Indian lenders are finding it increasingly difficult to bring large corporates back into the traditional banking fold as overall credit growth slows and capital markets find favour instead.

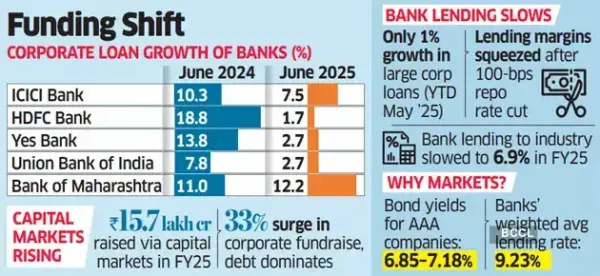

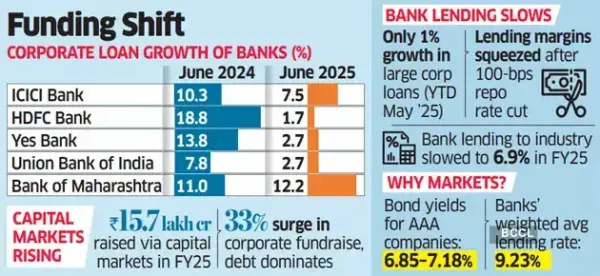

HDFC Bank reported a 1.7% year-on-year growth in corporate advances for the June quarter, a sharp decline from 18.8% growth in the same period last year. ICICI Bank’s domestic corporate loan book expanded by 7.5%, down from 10.3% previously. State-owned Union Bank of India reported a similar trend.

Bankers attribute the deceleration in corporate lending to rising competition from funding sources such as the bond and equity markets. The shift has also been amplified by the central bank’s ongoing rate cut cycle, which has compressed lending margins for banks. The Reserve Bank of India has reduced the policy repo rate by 100 basis points since February.

“Larger corporates are quite liquid, highly rated, and pretty strong on the balance sheet, which means the yield that one could get from that is lower,” said Srinivasan Vaidyanathan, chief financial officer at HDFC Bank. “And we have seen competition from certain segments of the financial system where the rates are pretty low. It is something that we manage on a close relationship basis with corporates — to participate not just in lending, but as a value proposition.”

Lending Margins Low

Margins are a key factor too. “Large corporates always give you very thin margins, so we have been very conscious in terms of growing that book,” said Prashant Kumar, managing director at Yes Bank. “In large corporates, wherever we see the opportunity to make revenue, we grow there.” In April-June, corporate bond issuances surged to a four-year high of Rs 3.27 lakh crore, according to a Bank of Baroda report.

The borrowing cost in terms of the weighted average yield was in the range of 6.85-7.18% for AAA-rated borrowers and 8.28-9.36% for those rated AA. This compares with banks’ weighted average lending rate of 9.23%. Raising funds through the capital markets, especially via private placements of corporate bonds, offers more competitive pricing and quicker access compared with the often lengthy and collateral-heavy bank loan process, experts said.

However, the pricing advantage in the bond market is only for top-rated borrowers and hence bank funding remains crucial for the majority of borrowers. In FY25, AAA-rated firms dominated issuances with a 67.1% share, while those rated below AA accounted for 16%. Banks are also focused on making up for the lower margins through fee income.

“Our corporate portfolio is about 20% of our total portfolio — it is doing well,” said Sandeep Batra, executive director at ICICI Bank. “We saw a decline, which was primarily driven by competitive pricing. We continue to look at these customers on a 360-degree basis and assess the ir total relationship value and the ecosystem’s, including the payment solutions that we are able to offer.

Accordingly, we take decisions on overall loan pricing.” Batra also said that corporates, especially the better-rated ones, have got multiple choices — with internal accruals as the primary source of funding, followed by the equity market, bonds and bank lending.

Indian corporates are increasingly tapping capital markets for cheaper and faster access to funds, which led to a 32.9% surge in resource mobilisation, RBI data showed. Funds raised through the capital markets rose to `15.7 lakh crore at the end of March, compared with Rs 11.8 lakh crore a year earlier. Debt dominated the fundraising mix, with a 63.5% share, almost entirely through private placements, which accounted for 99.2%, while equity contributed 27.4%.

HDFC Bank reported a 1.7% year-on-year growth in corporate advances for the June quarter, a sharp decline from 18.8% growth in the same period last year. ICICI Bank’s domestic corporate loan book expanded by 7.5%, down from 10.3% previously. State-owned Union Bank of India reported a similar trend.

Bankers attribute the deceleration in corporate lending to rising competition from funding sources such as the bond and equity markets. The shift has also been amplified by the central bank’s ongoing rate cut cycle, which has compressed lending margins for banks. The Reserve Bank of India has reduced the policy repo rate by 100 basis points since February.

“Larger corporates are quite liquid, highly rated, and pretty strong on the balance sheet, which means the yield that one could get from that is lower,” said Srinivasan Vaidyanathan, chief financial officer at HDFC Bank. “And we have seen competition from certain segments of the financial system where the rates are pretty low. It is something that we manage on a close relationship basis with corporates — to participate not just in lending, but as a value proposition.”

Lending Margins Low

Margins are a key factor too. “Large corporates always give you very thin margins, so we have been very conscious in terms of growing that book,” said Prashant Kumar, managing director at Yes Bank. “In large corporates, wherever we see the opportunity to make revenue, we grow there.” In April-June, corporate bond issuances surged to a four-year high of Rs 3.27 lakh crore, according to a Bank of Baroda report.

The borrowing cost in terms of the weighted average yield was in the range of 6.85-7.18% for AAA-rated borrowers and 8.28-9.36% for those rated AA. This compares with banks’ weighted average lending rate of 9.23%. Raising funds through the capital markets, especially via private placements of corporate bonds, offers more competitive pricing and quicker access compared with the often lengthy and collateral-heavy bank loan process, experts said.

However, the pricing advantage in the bond market is only for top-rated borrowers and hence bank funding remains crucial for the majority of borrowers. In FY25, AAA-rated firms dominated issuances with a 67.1% share, while those rated below AA accounted for 16%. Banks are also focused on making up for the lower margins through fee income.

“Our corporate portfolio is about 20% of our total portfolio — it is doing well,” said Sandeep Batra, executive director at ICICI Bank. “We saw a decline, which was primarily driven by competitive pricing. We continue to look at these customers on a 360-degree basis and assess the ir total relationship value and the ecosystem’s, including the payment solutions that we are able to offer.

Accordingly, we take decisions on overall loan pricing.” Batra also said that corporates, especially the better-rated ones, have got multiple choices — with internal accruals as the primary source of funding, followed by the equity market, bonds and bank lending.

Indian corporates are increasingly tapping capital markets for cheaper and faster access to funds, which led to a 32.9% surge in resource mobilisation, RBI data showed. Funds raised through the capital markets rose to `15.7 lakh crore at the end of March, compared with Rs 11.8 lakh crore a year earlier. Debt dominated the fundraising mix, with a 63.5% share, almost entirely through private placements, which accounted for 99.2%, while equity contributed 27.4%.