JioBlackRock Asset Management a 50:50 joint venture between Jio Financial Services and BlackRock has received market regulator Sebis approval to launch five mutual fund schemes. These funds are JioBackRock Nifty 50 index JioBlackRock Nifty 8-13 yr G-Sec Index Fund JioBlackRock Nifty Smallcap 250 Index Fund JioBlackRock Nifty Next 50 Index Fund and JioBlackRock Nifty Midcap 150 Index Fund an update with Sebi showed on Wednesday. Of these five schemes four are equity-oriented index funds while one is a debt-oriented index fund. JioBlackRock Mutual Funds NFO On July 7 JioBlackRock Asset Management announced the closure of its maiden New Fund Offer (NFO) recording a total investment of Rs 17800 crore (USD 2.1 billion). The fund was mobilised from three cash/debt mutual fund schemes: JioBlackRock Overnight Fund JioBlackRock Liquid Fund and JioBlackRock Money Market Fund. The three-day NFO received an overwhelming response from over 90 institutional investors and more than 67000 retail investors. What is Jio BlackRock? Jio BlackRock is a digital-first asset management company born out of a strategic partnership between Reliance Jio and global investment giant BlackRock. The venture wants to revolutionize the mutual fund landscape in India by combining Jio’s vast telecom reach with BlackRock’s investment profile.They want to make investing accessible to millions of Indians especially in Tier II and Tier III cities through mutual fund offerings. The platform plans to leverage Reliance’s digital and financial ecosystem like the Jio Finance app which comes pre-installed on smartphones used by over 475 million Jio subscribers and gives direct access to investment products. Jio Blackrock Impact On India’s Mutual Fund Industry India’s mutual fund industry has been concentrated in metro cities. In 2017 the top 35 cities accounted for nearly 90% of total Assets Under Management (AUM). By March 2025 this figure dropped to 70% showing a shift towards greater rural and semi-urban participation. Jio BlackRock wants to bridge the urban-rural divide and democratize access to wealth-building tools. Jio BlackRock’s strategy focuses on two key pillars: Expanding retail participation through affordable Systematic Investment Plans (SIPs) reportedly starting from just ₹500 per month. Harnessing technology and behavioral nudges to cultivate long-term consistent investment habits among users. (With Inputs From PTI)

-

Russian woman’s husband found in cave, serious allegations came out, struggle to meet his own daughters – News Himachali News Himachali

-

Baddu Kabila: settled UAE, Raja is doing this on Syria and a sign of doom

-

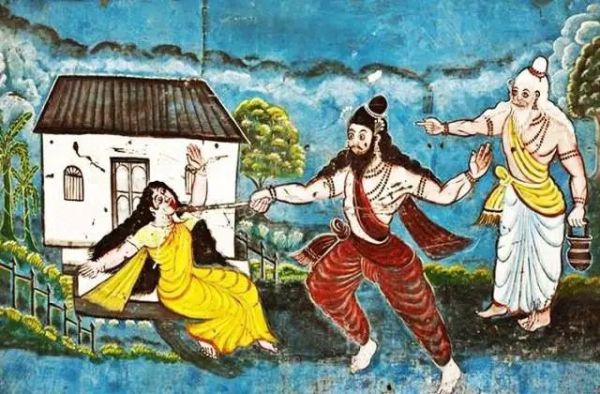

Despite being such a great ascetic, why did Parashuram cut his mother’s throat? Read the full story here – News Himachali News Himachali

-

Tarak Mehta’s wife’s wife is so stylish in real life, see photos

-

FIDE Women’s World Cup: Harika, Divya, Humpy script history with quarterfinal entry