Global luxury giants are bracing for another quarter of sluggish performance as they grapple with a fading appetite for high-end goods among aspirational consumers and looming import tariffs in the United States.

Market leaders LVMH and Kering are expected to post further declines in sales this quarter, reinforcing concerns of a sustained downturn in the $400 billion global luxury sector, reported Reuters.

US-China Slowdown, Tariff Threats Weigh on Consumer Sentiment

LVMH is set to report earnings on Thursday, followed by Kering on July 29, with market watchers anticipating further signs of weakened demand in the US and China — traditionally two of the most lucrative markets for premium fashion.

The luxury sector is also facing fresh headwinds from the threat of 30 per cent US tariffs on European imports. Brands manufacturing in France and Italy could be hit hard, forcing tough decisions on whether to absorb the costs or pass them on to increasingly price-sensitive US consumers.

"The level of price increases has been too much" for many brands, noted Caroline Reyl, head of premium brands at Pictet Asset Management, suggesting that steep hikes have alienated aspirational, middle-income buyers. The backlash has been especially evident in the United States, where consumer sentiment is being further shaken by stock market volatility tied to global trade tensions.

Flagship Labels Feel the Heat as Customers Seek Value

LVMH’s fashion and leather goods unit, which includes Louis Vuitton and Dior, is forecast to report a 6 per cent year-on-year decline in sales — the fourth quarterly drop in a row, based on Visible Alpha data. Kering’s flagship brand Gucci, currently undergoing a creative overhaul, is expected to fare even worse with sales likely to be down nearly 25 per cent from the previous year.

The broader industry slowdown is also reflected in share performance. LVMH stock has fallen by almost 27 per cent since the start of 2025, while Kering is down 15 per cent. Meanwhile, Hermès and Richemont — which cater primarily to ultra-wealthy customers — have remained relatively stable, with Hermès down just 0.9 per cent and Richemont up 1.6 per cent over the same period. LVMH, once Europe’s most valuable listed company as recently as January, has slipped to fifth place.

Handbags, once the backbone of luxury growth, have lost their lustre. Shoppers are now gravitating toward more timeless investments such as fine jewellery. Although brands like Dior, Gucci, and Chanel have hired new creative leads to reinvigorate product lines, it may take several seasons before those fresh ideas reach the shelves.

In response to slowing sales, companies like Louis Vuitton and Prada are pushing more items priced under $1,000 and are putting greater emphasis on accessible beauty products. But this strategy, analysts warn, may come at the cost of brand prestige. HSBC analysts pointed to Louis Vuitton, saying, "Some inconsistencies, we feel, are likely starting to have consumers wonder."

According to consensus forecasts, organic sales for LVMH are projected to fall by 3 per cent, while Kering may record a 13 per cent decline. In contrast, Hermès and Prada are expected to see a 10 per cent increase, with Prada’s Miu Miu brand reportedly gaining ground against competitors.

Hermès and Prada are scheduled to announce their earnings on July 30.

-

India vs England 4th Test Day 1: Bad light ends play early as Ravindra Jadeja, Shardul Thakur remain unbeaten

-

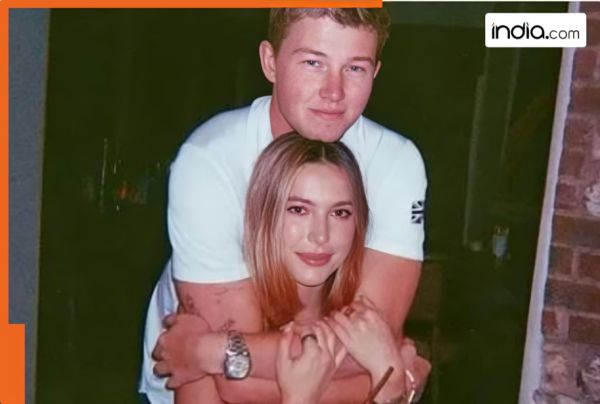

Steve Jobs’ daughter Eve to marry olympian Harry Charles in Lavish British countryside wedding, Here’s all you need to know

-

Big update for Infosys employees on salary hike, Narayana Murthy’s IT company says ‘next one we’ll have to…’

-

Qatar in talks to host 2036 Olympic Games

-

'Fully Within China's Sovereignty': Beijing Defends Brahmaputra Dam, Claims Won't Affect Downstream