If finalized, the deal would surpass Biocon’s Viatris buyout and Daiichi’s Ranbaxy purchase

Aurobindo Pharma has reportedly emerged as the frontrunner to acquire Prague-based generic drugmaker Zentiva for $5–5.5 billion from private equity firm Advent International.

The stock was the top loser on the Nifty Pharma Index on Wednesday. At the time of writing, shares were down 3.37% at ₹1,053.

Aurobindo is currently competing with US private equity firm GTCR, the only other serious bidder, according to a report by the Economic Times. Both parties are engaged in advanced negotiations over commercial and operational terms.

Advent, which acquired Zentiva in 2018 for $2.4 billion, has been working with Goldman Sachs and PJT Partners since last year to explore exit options. Aurobindo has already secured a $4.75 billion credit line from MUFG as a bridge loan, with the remaining $800 million to come from internal accruals.

If completed, the deal would mark the largest-ever acquisition by an Indian pharmaceutical company, surpassing Biocon Biologics’ $3.3 billion Viatris biosimilars buyout and the $3.2 billion Ranbaxy stake purchase by Daiichi Sankyo in 2014.

Strengthening European Business

For Aurobindo, acquiring Zentiva will significantly strengthen its European footprint, particularly in Eastern Europe, where government-led healthcare procurement ensures steadier returns compared with the US market’s price pressures.

Zentiva has a presence in 30 countries and aims to reach one in five Europeans by 2028. In India, it operates a manufacturing facility in Gujarat.

Biosimilars Boost

For Aurobindo, the deal aligns with its growing focus on biosimilars and specialty medicines. The company is developing therapies such as denosumab for osteoporosis, omalizumab for asthma, and bevacizumab for cancer treatment.

Its European business already grew 16.6% in FY25 to ₹8,356 crore and is expected to cross €1 billion in annual revenue by FY26. Biosimilars in the region are reportedly generating margins of 40 - 60%, with the company targeting blended gross margins of around 50%.

Latest Developments

Last month, Aurobindo announced the acquisition of US-based Lannett Company for $250 million, via its subsidiary Aurobindo Pharma USA. Lannett manufactures and supplies complex generic pharmaceuticals, including non-opioid controlled substances, particularly for ADHD treatments.

In June, Aurobindo partnered with global pharma major MSD to set up a biologics manufacturing facility through its biologics arm, TheraNym. With an investment of ₹1,000 crore, Aurobindo will set up the facility in Telangana.

It is expected to house large-scale bioreactors for mammalian cell culture and a vial filling isolator line capable of producing 25–30 million vials annually.

What Is The Retail Mood?

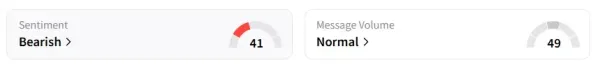

Retail sentiment on Stocktwits turned ‘bearish’ from ‘neutral’ a day earlier. Aurobindo was also among the top 2 trending stocks on the platform.

Year-to-date, the stock has shed over 21%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<

-

Alibag Beach Bike Rally Marks Youth And Sadbhavana Day, Spreads HIV/AIDS Awareness

-

Madhya Pradesh High Courts's No To Demolish Shops In Bamniya

-

Eight Maoists with combined bounty of Rs 30 lakh surrender in Chhattisgarh

-

Crunch time for Reform UK as Nigel Farage faces 8 big tests in 15 hours

-

SC order not followed in implementing internal reservation, claims K'taka BJP