When it rains, it pours—but for bond investors, it’s barely been a drizzle. Since the RBI’s surprise 50 bps rate cut in May, those expecting gains from their bond portfolios have been left disappointed. The anticipated payoff from the rate-cutting cycle that began in January has yet to materialise.

Experts maintain that bond yields aren’t rising due to any concerns on macro fundamentals. Choudhary insists that long end yields in India are rising simply because the supply of such bonds was raised over the past few years to accommodate larger demand from provident funds and insurers but hasn’t been readjusted back even as that demand has tapered. “The lack of more active recalibration of supply is the reason for this aggressive curve steepening and not any ‘penalty’ that the market is levying for fiscal uncertainties.”

Bond yields shot up after latest rate cuts

Apart from the big rate cut, the central bank surprised the bond market with two more unexpected moves. It slashed the Cash Reserve Ratio (CRR) by 100 bps to 3%. The CRR is a percentage of a bank’s total deposits that it must keep as reserves with the central bank.

The third, more damning part of RBI’s troika of policy actions was its change of stance from ‘accommodative’ to ‘neutral’. This marked a swift reversal from the ‘neutral’ to ‘accommodative’ shift in its previous policy. The central bank clarified that the stance was changed to signal the market that further space for supporting growth was limited. Puneet Pal, Head Fixed Income, PGIM INDIA Mutual Fund, reckons, “This led the bond markets to believe that the rate-cutting cycle has effectively ended, resulting in yields rising across the curve with a steepening bias.”

Most experts feel the bond market’s sombre reading of the policy stance is justified. Pal asserts, “The Monetary Policy Committee (MPC) is likely to stay put on policy rates over the next couple of policy meetings and focus more on ensuring effective transmission of rate cuts done so far.” Axis Mutual Fund observes in a note, “We expect a limited rally in the next 3–6 months. Directionally, we see yields for the 10-year G-sec to trade in the range of 6%-6.40% in the next 6 months.”

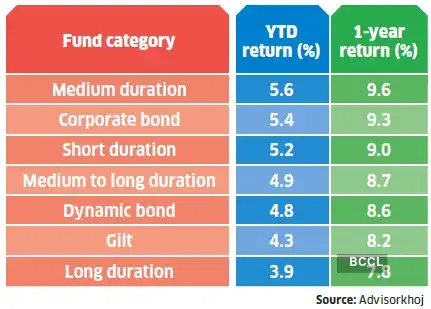

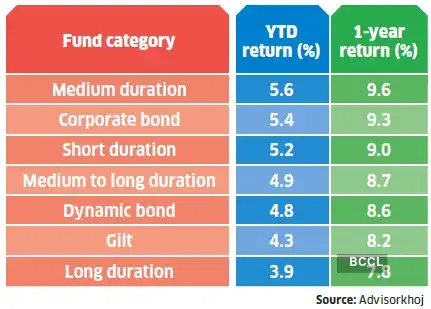

Rate cuts have not spelled bonanza for bonds

The rate-cutting cycle that kicked off this year has not translated into sizeable gains for bond fund investors.

This could keep a lid on returns from long-duration bonds. Incrementally, short bonds can outperform long bonds from the riskreward perspective due to a shallow rate cut cycle, lower open market operations (OMO) purchases in the second half of the year and a shift in focus to government debt to GDP targets, remarks Axis Mutual Fund.

The shift to a ‘neutral’ stance gives the central bank flexibility to move in any direction in response to the changing macro dynamics. It doesn’t imply it can’t cut rates further. “While the RBI frontloaded easing at a time of relative global calm and fair visibility on domestic macro dynamics, the negative reaction to the stance change may have been premature,” remarks Arora of Emkay. “With a likely impending reset in domestic macro dynamics through lower growth and inflation, the RBI may move to ease rates again by end-2025,” she adds.

Bandhan MF’s Choudhary reckons that while the bond story so far was purely about rate cuts, we are now entering the phase where you buy fixed income for relative value versus other assets, given the overall macro-cycle context, as well as for the starting valuations that bonds offer relative to economic fundamentals.

