Shares of BSE-listed Tiger Logistics (India) Ltd are in focus today as the company has informed exchanges that it has submitted an application for the direct listing of its securities on the mainboard of the National Stock Exchange of India Limited (NSE). This strategic move listing on Indias largest stock exchange NSE is expected to significantly enhance the companys visibility and market reach. Moreover the listing on NSE is anticipated to attract a wider range of investors including institutional investors thereby potentially boosting the companys growth and value. Heres What Company Said “It (NSE listing) is aimed at enhancing market presence improving share liquidity and increasing visibility among a broader investor base. The listing is expected to bolster investor confidence support value creation for existing shareholders and align with the Company’s long-term objectives of sustainable growth and strengthened corporate governance” Tiger Logistics (India) said in a regulatory filing. Share Price Today Meanwhile shares of the company remained volatile and started the session at Rs 54.35 against the previous close of Rs 55.34 on the BSE. The counter gained from here to reach the intraday high of Rs 54.35 representing a gain of 1.84 per cent from the closing price of the last trading session. This performance is in line with the overall market trend which has seen similar fluctuations in recent days. Stock has been losing for the last two days and has fallen 1.7 per cent in the period. The scrip is currently trading higher than the 100-day moving averages but lower than the 5-day 20-day 50-day and 200-day moving averages. This suggests a short-term bearish trend but a long-term bullish trend indicating potential volatility in the stocks price in the near future. The 52-week high of the stock is Rs 80.44 reached on December 10 2024 and the 52-week low is Rs 31.99 touched on July 23 2024. Share Price History According to BSE Analytics the stock has delivered impressive returns a multibagger return of 1404 per cent in five years and 152 per cent in three years. This strong performance over the years reflects the companys potential. However it has corrected 23.33 per cent on a YTD (year-to-date) basis which is a normal part of the market cycle. Stock Market Today The 30-share BSE Sensex declined 185.67 points to 82073.57 in early trade. The 50-share NSE Nifty dropped 45.4 points to 25066.05. From the Sensex firms Axis Bank tumbled nearly 5 per cent after the firm reported a 3 per cent dip in its June quarter consolidated net profit at Rs 6243.72 crore impacted by the implementation of changes in non-performing assets and loan upgrade policy.

-

The movie is India’s first horror film, earned 10 times more the budget, climax will make you sweat in fear, movie is…, lead actors were…

-

Who is Saiyaara actress Aneet Padda, once worked as extra in Kajol’s movie, now stars as lead in YRF film

-

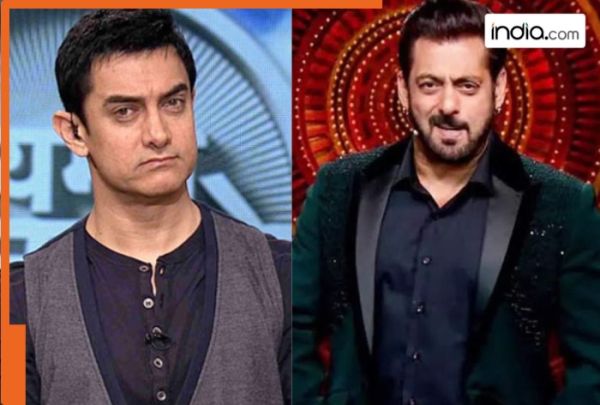

Meet India’s highest paid TV actor, fee is much more than Salman Khan, Aamir Khan, Rupali Ganguly, Kapil Sharma, name is…., fee per episode is Rs…

-

Even Shah Rukh Khan, Salman Khan will be left behind as Ranbir Kapoor’s 5 films are set to make him highest-paid actor, movies are…

-

Tesla Vs BYD: India new battleground! China’s this person to crush Elon Musk’s dream? he has been an expert in…