The Insolvency and Bankruptcy Code (IBC), introduced nine years ago, has played a crucial role in resolving stressed debt in India. According to an analysis by CRISIL Market Intelligence, the IBC has directly resolved about Rs 12 lakh crore worth of debt through nearly 1,200 cases of stressed borrowers.

It stated "Insolvency and Bankruptcy Code (IBC) nine years ago has enabled the direct resolution of approximately Rs 12 lakh crore of debt." The report highlighted that the impact of IBC goes beyond just the cases admitted by the National Company Law Tribunal (NCLT).

In addition to resolution under IBC, the report pointed out that nearly 30,000 cases involving around Rs 14 lakh crore of debt were settled even before formal admission to the NCLT.

This showed that the IBC has acted as a strong deterrent, pushing borrowers to settle dues early to avoid insolvency proceedings. The IBC has brought a major shift in the approach to debt resolution in India, moving from a debtor-in-control system to a creditor-in-control framework. This distinguishes it from earlier systems like the Debt Recovery Tribunal (DRT), Lok Adalat, and the SARFAESI Act.

Since 2016, total resolved debt through various mechanisms has touched Rs 48 lakh crore. Of this, the IBC has shown the highest recovery rate of around 30-35 per cent, compared to 22 per cent for SARFAESI, 7 per cent for DRT, and 3 per cent for Lok Adalat.

The flexibility under IBC to change management and restructure debt has also helped, especially in reviving viable businesses. In the past three years alone, about 60 per cent of resolution approvals were completed, although they accounted for only 40 per cent of total debt.

However, the report also noted some challenges, particularly the delay in resolution timelines. The average time to resolve a case under IBC has increased to 713 days, more than double the prescribed 330 day limit. The delay is mostly due to procedural bottlenecks and cross-litigations.

To improve this, the Insolvency and Bankruptcy Board of India (IBBI) has increased NCLT bench strength, allowed online submissions, and permitted part-wise resolution of debt.

Overall, while IBC has become India's primary tool for resolving stressed debt, the report believed the real test will be how effective the recent amendments are in ensuring faster and more efficient outcomes in the future.

(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

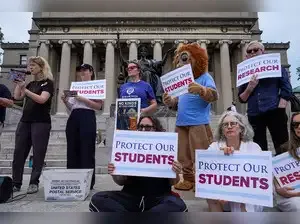

Columbia University to pay $200 mn fine in fight with Trump

-

PIB Fact Check debunks claims of Vice President's official residence being sealed

-

What made Karnataka HC halt Russian woman Nina Kutina's deportation after she was found living in Gokarna caves

-

Pakistan: Floods inundate hundreds of Punjab villages, mass evacuations underway

-

Ghislaine Maxwell may testify before Congress. A look at other convicted criminals who've done so