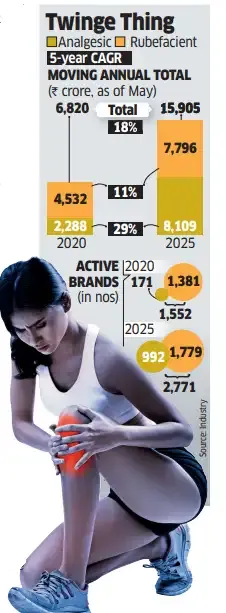

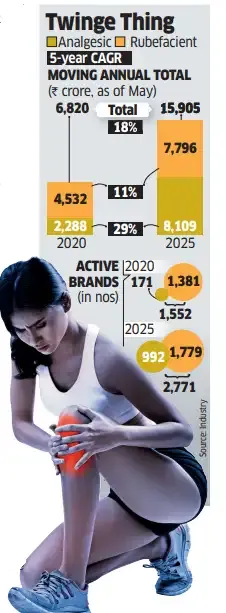

Mumbai: Indians are increasingly popping over-the-counter pills, using sprays or rubbing in creams to soothe their aches and pains, adding more than a billion dollars to the pain management market over the past five years. The category is the biggest within the non-prescription segment, and has seen about five brands launched every week on average since the pandemic, industry executives said, citing Nielsen data.

There were 1,552 brands -including Volini, Omnigel, Dolo and Saridon -to tackle the twinges in 2020; now, there are 2,771.

Consumers are more attentive to alleviating any pain on a more immediate basis, said Shivam Puri, managing director at Cipla Health, which sells the biggest rubefacient brand, Omnigel. Rubefacient are gels and creams for topical application. "Rise of urbanisation and increase in chronic illnesses have led to the need for faster, more convenient formats that are accessible across platforms," said Puri. This is despite medical professionals advising caution on random use of painkillers.

Analgesics account for 75% of the pain medication market and within analgesics, paracetamol is the biggest contributor, according to data from market researcher PharmaTrac.

Covid has changed Indians’ views on pain management, said Sandeep Verma, head for consumer health business for South Asia at Bayer Pharmaceuticals, which sells Saridon. “A lot of Indians view taking pain relief medication as a sign of weakness or worry about becoming dependent on it. Covid made many of us more aware of how stress, exhaustion, and even mild but recurring pain can chip away at our wellbeing and productivity,” he said.

“More people are starting to understand that living with untreated pain impacts their quality of life."

Experts said pain management medications are also used to treat inflammation and adjacent issues, widening the need for the pills.

“The analgesic segment that is dominated by paracetamols has been growing at a steady rate of 10%. This is because paracetamol medications are taken alongside other conditions that could include arthritis, any other bacterial or viral infection,” said Sheetal Sapale, vice president, commercial, at PharmaTrac.

Nitin Kumar Sinha, consultant physician at Mumbai-based WeCare Wellness, said lifestyle-related problems — including rising stress levels, lack of sleep and increasing obesity — are reasons for increasing demand for pain medications.

“Lack of physical exercise, increase in body weight leading to knee and joint pain, anxiety, depression are all causes of increase in body pain, headaches or migraine,” he said.

“There is also an increase in people doing self-medication and several mandatory prescription drugs, strong painkillers and anti-inflammatory medications — that can have severe harmful effects, such as damage to the kidneys, if used over a prolonged period — are today available easily at chemist shops without prescriptions,” said Sinha.

The top-selling drugs in the pain category are IPCA’s Zerodol SP, Janssen’s Ultracet, GSK’s Calpol, Micro Lab’s Dolo, Torrent’s Chymoral Forte and Cipla’s Ibugesic Plus. A majority of them are prescription drugs.

However, pain is not the only category that people are self-medicating in since the pandemic. Skin creams, earlier prescribed by dermatologists, are drawing a consumer base, especially Gen Z users.

Derma products, which treat scalp and skin issues and form the second biggest category after pain, expanded 8% CAGR over the past five years and are now a ₹14,854 crore market.

Bhanu Prakash, partner and healthcare services industry leader at Grant Thornton, said, “Over-the-counter as a segment has grown post-Covid because of more knowledge and information for categories including anti-allergic medications, skin creams, tear drops among others.”

There were 1,552 brands -including Volini, Omnigel, Dolo and Saridon -to tackle the twinges in 2020; now, there are 2,771.

Consumers are more attentive to alleviating any pain on a more immediate basis, said Shivam Puri, managing director at Cipla Health, which sells the biggest rubefacient brand, Omnigel. Rubefacient are gels and creams for topical application. "Rise of urbanisation and increase in chronic illnesses have led to the need for faster, more convenient formats that are accessible across platforms," said Puri. This is despite medical professionals advising caution on random use of painkillers.

Fast growth

The pain relief category is often lifestyle-driven in urban markets, especially with gym and sports injuries. As a result, the market for analgesics (pain relief medication) and rubefacient more than doubled to ₹15,905 crore as of May this year, from ₹6,820 crore as of May 2020, growing at a compounded annual rate of 18%. This is three times faster than overall over-the-counter market growth, which rose at 6% CAGR to ₹80,000 crore.Analgesics account for 75% of the pain medication market and within analgesics, paracetamol is the biggest contributor, according to data from market researcher PharmaTrac.

Covid has changed Indians’ views on pain management, said Sandeep Verma, head for consumer health business for South Asia at Bayer Pharmaceuticals, which sells Saridon. “A lot of Indians view taking pain relief medication as a sign of weakness or worry about becoming dependent on it. Covid made many of us more aware of how stress, exhaustion, and even mild but recurring pain can chip away at our wellbeing and productivity,” he said.

“More people are starting to understand that living with untreated pain impacts their quality of life."

Experts said pain management medications are also used to treat inflammation and adjacent issues, widening the need for the pills.

“The analgesic segment that is dominated by paracetamols has been growing at a steady rate of 10%. This is because paracetamol medications are taken alongside other conditions that could include arthritis, any other bacterial or viral infection,” said Sheetal Sapale, vice president, commercial, at PharmaTrac.

Nitin Kumar Sinha, consultant physician at Mumbai-based WeCare Wellness, said lifestyle-related problems — including rising stress levels, lack of sleep and increasing obesity — are reasons for increasing demand for pain medications.

“Lack of physical exercise, increase in body weight leading to knee and joint pain, anxiety, depression are all causes of increase in body pain, headaches or migraine,” he said.

“There is also an increase in people doing self-medication and several mandatory prescription drugs, strong painkillers and anti-inflammatory medications — that can have severe harmful effects, such as damage to the kidneys, if used over a prolonged period — are today available easily at chemist shops without prescriptions,” said Sinha.

The top-selling drugs in the pain category are IPCA’s Zerodol SP, Janssen’s Ultracet, GSK’s Calpol, Micro Lab’s Dolo, Torrent’s Chymoral Forte and Cipla’s Ibugesic Plus. A majority of them are prescription drugs.

However, pain is not the only category that people are self-medicating in since the pandemic. Skin creams, earlier prescribed by dermatologists, are drawing a consumer base, especially Gen Z users.

Derma products, which treat scalp and skin issues and form the second biggest category after pain, expanded 8% CAGR over the past five years and are now a ₹14,854 crore market.

Bhanu Prakash, partner and healthcare services industry leader at Grant Thornton, said, “Over-the-counter as a segment has grown post-Covid because of more knowledge and information for categories including anti-allergic medications, skin creams, tear drops among others.”