Technical setup points to bullish potential. Analyst sees upside towards record highs if key resistance breaks.

Larsen & Toubro (L&T) secured a mega order from Adani Power to build eight thermal power units this week. Each unit will produce 800 MW of electricity, making a total of 6,400 MW.

On its technical charts, SEBI-registered analyst Mayank Singh Chandel has flagged that the stock has been in a long-term uptrend, but since January 2024 it has been moving sideways between ₹3,000 and ₹4,000. The rising 200-day Exponential Moving Average suggests the overall trend is still slightly positive.

Technical Cues

Chandel noted that L&T stock gave a breakout from its pole & flag pattern with a sustained gap-up on July 30. Currently, it is consolidating in a zone while taking support from that gap, trading well above its key exponential moving averages 20, 50, and 100.

The resistance zone lies between ₹3,700 and ₹3,730, according to him. If this level breaks with good volume, he expects a 10% rally towards new all-time highs, with a stop-loss at ₹3,520.

What Should Investors Do?

Chandel suggested that aggressive traders can consider entering now, but advised that it would be safer to wait for a clear breakout from this range before taking a fresh position.

Q1 Earnings Snapshot

L&T posted a 16% growth in revenues, of which 52% came from international projects. Profits rose 30%.

The company’s infrastructure segment reported ₹41,000 crore orders, with a book-to-bill ratio of around 29 months, but margins were slightly soft at 5.7%. Energy project orders surged to ₹31,400 crore from ₹8800 crore last year. Hi-Tech manufacturing saw a healthy order book of ₹39,200 crore.

In IT and technology services, revenue rose 10% but margins were affected by investments in new business ventures. L&T Finance unit saw its loan book cross ₹1 trillion, of which 98% were retail loans.

What Is The Retail Mood?

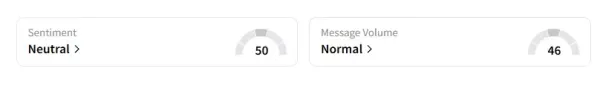

Data on Stocktwits shows that retail sentiment has remained ‘neutral’ for a week now.

L&T shares have risen only 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

All In Capital’s TorQLabs to invest in supply chain and logistics startups

-

Team India captain Shubman Gill gets MASSIVE honour after success on England Test tour, he has been…

-

Not Salman Khan, this actor is ‘enemy’ of the Bachchan family, did only one film with Amitabh Bachchan, abused Aishwarya Rai, rift with Abhishek Bachchan

-

Good news for Gautam Adani as he earns Rs 503015716000 in 1 day from…, behind Elon Musk by only….

-

Good news for Sunil Mittal, this company earns Rs 100000000, annual revenue crosses Rs 30000000000 in…, it is…