The finance ministry on Monday said there is room for further easing of interest rate by the Reserve Bank of India (RBI) as the inflation is comfortably below the central bank's median target of 4 per cent.

Retail inflation, based on Consumer Price Index (CPI), has remained below 4 per cent since February and dipped further to more than six-year-low of 2.82 per cent in May.

"Core inflation remains subdued, and overall inflation is comfortably below the RBI's 4 per cent target, affording room for the easing cycle to be sustained," said the finance ministry's monthly review report.

The central has cumulatively reduced the short-term benchmark lending rate (repo) by 100 basis points since February.

The next meeting of the RBI's rate-setting panel -- Monetary Policy Committee (MPC) -- during August 4-6.

The RBI has projected headline inflation at 3.4 per cent for the second quarter of the fiscal year, while in the first quarter, actual inflation came below the target of the RBI.

"It appears likely that the full fiscal year inflation rate would undershoot the central bank's expectation of 3.7 per cent," the report said.

It further said global crude oil prices are expected to remain subdued, following a larger-than-anticipated production hike by OPEC and its allies, who raised output by 5,48,000 barrels per day in August, on top of the production increases announced for the previous months.

On the fiscal front, both the Union and state governments have maintained momentum in capital expenditure while adhering to consolidation goals.

The revenue sources remain buoyant despite the tax cuts, continuing on the double-digit growth path, the report said.

The government has mandated the RBI to ensure inflation remains at 4 per cent with a margin of 2 per cent on the either side.

(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

India’s Green Steel Demand Projected To Hit 179 Million Tons By 2050: Report

-

10 Romantic Hindi Songs That Will Make You Believe In Love Again

-

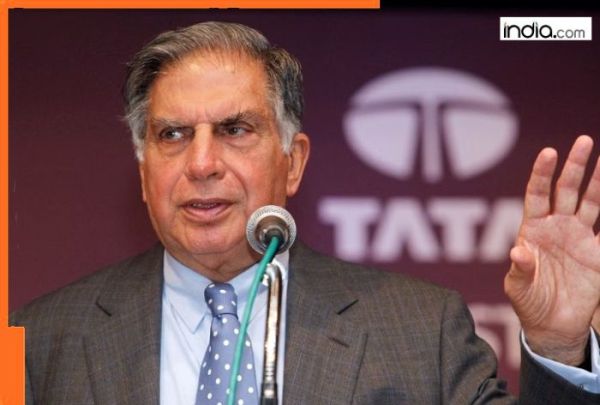

Ratan Tata’s TCS to layoff 12000 employees, this will affect real estate sector due to…

-

The Rise Of Sterlite Tech: Why Starlink Could Be Poised As A Potential Client?

-

Sonia Gandhi attacks PM Modi over 'shameful silence on Gaza genocide'