Technical charts indicate a rally if the stock breaks above ₹420 with strong volumes, according to the analyst.

Laxmi Dental is gaining traction on the analysts’ radar. The dental products maker acquired a 58% stake in AI Dent, a Gujarat-based AI dental-tech firm, earlier this month. However, its shares have declined 18% in the last month.

SEBI-registered analyst Pradeep Carpenter called this acquisition ‘a smart move’ into the digital diagnostics and treatment planning segment.

What sets Laxmi Dental apart is that they’re one of the few in the country that handle everything in-house, from designing a crown on CAD software to shipping it to a clinic in Europe. They have an expansive product basket and are already selling in over 30 countries.

Carpenter added that the company is debt-free and has high return ratios. However, he cautioned that premium valuation means expectations are sky-high. Also, its margin dip in the last quarter (Q4) hinted that cost control will be key going forward.

Strong FY25 Numbers

Profit after tax for FY25 came in at ₹318 million, up 26% from last year. The March quarter was a bit softer with ₹4.18 crore profit, down nearly 30% – mainly higher costs and seasonality.

Brokerages Bullish

Additionally, the end of the six-month IPO lock-in in July freed up about 37% of shares for trading. Around the same time, brokerage firm Motilal Oswal initiated a ‘Buy’ call with a ₹540 target..

Technical Picture

Carpenter observed that Laxmi Dental stock saw a good run from ₹280 in May to ₹420 by late July. Since then, it has taken a breather.

He identified support zones at ₹380 (short-term) and ₹360 (major), with immediate resistance at ₹410–₹420. If the stock clears this level with strong volumes, it could see a potential rally to ₹450.

Its Relative Strength Index (RSI) stands around 58, which is a comfortable zone, not overheated. And Moving Average Convergence Divergence (MACD) just turned positive again.

The Road Ahead

Carpenter said that Laxmi Dental is shaping up as a niche growth play in a space with few listed peers. For long-term investors, the combination of brand strength, export reach, and new tech bets makes it worth keeping on the radar.

He advised traders that if the stock moves above ₹420, momentum could carry it to ₹450–₹470. But a break below ₹380 could see it cool off to ₹360, where buyers are likely to show up again.

What Is The Retail Mood?

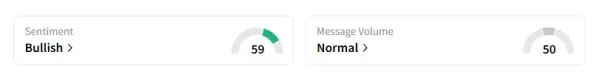

Data on Stocktwits shows that retail sentiment has been ‘bullish’ since the end of July and is inching higher.

Laxmi Dental shares have declined 32% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Independence Day 2025: BMC Launches 'Har Ghar Tiranga' Campaign, Announces Multiple Programs Across Mumbai

-

Two Die In Parvati River After Woman Jumps In To Save Son, Local Boy In MP's Guna

-

British tourists told to stay off roads in France between noon and 4pm

-

Man furious as neighbour escalates 'petty' parking war with extreme act

-

West Bengal's Paschim Medinipur secures first place in formation of women's self-help groups