Index, all moved lower on Thursday, dragged by LTI Mindtree, which tumbled 3% ahead of its results. Persistent Systems and Infosys shed 1.9% and 1.7%, respectively. Wipro, Mphasis, and Coforge fell around 1.5% each. HSBC said the stock has factored in a large proportion of the turnaround prospects.

"Other than telecom, most of the TechM verticals are around $1 billion size and can grow in the double digits in the long term, which in our view could support premium valuations for the stock," said the brokerage, which has a buy rating on the stock with a price target of ₹1,900.

Analysts said management expects FY27 revenue growth above peers and a pickup from next quarter, but remain divided over the stock's prospects citing rich valuations. JP Morgan said the stock is at 25 times estimated price to earnings (PE) ratio, which is at a premium to peers and 'bakes in' the margin improvement. The brokerage has a 'neutral' rating on the stock and a target price of ₹1,550, implying a downside potential of 0.9% from Thursday's close.

The Nifty IT Index declined 1.4% on Thursday, while the benchmark Nifty Index moved 0.4% lower on Thursday.

Among the 10 stocks on the Nifty IT Index, all moved lower on Thursday, dragged by LTI Mindtree, which tumbled 3% ahead of its results. Persistent Systems and Infosys shed 1.9% and 1.7%, respectively. Wipro, Mphasis, and Coforge fell around 1.5% each. HSBC said the stock has factored in a large proportion of the turnaround prospects.

"Other than telecom, most of the TechM verticals are around $1 billion size and can grow in the double digits in the long term, which in our view could support premium valuations for the stock," said the brokerage, which has a buy rating on the stock with a price target of ₹1,900.