India's industrial outlook is expected to remain weak in the near term due to the above-normal monsoon, mining and electricity output are expected to stay subdued, according to a report by ICICI Bank.

Additionally, the report mentioned that the ongoing geopolitical developments are affecting manufacturing exports at a time when urban demand is already underperforming.

It stated, "With monsoon rainfall continuing to be above normal, mining and electricity output is likely to remain muted in the near future. Manufacturing performance too is likely to be lackluster amidst geopolitical developments and its impact on manufacturing exports when urban demand is under-performing."

India's Index of Industrial Production (IIP) grew by just 1.5 per cent year-on-year (YoY) in June 2025. This is the lowest growth recorded since August 2024. As a result, the average IIP growth in the first quarter of FY26 (April to June) stands at 1.9 per cent, a sharp drop from 5.5 per cent in the same period last year (Q1FY25).

What is more concerning is the slowdown in sequential momentum. The IIP contracted by 2.7 per cent in June 2025 compared to the previous month. This is worse than the 2.4 per cent contraction in June last year. June also marks the second month in Q1FY26 and the third time in 2025 when IIP momentum has turned negative, raising worries of a credible slowdown in industrial activity.

The mining sector dragged the overall index lower, with a sharp contraction of 8.7 per cent YoY in June. This is the sector's weakest performance in nearly five years.

The poor showing is largely due to early and excessive monsoon rainfall as well as the base effect. Electricity output also fell by 2.6 per cent YoY in June, adding to the downward pressure.

On the positive side, manufacturing sector output grew by 3.9 per cent YoY in June, helping to hold up the overall index. The growth was mainly supported by the production of fabricated and base metals.

For the full quarter, manufacturing grew by 3 per cent YoY, compared to the overall IIP growth of 2 per cent. Consumer non-durables declined for the fifth straight month, contracting by 0.4 per cent YoY. Output of consumer durables and capital goods also remained soft, indicating weak urban demand and low private investment.

Overall, the data pointed to a slowdown in industrial growth, with weather disruptions, weak demand, and global uncertainties playing a major role.

(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

India’s Green Steel Demand Projected To Hit 179 Million Tons By 2050: Report

-

10 Romantic Hindi Songs That Will Make You Believe In Love Again

-

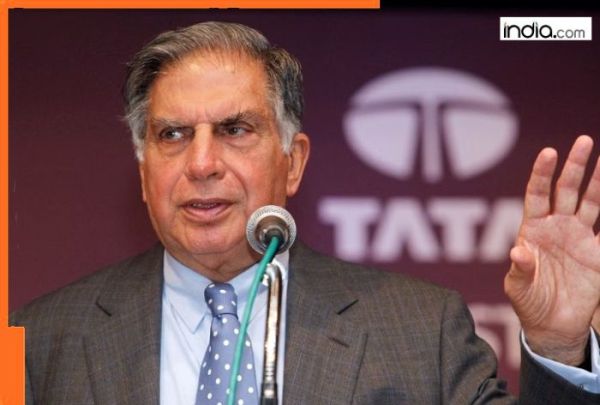

Ratan Tata’s TCS to layoff 12000 employees, this will affect real estate sector due to…

-

The Rise Of Sterlite Tech: Why Starlink Could Be Poised As A Potential Client?

-

Sonia Gandhi attacks PM Modi over 'shameful silence on Gaza genocide'