Bengaluru: The Enforcement Directorate (ED) has launched a major investifation against Buy Now Pay Later (BNPL) platform SIMPL and its parent company One Sigma Technologies Pvt. Ltd., filing a case under the Foreign Exchange Management Act (FEMA).

The company and its director Nityanand Sharma have been accused of violating FEMA norms to the tune of Rs 913.75 crore.

Massive FDI Inflows Under Scrutiny

According to the ED’s investigation, the fintech firm received substantial Foreign Direct Investment (FDI) from the United States, which allegedly breached existing Indian regulations.

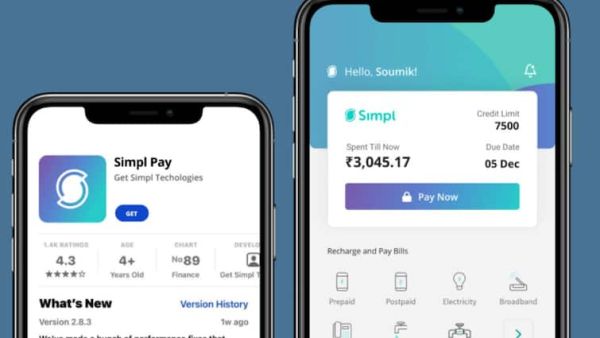

SIMPL, operated via a mobile app, allows users—especially young, online shoppers—to purchase products immediately and pay later in instalments. It has gained popularity for offering flexible payment options at the point of checkout.

The company had earlier claimed that it operates in the domain of Information Technology and computer-related services, which allowed it to receive Rs 648.87 crore in FDI and an additional Rs 264.88 crore through convertible notes, all under the 100 per cent automatic route.

ED Flags Violation of RBI Norms

However, the ED's probe revealed that the company's core business activities are financial in nature. Under the Reserve Bank of India’s October 20, 2016 circular, any financial services business that is not regulated by a statutory authority such as the RBI or SEBI must obtain prior government approval before accepting FDI.

SIMPL allegedly failed to secure such approval and proceeded to issue convertible notes and raise funds via FDI, in direct violation of FEMA provisions.

The ED has filed a formal complaint under Section 16(3) of FEMA, and the case has now been referred to the Adjudicating Authority. SIMPL could potentially face penalties or prosecution under Section 13 of FEMA, which allows for both fines and legal punishment.

-

Which disease is an indication of dizziness or darkness in front of the eyes? Know the opinion of the doctor and the necessary vigilance

-

What will be the benefit of health by applying oil to the soles before going to bed at night, definitely know

-

Enhance dry skin with home remedies

-

Dermatologist’s ‘gold standard in anti-aging’ and ‘biggest blind spot’

-

There are obstacles in love marriage? These 3 easy Vastu tips can help you