The Centre may introduce a bill in the winter session of Parliament to impose a levy on tobacco and tobacco products that would replace the goods and services tax (GST) compensation cess on such sin goods, said people familiar with the matter.

The current compensation cess on these items, on top of the 28% GST rate, may continue for at least three months to enable the Centre to fully repay the loans taken to compensate states against their losses due to their adoption of the new indirect tax regime eight years ago, they said.

The winter session of Parliament usually starts in late November or early December.

The GST Council, headed by Union finance minister Nirmala Sitharaman, decided on Wednesday to retain the GST rates and the compensation levy on pan masala, gutkha, cigarettes and chewing tobacco products such as zarda, unmanufactured tobacco and bidi until the full repayment of the loans. Once that's done, the GST rate on these tobacco products will be raised to the new highest bracket of 40% but the additional levy of the compensation cess will be scrapped, Sitharaman had said.

The compensation cess could then be replaced with another impost so that the overall indirect tax incidence on the sin products isn't trimmed from the current level, said one of the persons cited earlier, who did not wish to be identified. "On tobacco, the GST part is settled at 40% and we expect the compensation cess period to be over by this calendar year. So, there is time to weigh some options on the table. But a decision will be made in due course," said another person.

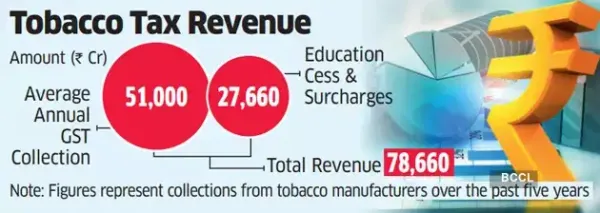

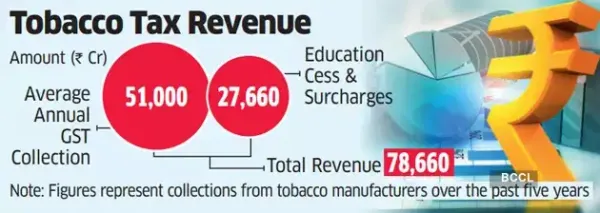

Currently, such products attract the highest GST rate of 28% plus compensation cess, central excise duty and national calamity contingent duty, taking the total indirect tax liability to 53%. The initial deadline to end the compensation cess by October 31 was firmed up on the basis of the estimated average compensation cess of roughly ₹10,000 crore per month, the second person said.

But now that high-end cars, coal and aerated drinks won't be subject to the compensation cess from September 22, when the revised GST rates on all other goods take effect, the monthly cess collection will go down. So, it will take longer to repay the entire loan amount.

The current compensation cess on these items, on top of the 28% GST rate, may continue for at least three months to enable the Centre to fully repay the loans taken to compensate states against their losses due to their adoption of the new indirect tax regime eight years ago, they said.

The winter session of Parliament usually starts in late November or early December.

The GST Council, headed by Union finance minister Nirmala Sitharaman, decided on Wednesday to retain the GST rates and the compensation levy on pan masala, gutkha, cigarettes and chewing tobacco products such as zarda, unmanufactured tobacco and bidi until the full repayment of the loans. Once that's done, the GST rate on these tobacco products will be raised to the new highest bracket of 40% but the additional levy of the compensation cess will be scrapped, Sitharaman had said.

The compensation cess could then be replaced with another impost so that the overall indirect tax incidence on the sin products isn't trimmed from the current level, said one of the persons cited earlier, who did not wish to be identified. "On tobacco, the GST part is settled at 40% and we expect the compensation cess period to be over by this calendar year. So, there is time to weigh some options on the table. But a decision will be made in due course," said another person.

Currently, such products attract the highest GST rate of 28% plus compensation cess, central excise duty and national calamity contingent duty, taking the total indirect tax liability to 53%. The initial deadline to end the compensation cess by October 31 was firmed up on the basis of the estimated average compensation cess of roughly ₹10,000 crore per month, the second person said.

But now that high-end cars, coal and aerated drinks won't be subject to the compensation cess from September 22, when the revised GST rates on all other goods take effect, the monthly cess collection will go down. So, it will take longer to repay the entire loan amount.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!