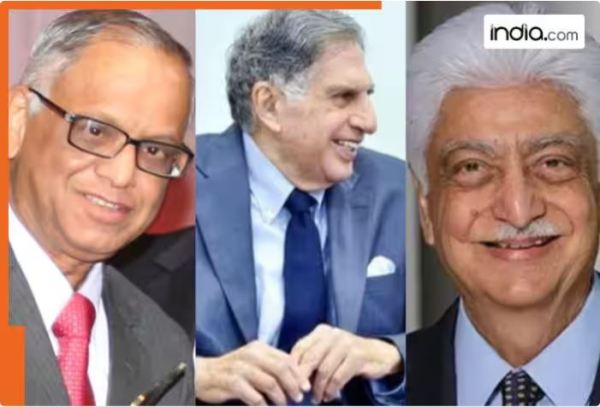

EPFO regularly introduces changes for the convenience of its subscribers. Now it is preparing to launch an all-new digital platform called EPFO 3.0. This will be an app-based system. To build and maintain this digitally advanced IT system EPFO has chosen three of India’s largest IT firms TCS Infosys and Wipro according to a circular issued by EPFO. To improve digital services the Employees Provident Fund Organisation (EPFO) has selected IT giants TCS Infosys and Wipro. In the upgraded system PF members will be offered features like automated claim settlement and PF withdrawal through ATMs. EPFO 3.0 What Infosys TCS Wipro Will Do? As reported by the Free Press Journal earlier on June 16 2025 EPFO had invited an Expression of Interest (EOI) from companies with expertise in managing large-scale digital platforms. After reviewing all applications EPFO shortlisted TCS Infosys and Wipro. Based on evaluation Infosys Limited TCS Limited and Wipro Limited were found to meet the required criteria and have been shortlisted for the next stage of the selection process. However the circular clearly stated that being shortlisted does not mean any legal or official contract has been given yet it is just an administrative step. What Will Change After EPFO 3.0 Implemented? The sole purpose of launching EPFO 3.0 is to make the system more modern and advanced than before. Once operational it will provide improved services to millions of subscribers. Let’s see what benefits will come with its launch: Automated Claim Settlement: Claims will now be processed automatically eliminating the hassle of manual processing. This will make the system faster and more efficient. Online Account Updates: With the new app subscribers won’t need to visit EPFO offices to update account details like name or date of birth. They will be able to make changes online from home. OTP Verification: Instead of the traditional form-based process an OTP (One-Time Password) verification system will be introduced. Any account-related change can now be confirmed through OTP authentication. PF Withdrawal via ATM: After a claim is approved subscribers will be able to withdraw PF money from ATMs just like a regular bank transaction.

-

Delhi MCD bypolls: BJP candidate wins Chandni Chowk

-

International Day Of Persons With Disabilities 2025: History, Purpose, Global Significance, And More

-

Rate Cut Hopes Rise As RBI MPC Meet Opens Against Strong GDP And Record-Low Inflation

-

Australia’s economy posts fastest growth in two years amid strong domestic demand, but inflation and rate pressures loom

-

Chennai weather today: Chennai, Tamil Nadu to receive more rainfall triggered by cyclone Ditwah? Check latest IMD prediction