Piper Sandler notes that Analog Devices posted a solid quarter, with notable momentum in its industrial division and an overall growth outlook for the fourth quarter.

Analog Devices Inc. (ADI) has received fresh attention from Wall Street analysts following its better-than-expected third-quarter (Q3) earnings, primarily driven by a rebound in industrial demand.

Multiple firms have raised their price targets for the semiconductor manufacturer, citing improved visibility into future demand and strength across its core segments, as per TheFly.

The company’s Q3 revenue of $2.88 billion and adjusted earnings per share (EPS) of $2.05 beat the analysts’ consensus estimate of $2.75 billion and $1.95 billion, respectively, as per Fiscal AI data.

Piper Sandler has increased its price target to $245 from $215, maintaining a ‘Neutral’ rating. The firm noted that Analog Devices posted a solid quarter, with notable momentum in its industrial division and a broad-based growth outlook for the fourth quarter (Q4).

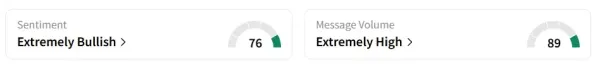

Analog Devices' stock inched 0.1% higher in Thursday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory with the message volume improving to ‘extremely high’ from ‘high’ levels in 24 hours.

A Stocktwits user lauded the Q3 earnings.

Piper Sandler emphasized that the company remains a high-quality option in the analog semiconductor space, though advised investors to wait for a more favorable entry point.

Wells Fargo also raised its price target on the stock to $250 from $235, while reiterating its ‘Equal Weight’ rating. The firm credited the company’s performance to continued strength in the industrial sector and expects that visibility into above-normal demand will stretch into fiscal 2026.

Meanwhile, Barclays analyst Tom O'Malley increased the price target on the shares to $240, up from $185, while also maintaining an ‘Equal Weight’ recommendation. He pointed out that the Q3 performance was fueled by early pull-in orders from data center and automotive customers in July.

Analog Devices' stock has gained over 15% year-to-date and 7% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Karnataka UGCET 2025 round 2 choice filling starts; check details here

-

Man told to tear down £5,000 driveway he built to help disabled wife

-

CCPA Penalises Rapido For Misleading Ads, Orders Refunds To Customers

-

Neil Robertson copied Wimbledon champion to beat Ronnie O'Sullivan in Saudi

-

The beautiful little UK seaside town where tourists flock to the Sainsbury's car park