RBI New Rule: This new system will be known as 'Continuous Clearing and Settlement on Realisation'. That is, there will be continuous clearing in banks during work.

RBI New Rule: The Reserve Bank of India has given relief to crores of customers by changing the rules for depositing checks in banks. This will benefit those who usually make payments by check. Check clearance takes a long time in the banking system of our country. That is, it takes 2-3 days for the money to come into the account after making a payment by check. This delay causes problems to those people or businessmen who usually give or take payment by check. However, this will not happen now.

The clearance system will be faster

The Reserve Bank of India (RBI) is going to introduce a fast clearance system. With this, money will come in the account within a few hours of depositing the check. From October 4, 2025, the time taken in the check clearance process will be reduced to a great extent. This change will be done under the Check Truncation System (CTS). Till now, it used to take till T+1 i.e. the next working day for the check to be cleared. If the check is from another bank, then it takes up to three days. At the same time, now the entire clearance process will be limited to a few hours.

Clearing will continue throughout the day

According to the RBI circular, this new system will be known as 'Continuous Clearing and Settlement on Realisation'. That is, clearing will continue continuously during the work in banks. Since till now the checks were processed in batches under the Check Truncation System (CTS), so the clearance also took time. Whereas under this new system, the checks deposited in the bank from 10:00 am to 4:00 pm will be scanned and sent to the clearing house immediately. This will speed up the process.

Rules will be more stringent in the second phase

The new system will be implemented in two phases. The first phase will start on October 4, 2025 and the second phase will start on January 3, 2026. In the first phase, banks will have to do positive or negative verification of the checks by 7 pm. Checks that are not verified on time will be considered approved and will be included in the settlement.

At the same time, the rules will be made more stringent in the second phase. In this, the verification of the check will have to be done in 3 hours. If the bank receives the check between 10:00 am and 11:00 am, then it will get time till 2:00 pm for verification. After the settlement is completed, the clearing house will send the confirmation details to the bank and the money will be sent to the customer immediately.

It has to be kept in mind that sending the money should not take more than an hour after settlement. Its objective is to reduce settlement risk, improve efficiency and provide better convenience to customers.

-

Diabetes Warning Signs: 5 Symptoms You Should Never Ignore

-

Modern Parenting, Ancient Ailments: The Comeback Of Rickets And Worm Infection

-

Kidney Stone: Drinks That Help and Drinks That Hurt

-

Cases of a Killer Virus That Makes The Body ‘Fold In On Itself’ Spiking in the UK; What Is Chikungunya?

-

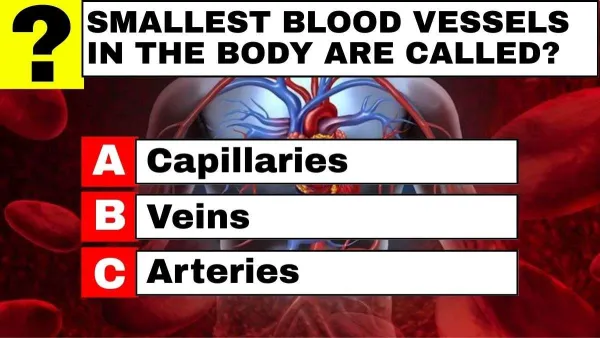

Trivia Questions With Answers: You Are A Born Genius If You Can Score 100% In This General Knowledge Quiz!