G-III now expects fiscal 2026 net sales to be about $3.02 billion, compared with the prior forecast of $3.14 billion.

G-III Apparel Group’s (GIII) CEO Morris Goldfarb stated on Thursday that the company was absorbing a portion of the costs tied to the Trump administration’s tariffs to remain competitive and capture market share.

“Gross margins in the quarter were impacted by higher-than-expected tariff costs, driven primarily by a greater volume of tariff inventory shipments than initially forecasted,” Goldfarb said. “We're actively mitigating these pressures through a combination of vendor participation, selective sourcing shifts, and targeted pricing,” he added.

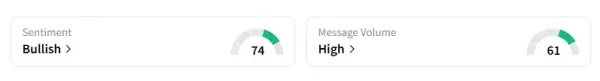

Retail sentiment on G-III remained unchanged in the ‘bullish’ territory, with chatter at ‘high’ levels, according to data from Stocktwits.

Goldfarb noted that in the second half of the year, the company’s retail partners became increasingly cautious about their inventory purchases in anticipation of tariff increases becoming more pronounced.

Tariffs imposed by U.S. President Donald Trump on global trading partners have impacted retailers and increased their costs, as most of these companies import products from Asian countries such as China, Vietnam, and India. This has resulted in higher product prices in the United States.

“We believe management continues to expect momentum across its owned brands. However, the tariffs are relatively fluid, and there's limited visibility into the macro environment and how consumer demand for discretionary products will be impacted in the back half of the year,” Dana Telsey of Telsey Advisory Group said.

G-III’s shares were down 2% during midday trading. The company now expects fiscal 2026 net sales to be about $3.02 billion, compared with the prior forecast of $3.14 billion.

The company forecast annual adjusted earnings per share (EPS) between $2.55 and $2.75. This compares to Wall Street expectations of $2.90, according to data compiled by Fiscal AI. Its second-quarter net sales came in at $613.3 million, compared to estimates of $571.2 million. The company’s adjusted EPS of $0.25 handily beat expectations of $0.09.

G-III’s shares have declined 19% this year and lost about 13% of their value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Virgo Horoscope Today, 5th September 2025: Creativity flows with steady discipline

-

Cancer Horoscope Today, 5th September 2025: Partnerships bring balance and clarity

-

Scorpio Horoscope Today, 5th September 2025: Focused communication brings steady progress

-

Not had talks with White House for longer-term Fed post: Nominee Stephen Miran

-

Taurus Horoscope Today, 5th September 2025: Optimism drives learning and steady growth