Asset under management (AUM) of infrastructure investment trusts (InvITs) is expected to cross Rs 8 lakh crore by fiscal 2027 from Rs 6.3 lakh crore in fiscal 2025, according to a latest report by Crisil Ratings.

According to the credit rating agency, the growth will primarily be driven by the acquisition of assets by mature trusts. The report further highlighted that although the growth in AUM will be accompanied by an increase in leverage levels, the credit profiles of InvITs will remain stable, supported by the good quality of assets, adequate cash flows, along with structural benefits of cash flow pooling and regulatory guardrails.

Asset addition is a key growth driver for InvITs, considering the finite life of infrastructure assets. The AUM addition of Rs 1.7-1.8 lakh crore over this fiscal and the next, will be marginally lower than Rs 2.0 lakh crore added in the past two fiscals. The roads sector is likely to account for 80 per cent of the incremental AUM, as in the past two fiscals.

While sectors such as renewable energy, transmission and warehousing will contribute to the incremental AUM, their share could be low due to a combination of any of the following factors: high upfront leverage of assets that require significant deleveraging under InvITs, sufficient access to capital outside InvIT platforms and limited availability of operational assets.

"Mature trusts acquiring assets are expected to form 80-85 per cent of the incremental AUM over two fiscals, compared with 65 per cent in the past two fiscals. Further, acquisitions typically increase leverage because the assets acquired generally have a higher proportion of debt. For instance, InvITs with a track record of 2-5 years have seen their leverage increase from 43 per cent as of March 2023 to 47 per cent as of March 2025 with a rise in AUM due to acquisitions. With most InvITs attaining operational stability now, they are ripe for growth. Hence, overall leverage is expected to inch up to 50 per cent by fiscal 2027, " said Manish Gupta, Deputy Chief Ratings Officer, Crisil Ratings.

Even as the leverage is likely to increase, credit profiles are expected to be stable, supported by predictable cash flows, long asset life and a diverse pool of assets, the report added.

Addition of low-risk assets also enables InvITs to withstand higher leverage. For instance, adding assets with annuity nature of cash flows, such as hybrid annuity model roads to a toll road trust or power transmission assets to a renewable trust, can enhance InvITs' ability to sustain higher leverage without compromising on credit quality, the rating agency added.

"With an increase in leverage, DSCR3 at 1.7x4 has contracted to some extent for most InvITs, compared to their DSCR of over 1.8x as of fiscal 2023. To be sure, DSCR in the past had a buffer, considering the low leverage. Hence, despite moderation, the current DSCR remains healthy. Furthermore, regulatory guardrails such as six consecutive distributions for increasing the leverage beyond 49 per cent and limits on under-construction assets continue to anchor credit profiles," said Anand Kulkarni, Director at Crisil Ratings.

As per the report, long-term cash flow adequacy plays an important role in credit risk assessment. At present, some trusts are opting for back-ended debt repayments supported by the long life of assets. While this helps InvITs to optimise distributions, gradual amortisation of debt remains important over the medium term, considering the finite life of assets.

Overall, while growth and credit outlook remain stable, prudent capital structure management will remain monitorable as InvITs scale up in terms of size, debt levels and complexity, the rating agency added.

(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

Meet Jab We Met’s Anshuman’s real-life Geet, who chased Bollywood dreams, worked with Salman Khan, but found stardom in the South, her name is…

-

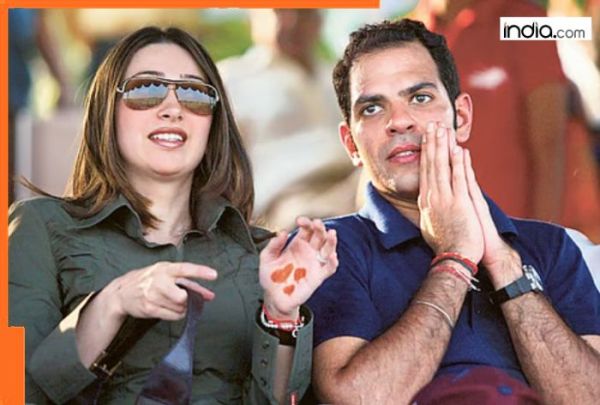

Who is named in Sunjay Kapur’s will? Does Karisma Kapoor have a share in ex-husband’s property? Sona Comstar approves…

-

Aneet Padda To Step Into Gritty Role Opposite Fatima Sana Shaikh In Courtroom Drama Nyaya After Saiyaara: Report

-

Indore: Traffic Signals To Be Installed At 61 More Squares In City

-

'The Silversmith's Puzzle': An action-packed, colourful murder mystery set in 19th-century Bombay