State-run banks have informed the government that they will actively pursue disinvestments in their insurance subsidiaries after the Centre approves 100% foreign investment in the sector.

Some lenders have shared their plans with the government during review meetings, held last month. This includes both initial public offerings and stake sales in their respective units and joint ventures, said people familiar with the developments.

"The government has been reviewing the progress on unlocking value from subsidiaries of banks. Lenders have shared that they expect better valuations from their insurance ventures once the foreign investment limit of 100% in the insurance sector is implemented," said an official, requesting anonymity.

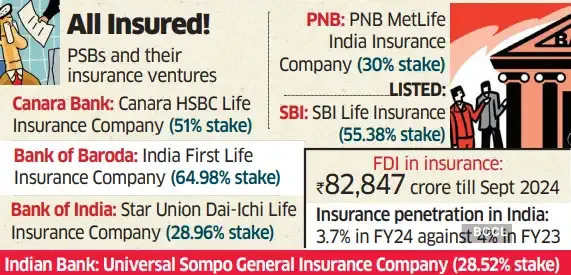

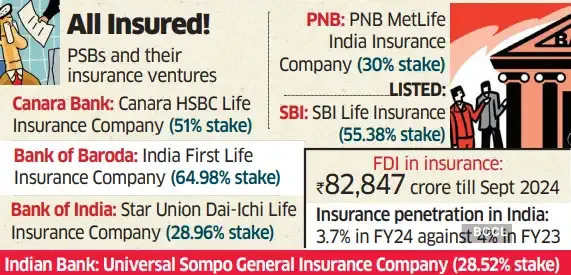

Almost all PSBs have invested in insurance companies, including the country's largest, State Bank of India. Others having insurance ventures include Canara Bank, Bank of Baroda, Punjab National Bank, and Union Bank of India.

"We are already in discussions with our partners. With other incentives in the Insurance Bill such as the appointment of key personnel, there is an interest from our foreign partners, and we expect optimum returns for our investment from the markets as well," said an executive director at a state-run bank, which has an insurance venture with a foreign insurer.

In the February budget, the Centre announced that FDI limit for insurance sector will be raised from 74% to 100% and the enhanced limit will be only allowed for companies who invest their entire premiums in India.

The government had further noted that current guardrails and conditionalities associated with FDI will be reviewed and simplified. Besides easing foreign investment limits, the proposed Insurance Amendment Bill also has provisions for composite licenses and allowing foreigners as key managerial personnel (KMP) in Indian insurance firms.

"The bill is ready, and the government is likely to introduce it in the ongoing session, subject to Parliament functioning without any major disruptions," said the official cited above.

Another bank executive said already some insurance ventures are proceeding with IPO plans to make it easier to find more market-determined valuation. "Canara HSBC Life Insurance has initiated the process; based on their learnings, other banks will follow suit," he said.

Some lenders have shared their plans with the government during review meetings, held last month. This includes both initial public offerings and stake sales in their respective units and joint ventures, said people familiar with the developments.

"The government has been reviewing the progress on unlocking value from subsidiaries of banks. Lenders have shared that they expect better valuations from their insurance ventures once the foreign investment limit of 100% in the insurance sector is implemented," said an official, requesting anonymity.

Almost all PSBs have invested in insurance companies, including the country's largest, State Bank of India. Others having insurance ventures include Canara Bank, Bank of Baroda, Punjab National Bank, and Union Bank of India.

"We are already in discussions with our partners. With other incentives in the Insurance Bill such as the appointment of key personnel, there is an interest from our foreign partners, and we expect optimum returns for our investment from the markets as well," said an executive director at a state-run bank, which has an insurance venture with a foreign insurer.

In the February budget, the Centre announced that FDI limit for insurance sector will be raised from 74% to 100% and the enhanced limit will be only allowed for companies who invest their entire premiums in India.

The government had further noted that current guardrails and conditionalities associated with FDI will be reviewed and simplified. Besides easing foreign investment limits, the proposed Insurance Amendment Bill also has provisions for composite licenses and allowing foreigners as key managerial personnel (KMP) in Indian insurance firms.

"The bill is ready, and the government is likely to introduce it in the ongoing session, subject to Parliament functioning without any major disruptions," said the official cited above.

Another bank executive said already some insurance ventures are proceeding with IPO plans to make it easier to find more market-determined valuation. "Canara HSBC Life Insurance has initiated the process; based on their learnings, other banks will follow suit," he said.