He feels that the yields on 3-year corporate bonds have retraced substantially since the RBI policy and offer reasonable value, so long as one expects limited mark-to-market gains. “If the pursuit is mark-to-market gains, however, then the government bonds seem much better poised with the recent sell-off having revealed clear value in two segments, in our view: 6-8 years and 30 years. The former is good consideration space for short and mid duration funds to play, whereas the latter remains our segment of choice for dynamic and gilt funds.”

Triple threat

In normal circumstances, interest rates and bond prices share an inverse relationship, even as bond yields move in tandem with interest rates. When interest rates fall, bond prices rise and bond yields fall. This theory held sway during the initial phase of this rate-cutting cycle. But this time, bond yields have moved up in response to rate cuts. Bond values that would normally rise, have eroded. Investors have been left running for cover. “Ever since the rate cut that didn’t feel at all like a rate cut, bond markets have been finding it difficult to regain their footing,” observes Suyash Choudhary, Head–Fixed Income, Bandhan Mutual Fund.Experts maintain that bond yields aren’t rising due to any concerns on macro fundamentals. Choudhary insists that long end yields in India are rising simply because the supply of such bonds was raised over the past few years to accommodate larger demand from provident funds and insurers but hasn’t been readjusted back even as that demand has tapered. “The lack of more active recalibration of supply is the reason for this aggressive curve steepening and not any ‘penalty’ that the market is levying for fiscal uncertainties.”

Bond yields shot up after latest rate cuts

Apart from the big rate cut, the central bank surprised the bond market with two more unexpected moves. It slashed the Cash Reserve Ratio (CRR) by 100 bps to 3%. The CRR is a percentage of a bank’s total deposits that it must keep as reserves with the central bank.

The third, more damning part of RBI’s troika of policy actions was its change of stance from ‘accommodative’ to ‘neutral’. This marked a swift reversal from the ‘neutral’ to ‘accommodative’ shift in its previous policy. The central bank clarified that the stance was changed to signal the market that further space for supporting growth was limited. Puneet Pal, Head Fixed Income, PGIM INDIA Mutual Fund, reckons, “This led the bond markets to believe that the rate-cutting cycle has effectively ended, resulting in yields rising across the curve with a steepening bias.”

Most experts feel the bond market’s sombre reading of the policy stance is justified. Pal asserts, “The Monetary Policy Committee (MPC) is likely to stay put on policy rates over the next couple of policy meetings and focus more on ensuring effective transmission of rate cuts done so far.” Axis Mutual Fund observes in a note, “We expect a limited rally in the next 3–6 months. Directionally, we see yields for the 10-year G-sec to trade in the range of 6%-6.40% in the next 6 months.”

Rate cuts have not spelled bonanza for bonds

The rate-cutting cycle that kicked off this year has not translated into sizeable gains for bond fund investors.

This could keep a lid on returns from long-duration bonds. Incrementally, short bonds can outperform long bonds from the riskreward perspective due to a shallow rate cut cycle, lower open market operations (OMO) purchases in the second half of the year and a shift in focus to government debt to GDP targets, remarks Axis Mutual Fund.

Flicker of hope

However, not everyone is convinced that the party is over for long-term bonds. There could yet be light at the end of the tunnel. With inflation easing further, the higher real rate may open up space for RBI to cut rates incrementally.The shift to a ‘neutral’ stance gives the central bank flexibility to move in any direction in response to the changing macro dynamics. It doesn’t imply it can’t cut rates further. “While the RBI frontloaded easing at a time of relative global calm and fair visibility on domestic macro dynamics, the negative reaction to the stance change may have been premature,” remarks Arora of Emkay. “With a likely impending reset in domestic macro dynamics through lower growth and inflation, the RBI may move to ease rates again by end-2025,” she adds.

Bandhan MF’s Choudhary reckons that while the bond story so far was purely about rate cuts, we are now entering the phase where you buy fixed income for relative value versus other assets, given the overall macro-cycle context, as well as for the starting valuations that bonds offer relative to economic fundamentals.

He feels that the yields on 3-year corporate bonds have retraced substantially since the RBI policy and offer reasonable value, so long as one expects limited mark-to-market gains. “If the pursuit is mark-to-market gains, however, then the government bonds seem much better poised with the recent sell-off having revealed clear value in two segments, in our view: 6-8 years and 30 years. The former is good consideration space for short and mid duration funds to play, whereas the latter remains our segment of choice for dynamic and gilt funds.”