Oil prices inched higher on Thursday, as traders weighed the potential impact of Friday’s scheduled US-Russia summit on Ukraine, where the prospect of fresh sanctions or a tightening of existing restrictions on Russian crude remains a key concern. Gains were, however, tempered by a subdued market outlook.

Brent crude futures rose 24 cents, or 0.37 per cent, to $65.87 a barrel at 0356 GMT, while US West Texas Intermediate futures were up 21 cents, or 0.34 per cent, at $62.85. Both benchmarks had fallen to two-month lows on Wednesday following downbeat supply projections from the US government and the International Energy Agency (IEA), reported Reuters.

Geopolitical Tensions Lift Risk Premium

On Wednesday, US President Donald Trump warned of “severe consequences” should Russian President Vladimir Putin fail to agree to peace in Ukraine during the Alaska meeting. While Trump stopped short of detailing the measures, he has previously floated the idea of extending economic sanctions if talks collapse.

“The uncertainty of US-Russia peace talks continues to add a bullish risk premium given Russian oil buyers could face more economic pressure,” analysts at Rystad Energy noted. The firm cautioned that the outcome of the Ukraine crisis and any shifts in Russian crude flows could spring “unexpected surprises” on the market.

Trump has also threatened secondary tariffs targeting major importers of Russian oil, particularly China and India, if Moscow maintains its war stance. Warren Patterson, head of commodities strategy at ING, said, “Clearly there’s upside risk for the market if little progress is made on a ceasefire.”

Patterson added that while the market could likely absorb the impact of tariffs on India due to the anticipated oil surplus and OPEC’s spare capacity, the situation would become more challenging if China and Turkey were also targeted.

Economic Factors and Inventory Data Shape Market Mood

Expectations of a US Federal Reserve interest rate cut in September are offering additional support to oil prices. Market data from the CME FedWatch tool places the probability of a quarter-point cut at 99.9 per cent, with Treasury Secretary Scott Bessent suggesting a half-point reduction is possible amid weakening employment figures. Lower borrowing costs typically spur economic activity and boost fuel demand.

However, oil price gains were limited by fresh data from the US Energy Information Administration showing an unexpected rise in crude inventories by 3 million barrels in the week ending 8 August. Adding to the headwinds, the IEA projected that global oil supply in 2025 and 2026 would grow faster than previously forecast, driven by increased production from OPEC members and non-OPEC producers alike.

With geopolitical risks colliding with signs of ample future supply, the market remains in a fragile balancing act ahead of Friday’s high-stakes diplomatic talks.

-

Raj Kundra REACTS To Trolls Calling His Kidney Donation Offer To Premanand Maharaj As 'PR Stunt': 'Not Defined By Labels Thrown At Me'

-

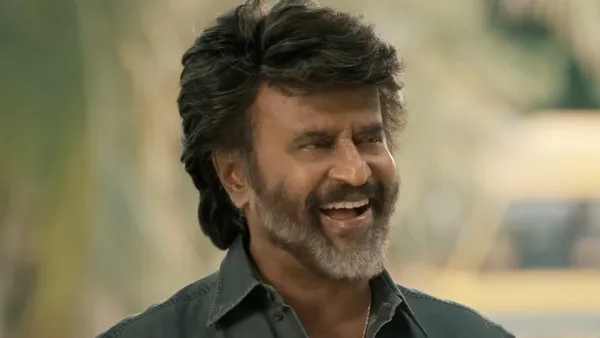

Rajinikanth Pens Note On Completing 50 Years In Cinema: 'Thanks To My Fans, The Gods Who Keep Me Alive'

-

Hema Malini once rejected this film of Raj Kapoor, later became a blockbuster but left Ranbir Kapoor’s grandfather disappointed, film was.., earned Rs..

-

Coolie Box Office Collection Day 2: Rajinikanth, Nagarjuna’s action-thriller enters Rs 100 crore in just two days, but where is War 2?

-

Mukesh Ambani owns Asia’s largest mango orchard, over 200 varieties of mangoes are produced here, it was set up due to…, is named after…